Data from the 2024 Intuit Financial Literacy Survey lifts the lid on an important trend: women are less likely than men to feel confident about their finances. This isn't just a personal issue; it's a major roadblock standing between women and their life goals, their dream businesses, and their ability to handle everyday money worries. The survey shines a spotlight on the uncomfortable truth about money — it's still a taboo topic, especially for women — and explores the consequences financial stress and disparities have on financial prosperity and overall well-being.

Findings at a glance:

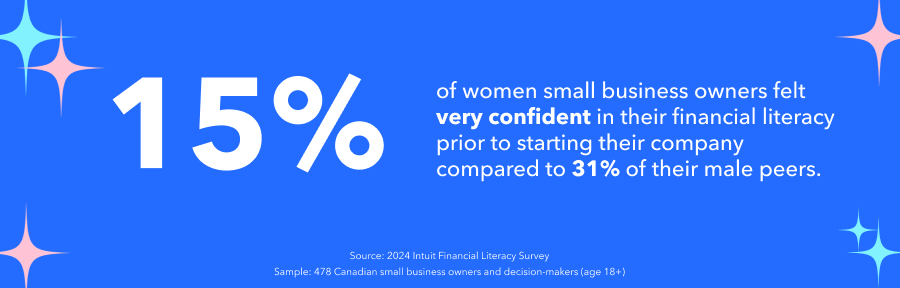

- Many women face barriers to financial success, with 55% of women surveyed wanting to improve their financial literacy, and just 15% of women small business owners feeling very confident in their financial knowledge before launching a business.

- Financial insecurity is a pressing concern, with only 38% of women having 3 or more months of savings and 19% of women-owned businesses possessing adequate cash reserves to navigate unforeseen financial challenges for 6+ months.

- Financial stress is widespread, affecting 57% of consumers surveyed, with women (61%) and Gen Z (71%) disproportionately impacted; plus, nearly a quarter of small business owners (23%) feel less financially confident than their peers — and among women, this rises to 26%.

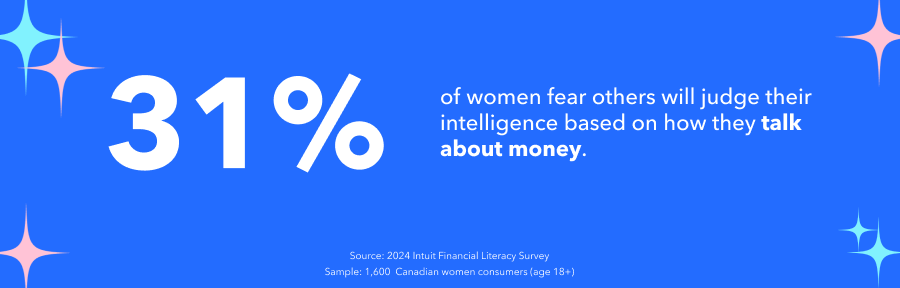

- The stigma surrounding money talk persists, with 22% of consumers feeling uncomfortable discussing finances in social settings. This discomfort is particularly pronounced among women (27%) and women small business owners, of whom 15% confess they find it easier to talk about their sex lives than finances.

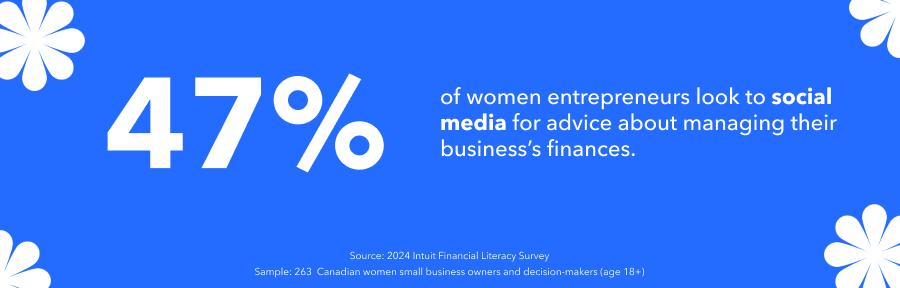

- Women are taking their financial education into their own hands with personal research providing their biggest financial lessons (29%) and nearly half of women entrepreneurs (47%) turning to social media platforms for financial advice.