Over the past week, as the government has begun lifting restrictions, we have seen many small and medium businesses (SMBs) across Canada reopen their doors and slowly resume operations. However, we’re far from business as usual. SMBs are navigating new regulations and unpredictability, and planning for the future is more important than ever.

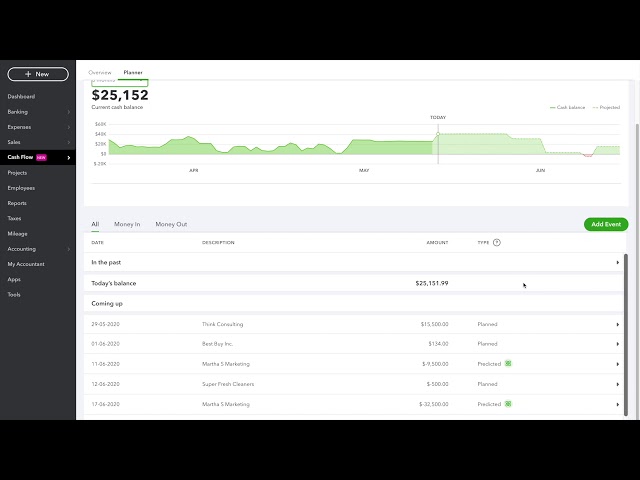

To support SMBs through the recovery phase and beyond, today, Intuit QuickBooks Canada launched their new Cash Flow Planner, which infuses QuickBooks’ accounting software with artificial intelligence (AI) to help better predict cash flow positions.

The Cash Flow Planner will help SMBs make informed financial decisions to manage cash flow more effectively, at a time when it is needed more than ever.

“The QuickBooks Cash Flow Planner is a first in the industry in Canada,” said Melika Hope, Head of Product at Intuit QuickBooks Canada. “Our AI sees transactions across the platform, looking at cash flow, expenses and invoices pending.”