The self-employed life has a lot going for it. For one thing, there's never a shortage of things to do.

One thing to keep in mind? Those little administrative tasks like invoicing and bookkeeping might seem like number 67 on your priority list, but they're actually the fuel that keeps the whole engine running. After all, you're doing this to earn an income, right?

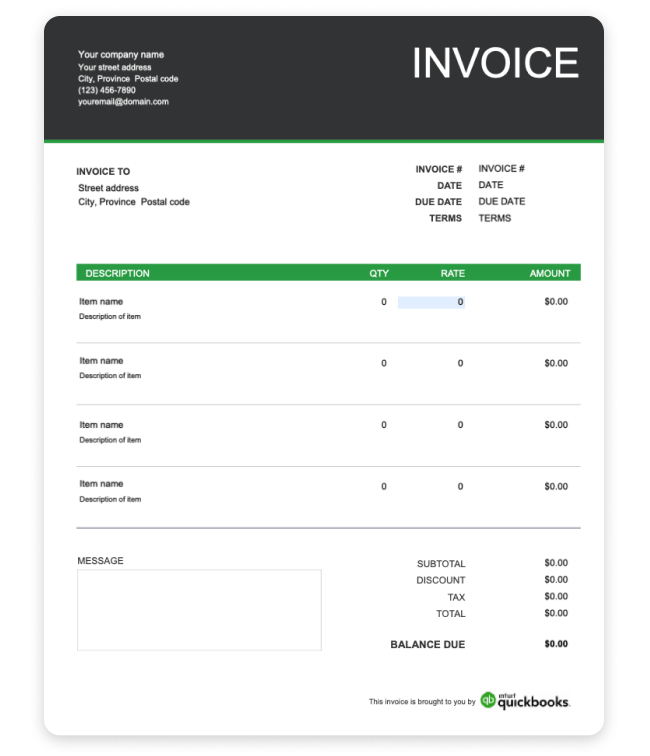

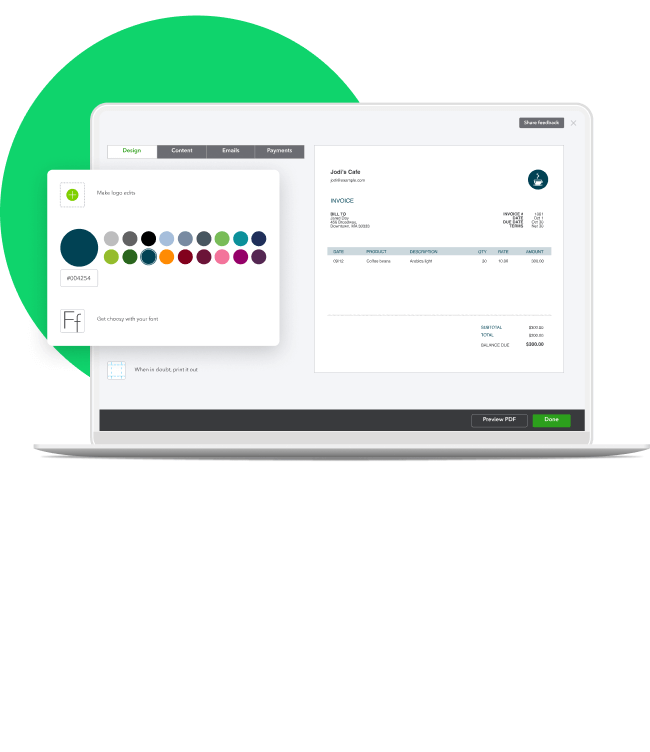

Make your life easier by using our free downloadable freelance and self-employed invoice template so you can track your work and streamline your billing process. Read on to learn how to write an invoice for freelance work, including what should be on a professional invoice, and how and when to send it off to clients to get paid quicker.

Download and customize your freelance and self-employed invoice template now.