Common bank reconciliation errors

If your balances don’t match after making all the required adjustments, look for the following common types of errors and omissions.

Data entry errors

Errors can occur during manual data entry, such as mistyped amounts or incorrect transaction dates. Use accounting tools like QuickBooks Online whenever possible to reduce the likelihood of these errors.

Omitted transactions

Sometimes transactions are recorded in the bank statement but missed in the books, or vice versa. Regular reconciliation can help catch these omissions. Ensure all transactions are recorded correctly in your books, including amounts, dates, and transaction types.

Transposition errors

Transposition errors occur when numbers are accidentally switched (for example, $123 becomes $132). These errors can significantly impact your reconciliation, so double-check your entries.

Fraudulent transactions

Regular reconciliation is one of the best ways to spot unauthorized transactions quickly. If you find any transactions you don’t recognize, investigate immediately to safeguard your finances.

Timing differences

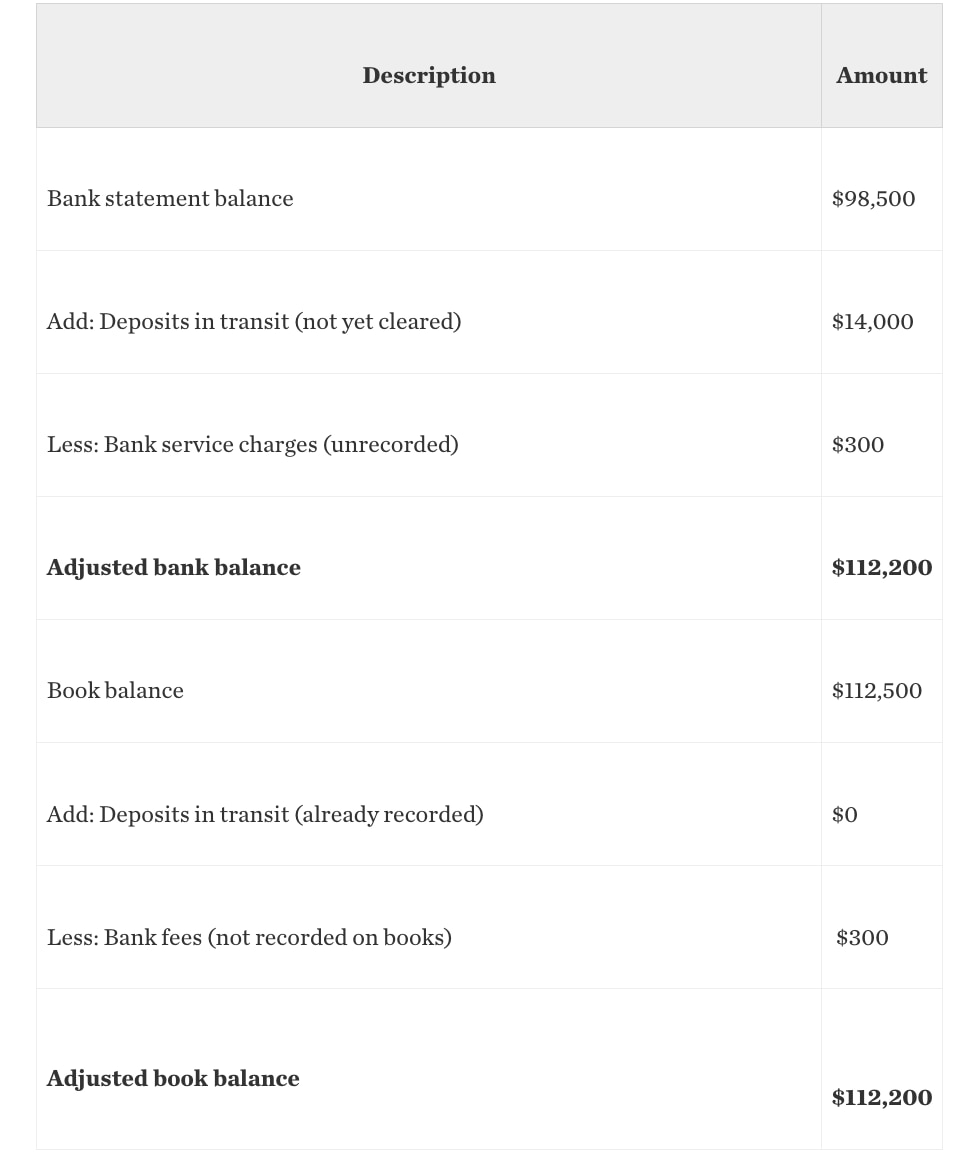

Timing differences, such as outstanding checks or deposits in transit that haven’t yet been cleared by the bank, are common reconciliation issues. Although these transactions have been recorded in your books, they have not yet cleared the bank, so they don’t appear on the bank statement.

It’s crucial to keep track of these payments properly to minimize disruptions later during the reconciliation process.

Bank errors

Although it's rare, banks can make mistakes too. These errors might include duplicate charges or recording incorrect amounts for transactions. If you identify a bank error, contact them immediately to correct the issue.

Bank service charges

Banks often charge fees for various services, such as account maintenance or expedited payments. These charges may not be known in advance and only become apparent when reviewing the bank statement. When discovered, these fees need to be recorded in the company’s financial records.

Interest earnings

Interest income is another figure that might not be clear until it appears on the bank statement. This amount must be added to the company’s books as part of the reconciliation process.

Regular reconciliations help keep your financial records up to date and minimize the chance of errors accumulating over time.

Regular reconciliations help keep your financial records up to date and minimize the chance of errors accumulating over time.