Painting is hard work, and you want to make sure you get paid in full — and on time. One key step to achieve this is to send out professional invoices that detail the right information, laid out so customers understand what they're paying for, how to pay, and when.

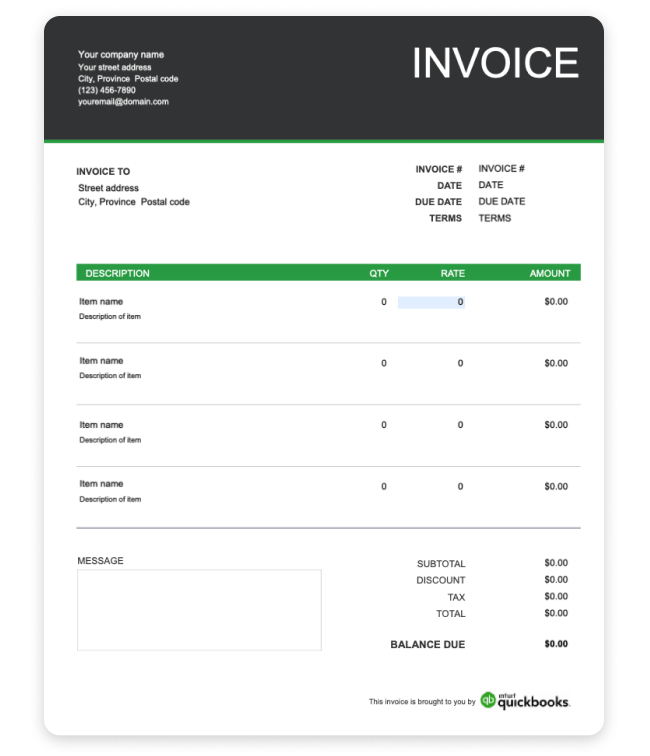

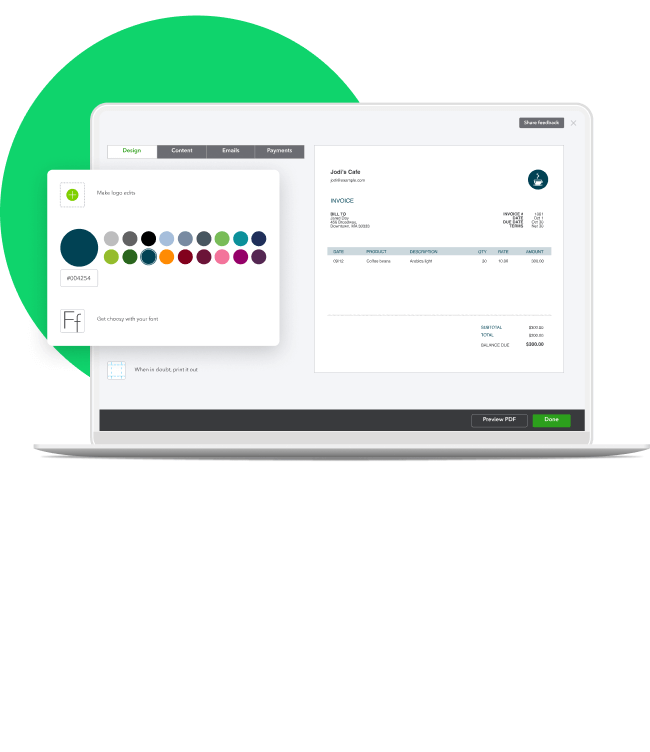

But you're a busy painter. While you're an expert in cutting in and rolling techniques, designing an invoice might not be in your skill set. Our downloadable free painting invoice template is here to make your life easier.

Read through our invoicing tips for more advice on sending the best invoices you can.