Today, Intuit Canada launches QuickBooks Self-Employed in Canada, a new, simple mobile app that makes it easy for the nation’s freelance workers to stay in control of their business finances and help them prepare for tax time while on the go with effortless expense, mileage and invoice tracking all in one place.

Intuit Canada Launches QuickBooks Self-Employed Mobile App

Rise of the Self-Employed Economy

A QuickBooks study in partnership with Emergent Research shows that full and part-time freelancers, independent contractors and on-demand workers are expected to account for up to 45 percent of the workforce by 2020 . This growth will be driven in part by an increase in the on-demand economy, like ride-sharing, peer-to-peer rental, project-based job platforms and online retail platforms.

Additional QuickBooks Canada research on this rapidly expanding demographic reveals that nearly half (47 per cent) of self-employed Canadians pursued that work because of a desire for greater work life flexibility, but the rise of self-employment is also a function of need. Forty-one per cent of self-employed workers are doing so to supplement income.

QuickBooks Self-Employed is specifically designed to make it easy for these freelancers to manage business and personal finances, prepare for tax time throughout the year, and help meet compliance requirements.

“As the on-demand economy continues to expand, there will be unprecedented income opportunities for freelancers. But this work comes with a host of new challenges: co-mingled and confusing business expenses, quarterly and year-end tax headaches, and a general lack of visibility into their ‘real income’,” said Jeff Cates, president, Intuit Canada. “We’re thrilled to introduce the QuickBooks Self-Employed app, tailor-made to meet the unique financial management needs of this new type of entrepreneur operating in a new economy.”

Self-Employed Canadians Face Financial Challenges

The financial situation for the self-employed is often vastly different from traditional, full-time workers. This demographic must understand potential tax deductions, untangle integrated business and personal expenses and stay on top of record keeping. Accordingly, many are surprised by the amount of taxes they owe the government.

QuickBooks research shows that many self-employed workers are struggling to manage their finances:

- The biggest challenge of self-employment is not enough predictable income (59 per cent).

- Twenty-nine per cent of self-employed Canadians manually keep track of their finances on paper.

- Almost half (47 per cent) of self-employed Canadians said that financial management software would be helpful for their work.

- Two in three (66 per cent) of on-demand workers said a better understanding of their financial fundamentals would be helpful.

QuickBooks Self-Employed Can Help

QuickBooks empowers self-employed workers to stay on top of their finances and easily keep a close pulse on the overall health of their business:

- Say goodbye to your logbook: Track mileage automatically with your phone GPS and categorize trips with a swipe, so there is no need to touch a logbook again. It also helps users identify potential vehicle deductions and get better prepared for their returns come tax time.

- Track expenses on the go: As business and personal expenses are easily categorized by swiping left or right on your phone, it’s easy and fast to claim every deduction.

- Tax savings are a snap: Help increase tax savings when your receipts are linked to expenses right from your phone. Come tax time, you can be ready to file without a shoebox in sight. Users find an average of $4,340 in tax savings per year.

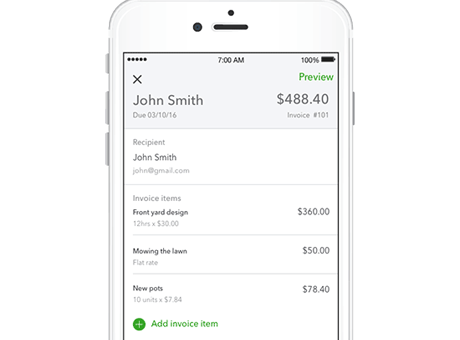

- Get paid faster with effortless invoicing: Create and send invoices effortlessly through the app on the go, and know when to follow up with customers by seeing when they’ve been viewed.

- Profits you can picture: Snap and store receipts, manage expenses, mileage and invoices all in one place, allowing you to access strategic cash-flow insights in real-time and instantly see how much you’re earning and where your money is going so you can plan for what’s next.

Download the new QuickBooks Self-Employed mobile app today from the App Store or Google Play.

About Intuit Inc.

Intuit Inc. creates business and financial management solutions that simplify the business of life for small businesses, consumers and accounting professionals.

Its flagship products and services include QuickBooks® and TurboTax®, which make it easier to manage small businesses and tax preparation and filing. Mint.com provides a fresh, easy and intelligent way for people to manage their money, while Intuit’s ProConnect brand portfolio includes ProSeries® and Lacerte®, the company’s leading tax preparation offerings for professional accountants.

Founded in 1983, Intuit had revenue of $4.7 billion in its fiscal year 2016. The company has approximately 7,900 employees with major offices in the United States, Canada, the United Kingdom, india , Australia and other locations. More information can be found at www.intuit.com.