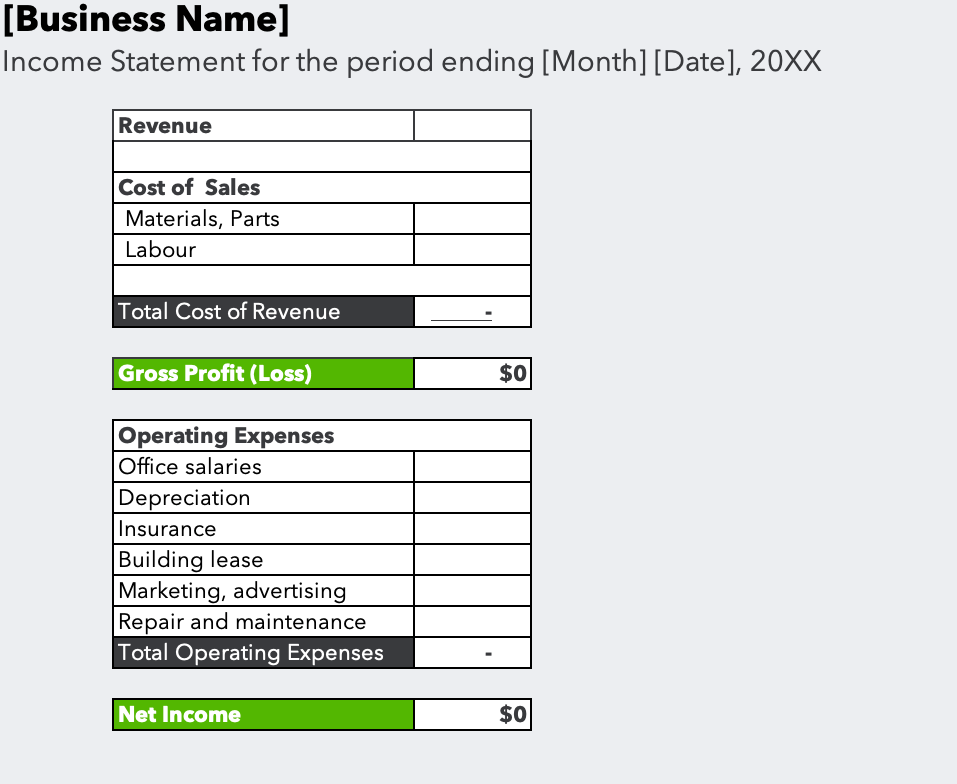

What’s an Income Statement?

An income statement, along with the balance sheet and cash flow statement, is one of the primary financial statements used to assess your company’s financial position. Sometimes called a “statement of operations,” an income statement measures a company’s financial performance over a specific period of time. It’s typically generated monthly, quarterly, or annually, and it lists all relevant revenues, expenses, gains, and losses to calculate the company’s net income for the period.

Understanding your company’s profitability is vital to ensuring it delivers the necessary profits to stay solvent. Along with understanding your company’s profitability for a period of time, using your income statement to compare its profitability to a prior time period is equally as important.

This will give you an accurate view of whether the company’s sales and profits have increased over time and can be an important tool to help you make informed business decisions. Income statements can also help demonstrate your company’s return on investment, risk, financial flexibility, and operating capabilities.

Choosing the time period for your statement depends on your needs. If you use the income statement to review your operations, select any period that works for you. This may be quarterly or even monthly. If you need the income statement for a loan application, typically the statement is year-to-date, ending with the most recent month. You may also need to provide a statement for the prior full year as well.