Do you accept jobs that take several years to complete? If so, it’s important to consider the time value of money. The idea is that money isn’t worth as much in the future as it is right now. Though the face value of the money doesn’t change, its purchasing power fluctuates as years go by. In some cases, money becomes less valuable because of inflation. In rare cases, though, money could increase in value due to deflation. To take advantage of the time value of money, it’s helpful to understand present value and future value and how to calculate these essential amounts.

How to Incorporate Present and Future Values

Calculating Present Value of Money

Suppose your business has a job from a new customer that requires a time frame of three years to complete. In contract negotiations, you both settled on a price of $100,000, and now you’re bouncing around different possibilities for payment terms. Your company prefers to receive payment up front, but the client wants to pay after your company completes the work.

The client is so adamant about paying when you finish the job that he threatens to walk if you don’t agree to his terms. Your company agrees, but points out that, due to inflation, $100,000 received in three years isn’t really $100,000. The client doesn’t understand, so you show him the present value calculation to explain.

To determine what money today could be worth in three years, you have to subtract the inflation accumulated during that time. The equation goes like this: PV = FV (1+i)^-n, where PV equals present value, FV equals future value, i equals annual inflation, and n equals number of years.

Assuming an inflation rate of 3% (or 0.03), the equation looks like this: PV = $100,000 * 1.03^-3. The present value of $100,000 in three years is $91,514. If the customer waits to pay you the agreed-upon $100,000, he essentially shorts your company $8,486.

Calculating Future Value of Money

Continuing with this example, you show the customer why $100,000 in three years isn’t the same as $100,000 today. The customer still wants to pay after you complete the project, but the customer is willing to renegotiate a higher payment amount that represents what $100,000 today is worth in three years.

The future value formula exists to find this value, and the calculation looks a lot like the formula for present value: FV = PV (1+i)^n. Since you already know that the present value is $100,000, the annual inflation rate is 0.03, and the number of years is three, you can plug in the numbers and calculate the future value: FV = $100,000 * 1.03^3. The client should pay your company $109,272 in three years to offer the equivalent of paying $100,000 today.

Why Calculate Present and Future Value

When making long-term business decisions, calculating present and future values gives you a better picture of your future cash flow and accounts for inflation and opportunity costs. In the above example, not accounting for the time value of money could cost your business nearly $10,000 by incorrectly assuming that $100,000 is $100,000, whether you receive it today or in three years. The time value of money also helps you match expected future revenues to expenses and get a more accurate picture of expected cash flows.

Present Value Calculation Tables

You can also calculate the present value of an annuity, which is a series of equal payments over a period of time. For example, if the client mentioned above agreed to divide $100,000 into 36 equal payments and pay monthly for three years, you can use the present value calculation to determine how much the sum of these payments is worth today.

You can make this calculation with present value tables without having to memorize formulas or plug in numbers. Instead, you simply locate the number of periods, find the interest or inflation rate per period on the table, find the cell where they intersect, and multiply that number by the annuity amount. The only drawback to using present value tables is a lack of precision.

As inflation or interest rates usually round off to whole numbers on tables, accurately calculating present or future value when the value is a decimal requires using a formula. The value of money changes over time. Accounting for these changes is vital for making good long-term business decisions. Understanding the time value of money lets you plan for the future with confidence.

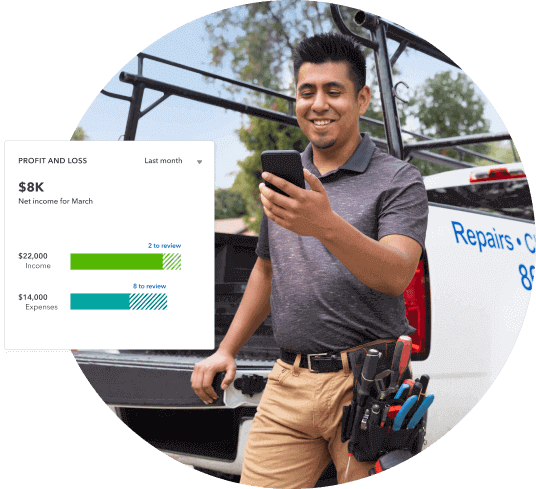

As a small business owner, you already know it’s essential to quickly receive revenue for your cash flow and future growth of the company. Improve your cash flow with invoices, payments, and expense tracking. See how much cash you have on hand with QuickBooks.