Invoices are a vital part of your small business. They keep track of what customers or clients owe you when money is due, and what kind of cash flow you can expect in the coming weeks or months. Without invoices, your small or medium-sized business doesn’t have a way to collect money. You may also need an invoice to accrue the right amount of sales tax as required by the Canada Revenue Agency.

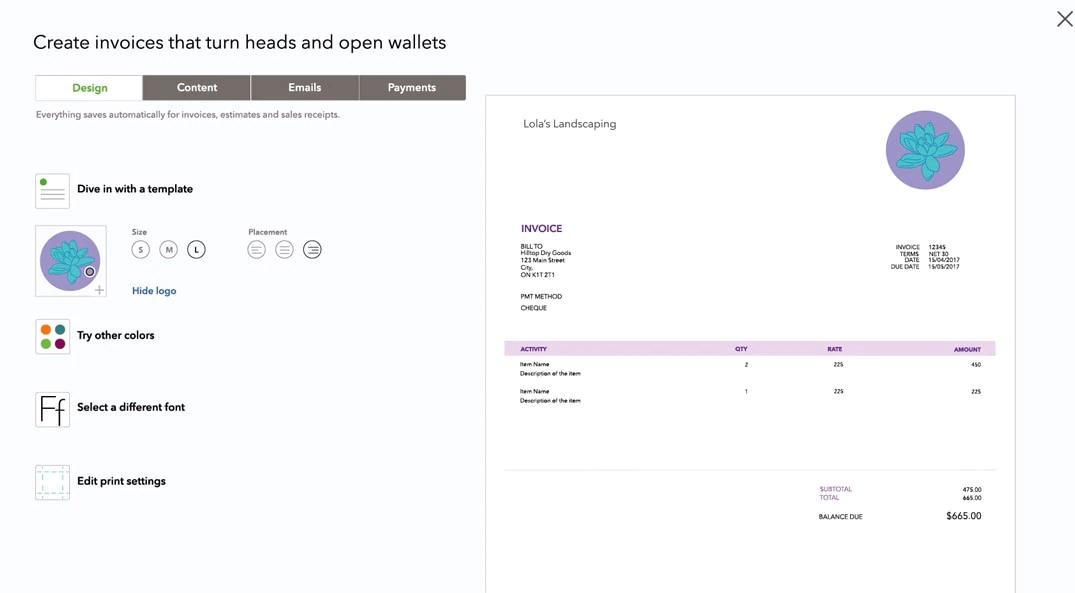

Invoice templates offer a way to streamline your invoicing process, which saves time and money. Learn how to create an invoice that distinctively fits your business, with the basic invoice template options that are available within three great software programs.