Advice for aspiring small business owners

For Mélanie Bernard, staying true to one’s values and vision is essential. “Authenticity resonates with people and can guide you through challenging times,” she says.

Bernard advises entrepreneurs to focus on building a supportive community: “It’s about forming lasting relationships — from your suppliers to your collaborators to your clients.” This focus on relationships has helped MINI TIPI create a business that goes beyond products, fostering a sense of connection with every item it produces.

From the accounting perspective, Marc-Antoine Synnott encourages small business owners to clearly understand their financial needs and research potential partners thoroughly.

“Before you start looking for an accounting firm, identify what services you need. Do you need help with bookkeeping, tax preparation, financial planning, or all of the above? Knowing your needs will help you find a firm that offers the right services,” Synnott says.

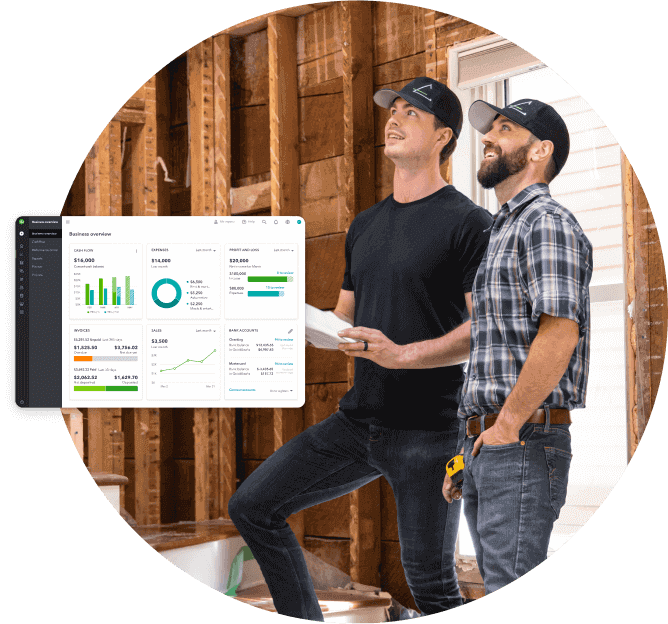

He also emphasizes the importance of technology in today’s business landscape. “Look for a firm that uses modern accounting software and technology. This can streamline processes and provide you with real-time access to your financial data,” he explains.

In addition, Synnott highlights the importance of building a strong relationship with your accountant, describing them as a trusted advisor who can help your business scale. “Building a strong relationship with them can lead to better financial advice and support as your business grows,” he adds.

Both Bernard and Synnott agree that prioritizing relationships, authenticity, and strategic financial planning can lay a strong foundation for long-term success. Whether it’s through cultivating community ties or aligning with technology-driven financial practices, their combined wisdom underscores the value of adaptability and purpose in building a resilient business.

This collaboration means MINI TIPI can focus on its long-term vision and confidently pursue growth opportunities without fearing unexpected financial pitfalls.

This collaboration means MINI TIPI can focus on its long-term vision and confidently pursue growth opportunities without fearing unexpected financial pitfalls.