When your small business makes items or offers services, you need a good way to measure how much each item or service costs so you know how much money you need to make to turn a profit. Cost of goods sold (COGS) lets you calculate total direct costs of the products or services your business sells. This formula includes raw material and supplies costs, direct labour, and direct factory overheads such as utility payments. You report COGS on the second line of your income statement, just below sales revenue.

How to Track Cost of Goods Sold for Your Business

What Is Cost of Goods Sold (COGS)?

The cost of goods sold (COGS) refers to the cost of producing an item or service sold by a company.

Knowing the cost of goods sold can help you calculate your business’s profits. COGS can also inform a proper price point for an item or service. Understanding this term can help you better manage your inventory, taxes, and business.

Is the cost of goods sold the same as the cost of sales?

Yes, the cost of goods sold and cost of sales refer to the same calculation. Both determine how much a company spent to produce their sold goods or services.

What is included in the cost of goods sold?

The cost of goods sold may include

- Materials used to create a product or perform a service.

- Labour needed to make a product or perform a service.

- Overhead costs directly related to production (for example, the cost of electricity to run an assembly line).

The cost of goods sold excludes

- Indirect expenses (for example, distribution or marketing).

- Overhead costs associated with general business operations.

- The cost of creating unsold inventory or services.

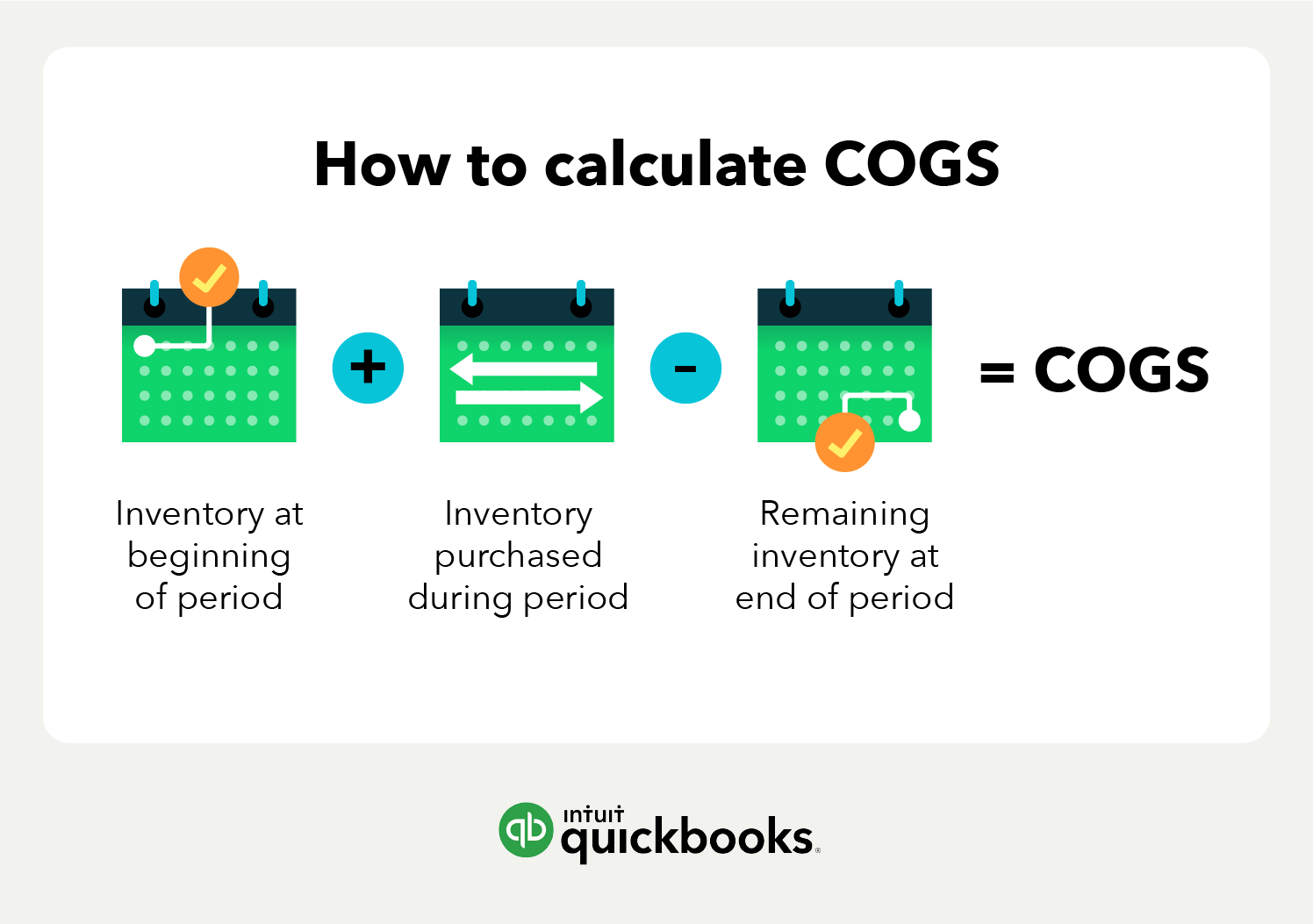

How to calculate the cost of goods sold

Calculate COGS by adding the cost of inventory at the beginning of the year to purchases made throughout the year. Then, subtract the cost of inventory remaining at the end of the year. The final number will be the yearly cost of goods sold for your business.

Typically, calculating COGS helps you determine how much you owe in taxes at the end of the reporting period—usually 12 months. By subtracting the annual cost of goods sold from your annual revenue, you can determine your annual profits. COGS can also help you determine the value of your inventory for calculating business assets.

There are other inventory costing factors that may influence your overall COGS. The CRA refers to these methods as “first in, first out” (FIFO), and average cost.

Inventory Costing Methods

