Payroll remittances in Ontario

Here are the common payroll responsibilities that employers must follow:

Step 1: Open and maintain a payroll program account. Be sure to meet the conditions in Chapter 1 on the Canada Revenue Agency (CRA) website.

Step 2: Obtain your employee's social insurance number (SIN).

Step 3: Get a completed federal Form TD1 Personal Tax Credits Return, and, if applicable, a provincial or territorial Form TD1. New employees or recipients of other amounts, such as pension income, must fill out this form.

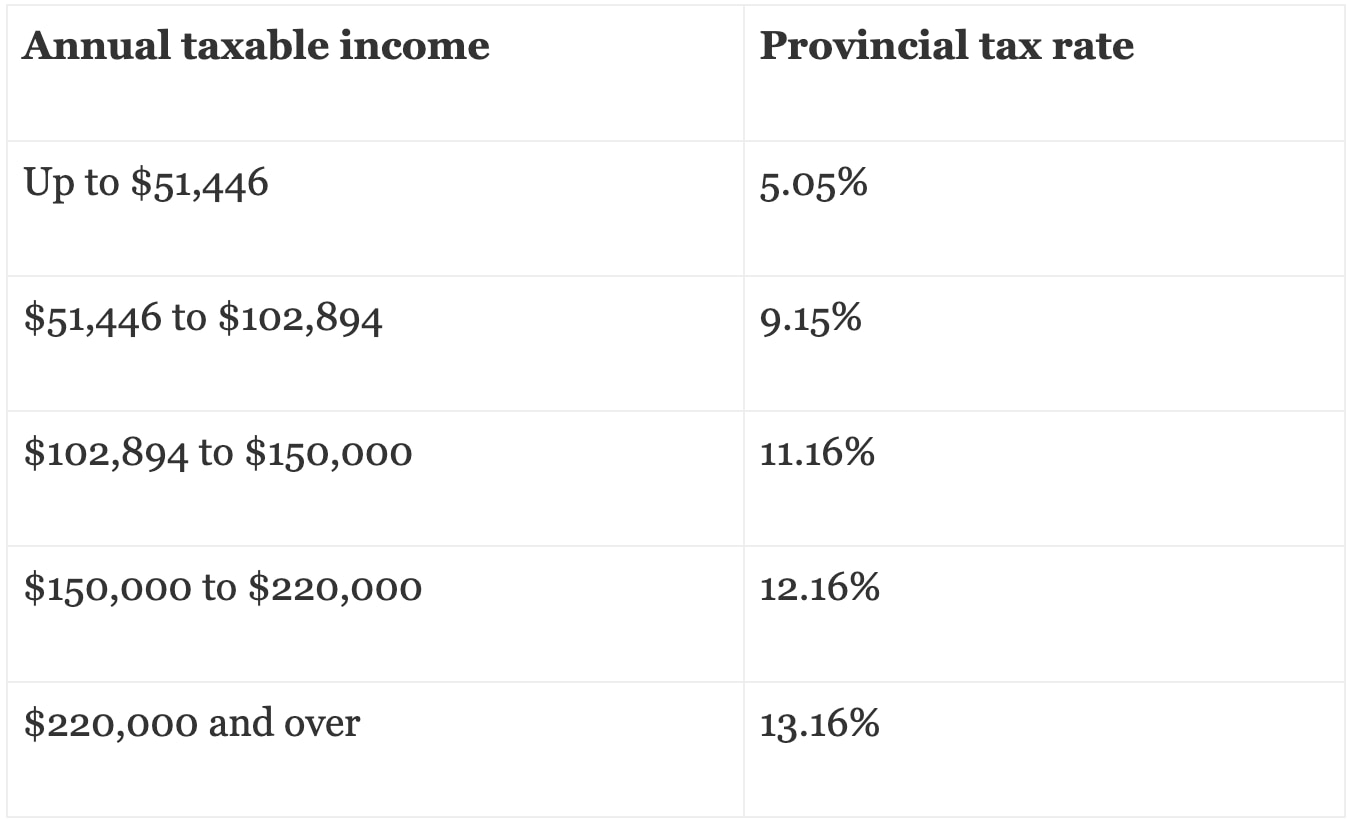

Step 4: Deduct the Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, and income tax from remuneration or other amounts, including taxable benefits and allowances, that you pay in a pay period.

- Be sure to hold these amounts in trust for the Receiver General and keep them separate from the operating funds of your business.

