When conducting financial analysis, quick ratio calculations can help chief financial officers (CFOs) and finance teams determine their company’s liquidity and ability to meet short-term financial obligations. With prevalent economic uncertainty in the foreseeable future, 36% of Canadian businesses say one of their biggest challenges is financial strain, according to a Canadian Federation of Independent Business survey.

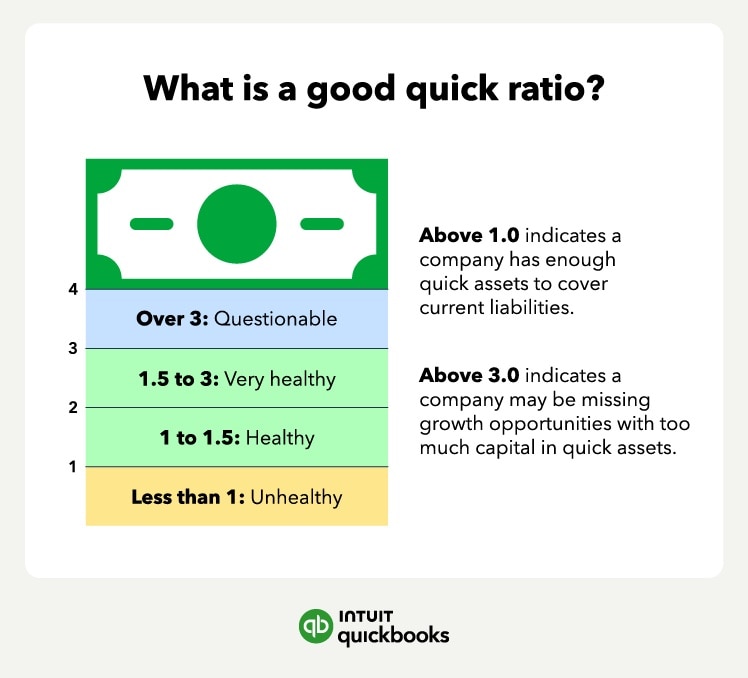

By evaluating the quick ratio, analysts, investors, and key stakeholders can obtain valuable insight into a mid-sized company’s financial stability and cash flow management. Financial liquidity allows businesses to maintain positive relationships with lenders and suppliers.

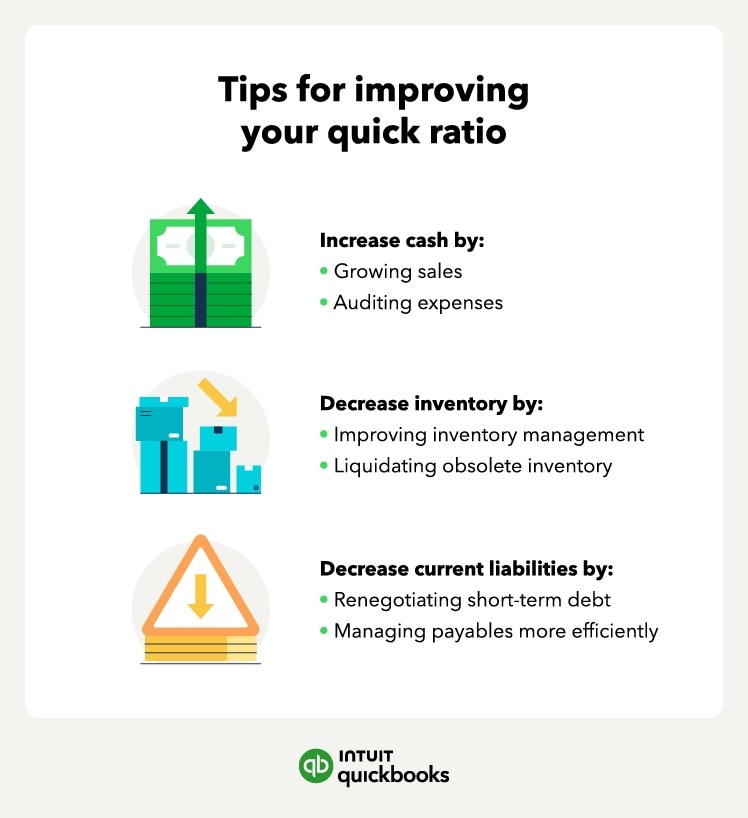

In this article, we’ll explore how the quick ratio works, explain what makes a good quick ratio, evaluate the advantages and disadvantages, provide industry examples, and offer strategies on improving liquidity.