- What is a statement of account?

- Is a statement of account the same as an invoice?

- What’s the difference between a statement of account and other types of financial account statements?

- Why are account statements important?

- When to send out customer statements

- Essential aspects of a statement of account

- Frequently asked questions

Statement of account: A 2024 guide for business owners

Maintaining clear and accurate financial records is crucial to the success of any small business. One vital document is the statement of account, which offers a comprehensive overview of all transactions between a business and its clients over a specified period.

Keep reading to learn how to create and use statements of accounts and why they’re essential for ensuring financial transparency, smooth business operations and healthy client relationships.

What is a statement of account?

A statement of account is the documentation of transactions between your small business and each client within a specific time frame. This document is a full overview of the business completed between you and an individual customer, typically within a monthly period, and includes the balance due. It’s an effective way to remind customers of any outstanding payments and keep them up-to-date.

Creating invoices through Excel sheets can run the risk of invoicing mistakes, which can then reflect poorly on your business and the subsequent account statement. It is best to use accounting software that will automatically update and organize client transactions. Keeping proper invoice documentation will make the process of creating statements of accounts effortless.

Is a statement of account the same as an invoice?

An invoice and a statement of account are not the same thing.

The statement of account format includes a complete financial record of transactions between the company and the client within a monthly period. It includes a list of all invoices created within that time frame.

While a sales invoice is a bill for one transaction only, a statement of account is the complete list of all invoices attached to that client within a stated period. This document is handy for both small businesses and their clients, as it displays the monthly transaction history and account activity between the two, all in one place.

What’s the difference between a statement of account and other types of financial account statements?

Unlike other types of financial account statements such as a balance sheet or profit and loss statement, a statement of account isn’t enough on its own to evaluate a company’s financial health or stability. It’s limited to transactions between two parties to keep track of amounts owed and paid, but doesn’t tell you much about the company’s financial position otherwise.

Why are account statements important?

In a statement of account, the document reflects the ongoing transactional relationship between your business and your clients. This financial overview is vital for both the company and the client. It illustrates the overall state of affairs of the working relationship.

The main reason behind creating this statement is to show the outstanding amount — if any — a client may owe to your small business. Similar to a bank statement, this document illustrates the customer’s transactions on a monthly basis, including payments received and refunds made by the supplier.

When to send out customer statements

Typically, companies issue monthly statements to their clients with up-to-date transactions, as shown through a PDF file and sent through email. Sending off a statement of account to a client at the end of the month is a good way to remind them of overdue accounts and help them avoid late fees. Accounts receivable is the money owed to a business by the client, which can be found in these statements.

If a customer’s statement displays a zero balance, they are up-to-date on all payments. Typically customers who have zero balances do not need to be sent this document unless they specifically request it. However, these customer statements are still used internally within a business to keep track of financial reports and transactional history for managing customer relations and in case of disputes.

If your small business offers customers the ability to make purchases on credit, these statements should always be sent out to the clients at the end of the month to bring awareness to the overdue credit and outstanding payments.