The CRA requires businesses that produce, purchase, or sell merchandise for income to calculate the cost of their inventory. Depending on the business’s size, type of business license, and inventory valuation, the CRA may require a specific inventory costing method. However, once a business chooses a costing method, it should remain consistent with that method year over year. Consistency helps businesses stay compliant with generally accepted accounting principles (GAAP).

The CRA explains costing methods in IT473R. If an item has an easily identifiable cost, the business may use the average costing method. However, some items’ cost may not be easily identified or may be too closely intermingled, such as when making bulk batches of items. In these cases, the CRA recommends the FIFO costing methods.

Please note the LIFO isn't an acceptable costing method in Canada.

First in, first out (FIFO)

The first in, first out (FIFO) costing method assumes two things:

- The items purchased or produced first were also the first items sold.

- The inventory items at the end of your reporting period are matched with the costs of related items recently purchased or produced.

The price of items often fluctuates over time, due to market value or availability. Inflation causes prices to increase over time. Deflation causes prices to decrease over time. Depending on how those prices impact a business, the business may choose an inventory costing method that best fits its needs.

During inflation, the FIFO method assumes a business’s least expensive products sell first. As prices increase, the business’s net income may increase as well. This process may result in a lower cost of goods sold compared to the LIFO method. However, during price deflation, the opposite may occur.

For example, a jeweller makes 10 gold rings in a month. When production started, it cost $100 to make gold rings. Due to inflation, the cost to make rings increased before production ended. By the end of production, gold rings cost $150 to make. Using FIFO, the jeweller would list COGS as $100, regardless of the price it cost at the end of the production cycle. Once those 10 rings are sold, the cost resets as another round of production begins.

Average cost method

To determine the average cost of an item, use the following formula:

(Total cost of goods purchased or produced in a reporting period)/ (Total number of items purchased or produced in a reporting period)

In other words, divide the total cost of goods purchased in a year by the total number of items purchased in the same year.

The average cost method, or weighted-average method, doesn't take into consideration price inflation or deflation. Instead, the average price of stocked items, regardless of purchase date, is used to value sold items. Items are then less likely to be influenced by price surges or extreme costs. The average cost method stabilizes the item’s cost for the year.

