Need to use your personal vehicle for business? You can transfer ownership of the vehicle from yourself to your company. There are a variety of reasons you may need to transfer personal property to your small business. The Canada Revenue Agency (CRA) has a specific process on how to account for these transactions, and the steps vary based on your business structure. Ensure that you handle these transactions correctly to avoid future headaches.

How to Bring Personal Assets Into Your Small Business

Understand Business Versus Personal Use

If you plan to use your vehicle exclusively for your business, you should use its fair market value when determining your business deduction. On the other hand, if you plan to use your vehicle for both business and personal use, you should only use a portion of its value to calculate your deduction.

With items such as office furniture, computers, or tools, you can simply estimate the portion of time you use the item professionally and personally. For example, if you use your computer half the time for work and half the time for play, 50% of its value is a business expense.

With a vehicle, you need to keep detailed records to determine the portion used for the business. Most self-employed people handle this task with a simple mileage log. To explain, suppose you drove your vehicle 20,000 kilometres total over the year, and 5,000 of those kilometres were for business. In this case, you can claim 25% of the vehicle’s fair market value, or $2,500, as a business expense.

The vehicle is a capital expense, and that means you can’t write off the $2,500 right away. Instead, you need to write it off incrementally over a few years.

Transfer Personal Assets to Sole Proprietorships

If you’re a sole proprietor, you must transfer assets using fair market value. To assess the fair market value of your car, you could:

- Look at prices of the same type of vehicle on a used car site

- Use the Black Book value of the vehicle

- Talk with a dealer about the trade-in value

Imagine that you bought a car for $10,000. You use the car personally for a couple of years and its value declines. To determine its fair market value currently, you look at the prices of similar used cars for sale and assess that the car is worth $5000. When you transfer the car to your business, you treat the transaction as if your business purchases the computer from you for $5000. This is the number you use when establishing your capital cost allowance for your tax return.

Partnerships and Corporations

You may also use fair market value when you transfer personal assets to a partnership or corporation, but in these cases, you could opt to use elected value instead. Elected value is an amount you and the business agree on for the transaction, and it doesn’t have to be the same as the fair market value of the item. If the elected amount is more than the original sales price of the item, you may need to report a capital gain on your personal tax return.

Imagine you have a building that you plan to transfer to your partnership. You and your partners decide on $100,000 as the elected value of the building. As explained above, the partnership treats this amount as the purchase price of the item for its records.

For your own personal tax records, you may need to do a few more calculations. If you only pay $60,000 for the building, you have to report $40,000, the difference between your original purchase price and the elected value, as a capital gain on your tax return. In some cases, you can delay the reporting of that gain, but you may want to talk with an accountant before taking that deferral.

Input Tax Credits When Selling Personal Assets

If your business is a GST/HST registrant, you may be able to claim an input tax credit on transferred personal assets. This rule applies regardless of your business structure. Generally, the input tax credit provides a refund of any sales tax paid on business expenses, and who doesn’t love a tax refund? When you transfer personal property to your business, you should calculate the sales tax based on the fair market or elected value of the property you transfer.

Capital Property

In most cases, these transfer rules only apply to capital property. For example, if you transfer office furniture to your business, that is a transfer of capital property. In contrast, if you transfer a few office supplies, such as paper or pens, you are not eligible to use this rule.

Capital property can be real property, but it can also include non-tangible things, such as debt obligations. If you need to use personal assets in your business, don’t forget to account for the transfer. Accounting for these transactions helps increase business expenses on paper, which ultimately lowers your taxable income and your tax liability.

Maintain Records

The CRA requires taxpayers to keep all records for six years. If you’re self-employed, you need to keep records and receipts of all your business transactions. In cases where you transfer personal assets to your business, it’s a good idea to keep information on how you determined the fair market value of the asset, and you may also want to keep records on how and when you used the asset for work.

Using personal assets for your new business can help reduce your startup costs. If you claim the transaction on your tax return, that can lower your business income and reduce your tax liability. This process applies only to independent contractors and self-employed individuals. If your business is a partnership or a corporation, you can still transfer personal assets, but the process is slightly different.

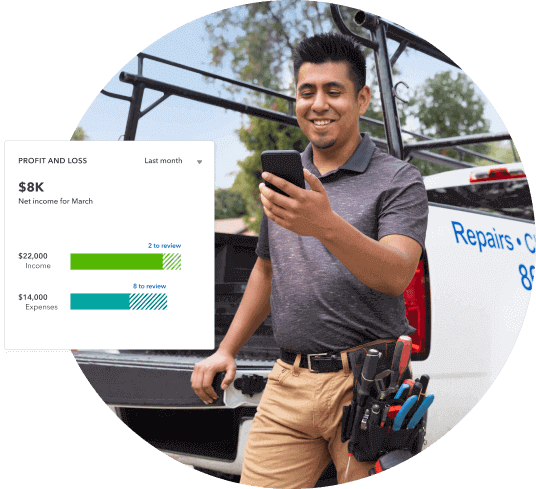

Part of running a successful business is keeping up with its financial details. Keep your books accurate and up to date automatically. Change the way you manage your finances now.