When should you send your small business invoice to your clients?

If you provide short-term, small-scale services, it’s customary to send an invoice at the end of the project directing the client that payment is due upon receipt.

If your projects are larger in scope, breaking them into scheduled invoices is a common practice.

Depending on the scope of a project, you can also invoice for a deposit upon signing the contract and break down remaining payments into monthly, bi-monthly, or quarterly payments.

Using online invoices or invoicing tools will make creating and sending your invoices easier and more efficient.

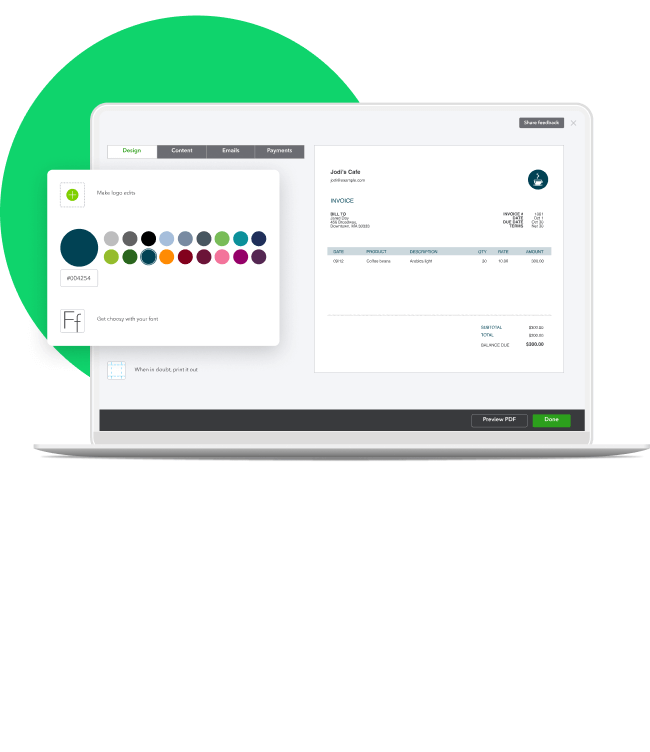

With QuickBooks, you will get access to features that will allow you to:

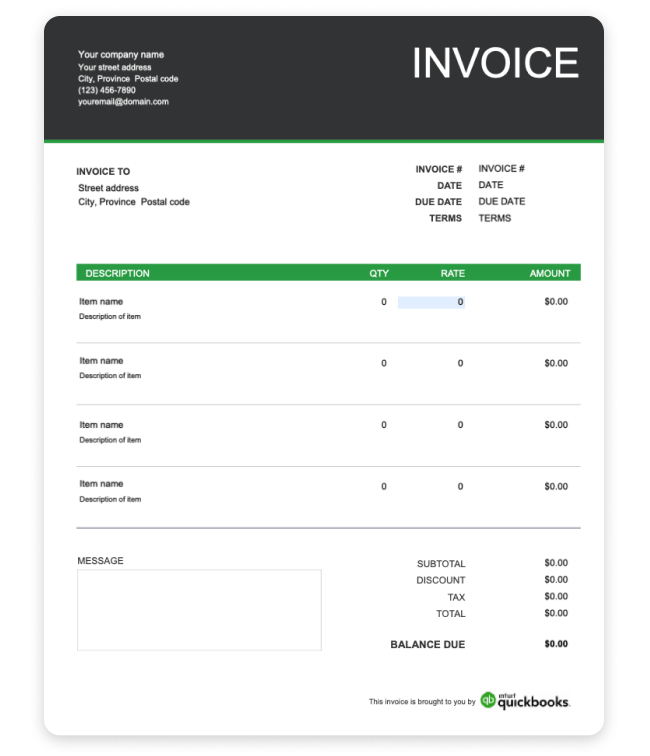

- Customize your small business invoice template (choosing brand colours, currency type, and language preferences).

- Set up automated scheduled invoices.

- Automate sales tax calculations.

- Make it easier for customers to pay with the “Pay Now” button.

- Automatically match the client's payment with the invoice in your books to save you time and keep everything updated with QuickBooks instant payment matching.

And the list doesn’t end there.

Download the free invoice template and try QuickBooks invoicing solutions today to see how QuickBooks can help simplify your entire billing process.