Here’s what this method looks like, using the same jeweller example: 10 gold rings cost $100 to make at the beginning of production. By the end of production, the rings cost $150 to make, due to price inflation. Let’s assume five rings were made at $100, and five were made at $150. Once all the rings are sold, the jeweller can calculate the average cost. Divide $1,250 (the total cost to make all the rings) by 10 (the total rings sold). The jeweller would report COGS as $125.

Examples of the cost of goods sold

When calculating COGS, the first step is to determine the beginning cost of inventory and the ending cost of inventory for your reporting period. Here’s an example.

Twitty’s Books began its 2018 fiscal year with $330,000 in sellable inventory. By the end of 2018, Twitty’s Books had $440,000 in sellable inventory. Throughout 2018, the business purchased $950,000 in inventory.

Let’s assume the bookshop is using the average costing method when determining their inventory’s starting and ending cost. Here’s what calculating COGS looks like:

($330,000) + ($950,000) – ($440,000) = $840,000 cost of goods sold

Twitty’s Books would then notate this amount on its 2018 income statement.

Cost of goods sold in a service business

Some service companies may record the cost of goods sold as related to their services. But other service companies—sometimes known as pure service companies—will not record COGS at all. The difference is some service companies do not have any goods to sell, nor do they have inventory.

Examples of service companies that do have inventory:

- Construction

- Plumbing and electrical

- Repair and installation

- Mining and manufacturing

- Transportation and lodging

For example, a plumber offers plumbing services but may also have inventory on hand to sell, such as spare parts or pipes. To calculate COGS, the plumber has to combine both the cost of labour and the cost of each part involved in the service.

Or picture a bed and breakfast. Its primary service doesn’t require the sale of goods, but the business might still sell merchandise, such as snacks, toiletries, or souvenirs.

Examples of pure service companies that don't have inventory:

- Accounting firms

- Law offices

- Doctors

- Dancers

- Real estate appraisers or firms

- Business consultant

Cost of Goods Sold on an Income Statement

You should record the cost of goods sold as a business expense on your income statement. Under COGS, record, any sold inventory. On most income statements, cost of goods sold appears beneath sales revenue and before gross profits. You can determine net income by subtracting expenses (including COGS) from revenues.

However, some companies with inventory may use a multi-step income statement. COGS appears in the same place, but net income is computed differently. For multi-step income statements, subtract the cost of goods sold from sales. The result is gross profits. You can then deduct other expenses from gross profits to determine your company’s net income.

Is the cost of goods sold an expense?

Yes, you should record the cost of goods sold as an expense. COGS is considered a cost of running the business. To create inventory, you have to spend money. That may include the cost of raw materials, the cost of time and labour, and the cost of running equipment. Selling the item creates a profit, but a portion of that profit was lost, due to the cost of making the item.

Typically, COGS can be used to determine a business’s bottom line or gross profits. If the cost of goods sold is high, net income may be low. During tax time, a high COGS would show increased expenses for a business, resulting in lower income taxes.

Journal example of how to record the cost of goods sold

You should record the cost of goods sold as a debit in your accounting journal. You then credit your inventory account with the same amount.

For example, a local spa makes handmade chapsticks. One batch yields about 500 chapsticks. It costs $2 to make one chapstick. To determine the cost of goods sold, multiply $2 by 500. The spa’s total cost of goods sold for a batch is $1,000. Recorded in their journal, the entry might look like this:

The above example shows how the cost of goods sold might appear in a physical accounting journal. The entry may look different in a digital accounting journal.

No matter how COGS is recorded, keep regular records of your COGS calculations. Like most business expenses, records can help you prove your calculations are accurate in case of an audit. Plus, your accountant will appreciate detailed records come tax time.

In accounting, debit and credit accounts should always balance out. The example above shows COGS listed as a positive expense. Inventory is listed as negative credit. Inventory decreases because, as the product sells, it'll take away from your inventory account.

The Value of COGS for Your Business

Calculating and tracking COGS throughout the year can help you determine your net income, expenses, and inventory. And when tax season rolls around, having accurate records of COGS can help you and your accountant file your taxes properly. Determining the cost of goods sold is only one portion of your business’s operations. But understanding COGS can help you better understand your business’s financial health.

QuickBooks Advanced can keep all of your reports in order with end-to-end custom reporting.