- Make sure these amounts are not part of an estate in liquidation, assignment, receivership, or bankruptcy.

Step 5: Remit these deductions along with your share of CPP contributions and EI premiums.

Step 6: Report the employee's income and deductions on the appropriate T4 or T4A slip. You must file an information return on or before the last day of February of the following calendar year.

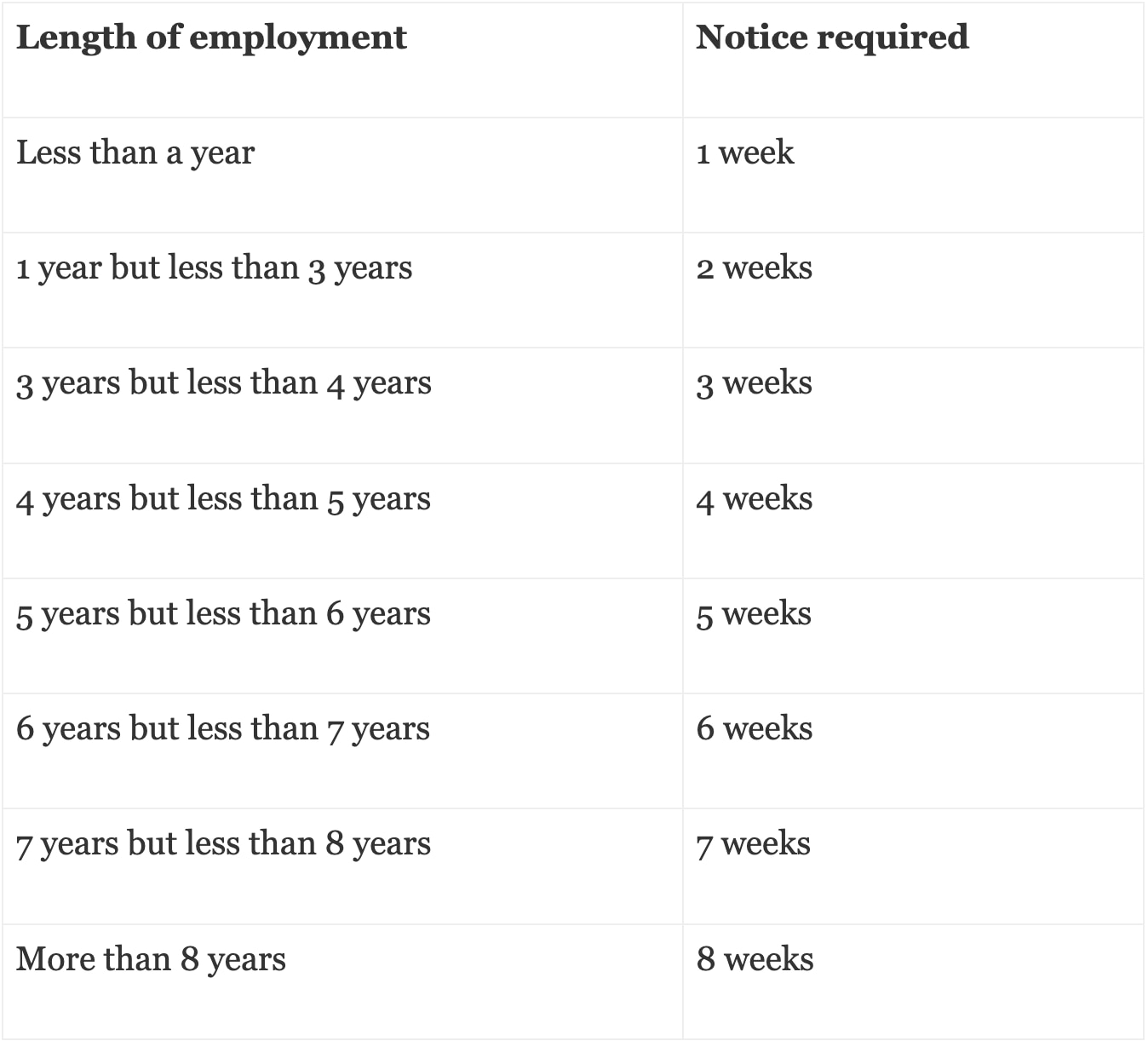

Step 7: Prepare a record of employment (ROE) when an employee stops working and has an interruption of earnings (for example, if a temporary layoff occurs).

Step 8: Keep records in your payroll account because the CRA may ask to see them.

.png)