What to consider when choosing an automated payroll system

Choosing the right automated payroll system for your business is crucial. Some key factors to consider include the system's ease of use, cost, customer support availability, integration capabilities with other business software, and how well it can adapt to your business's growth.

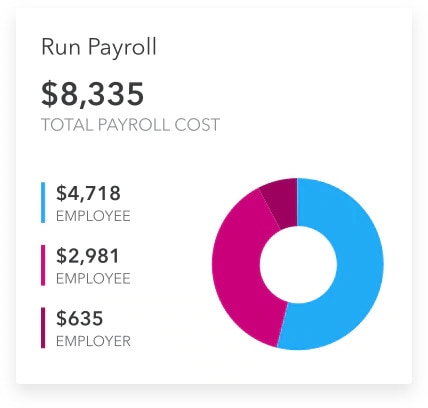

You'll want to make sure the system can handle your specific payroll requirements such as different pay rates, bonuses, and benefits.

Embracing payroll automation

Embracing payroll automation isn't just about efficiency—it's a step toward better overall business management. It allows for improved cash flow management, enhanced data security, and more accurate financial forecasting.

Payroll automation also provides more effective human capital management by freeing up time to focus on your greatest assets—your employees.

Payroll doesn't have to be a stressful process. With QuickBooks Online you can turn it into an efficient, error-free system that offers peace of mind. For example, the employee portal allows employees to track their vacation days, view pay stubs, and access T4/RL1 slips. We also assist you by automatically preparing your year end forms, staying on top of tax rates and more. Try QuickBooks Online today.