Essential aspects of a statement of account

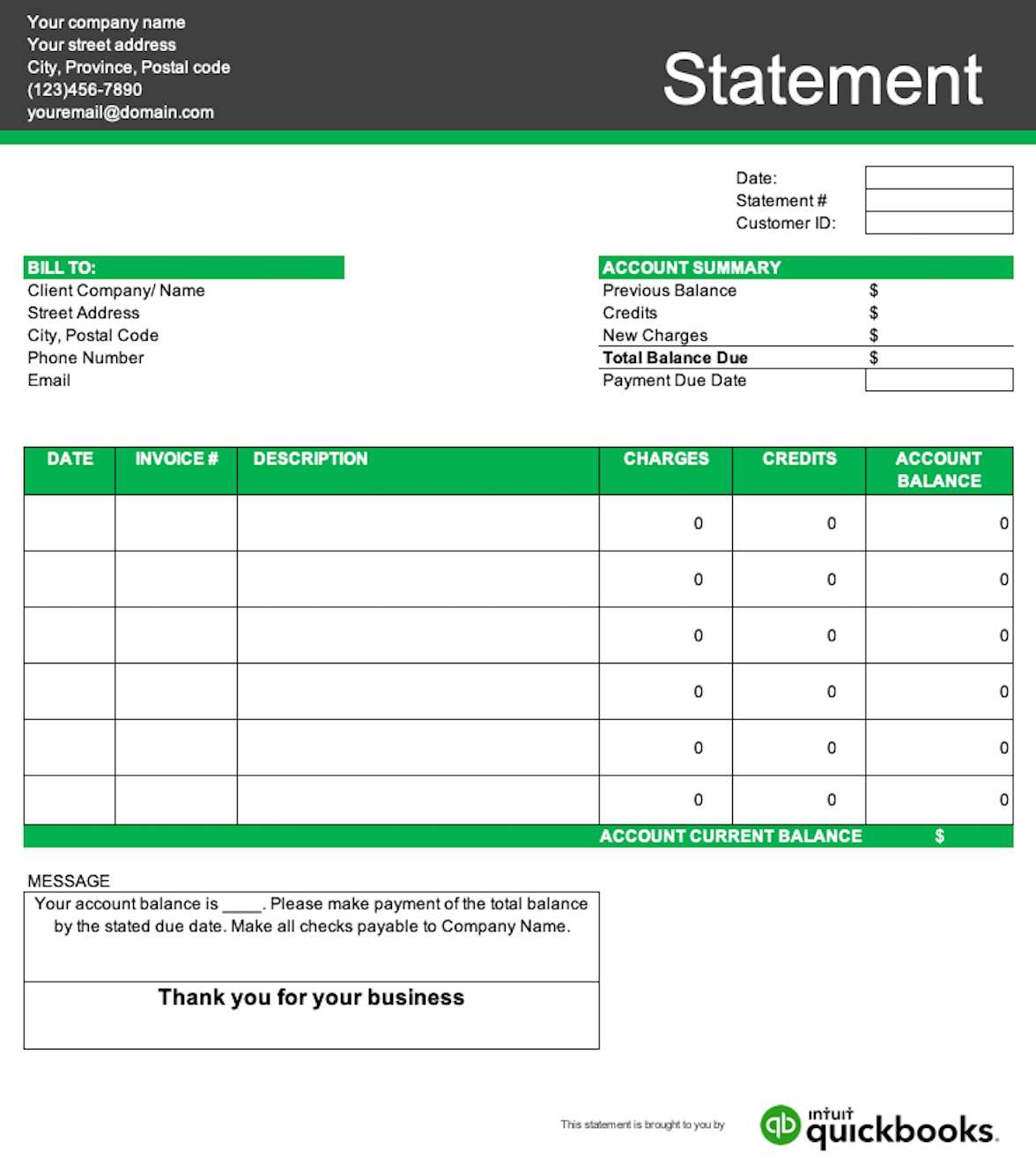

Your statement of account template should include the following essential elements:

- Client information: Always include the client’s information at the top of the document to illustrate who the account holder is.

- Company information: As with all documents and reports created by your company, they should contain the business name, contact and location information.

- Date: State the date range which the statement falls under. This is typically a monthly span but sometimes quarterly and yearly account statements are also issued.

- Account summary: Displayed at the top of the accounts statement, this provides an overview of the current transactional balance between business and client- including previous balance, credits, new charges, and total balance due.

- Invoice number: All invoice amounts sent out within the date range must be listed in the main body of this document, breaking down the charges by date and in chronological order.

- Charges: These are the amounts charged per invoice given.

- Credits: This is the amount owed for the account, minus all payments made, or credit available.

- Account current balance: This is the amount owed by the customer that must be paid to your company at the time of the statement.

Creating invoices through Excel spreadsheets may result in mistakes that will reflect poorly on your business. Consider using QuickBooks accounting software — which offers invoicing and statement templates — to simplify the process for your business, automatically keeping all your accounts effortlessly up to date.

Frequently asked questions

Disclaimer

This content is for information purposes only and should not be considered legal, accounting or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by region, province, state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.