If you’re self-employed, you likely know a critical way to maximize your deductions is to claim your business expenses. However, did you know you could be missing out on major tax deductions? Without a smart expense management system, you could be leaving money on the table.

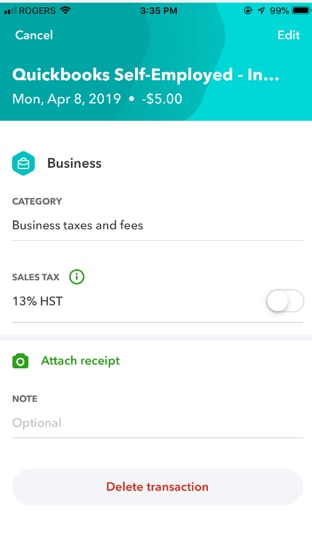

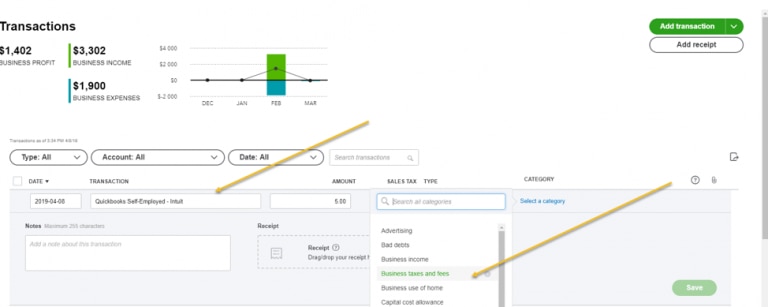

On average, QuickBooks users saved $19,290 in deductions per year by using QuickBooks’ cash flow management tools. QuickBooks Self-Employed helps you organize your expenses and save money. The software is also tax-deductible, which means you can write off the cost of the software, in turn lowering your tax bill.

Test drive QuickBooks Self-Employed for free.