Types of journal entries

Although all journal entries follow the same blueprint and have similar sections, different types are used for different purposes in accounting. Needless to say, it is important to select the appropriate type for each entry to maintain accuracy. Here are some common types:

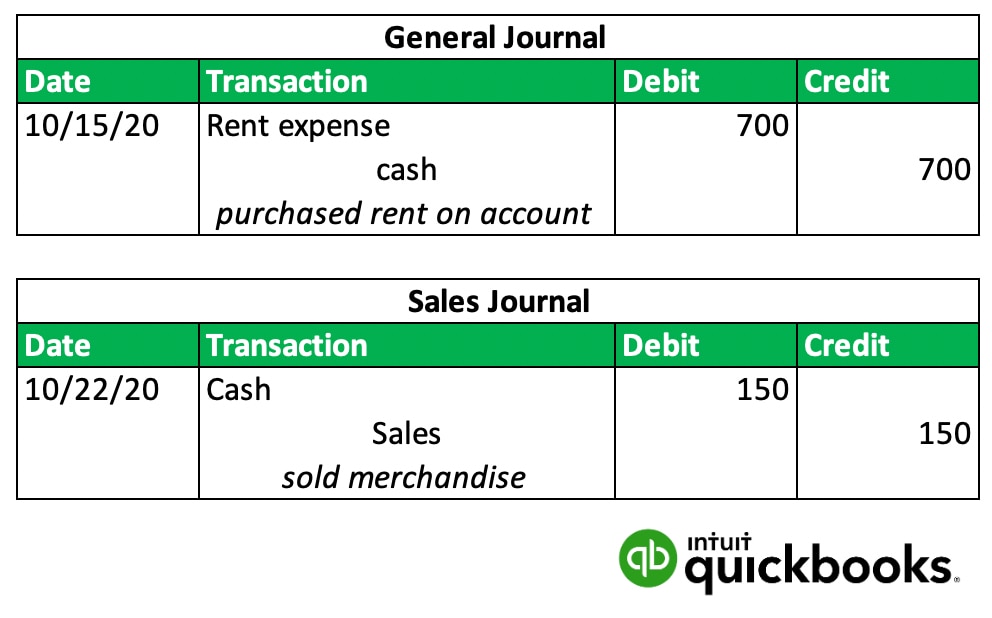

General journal entries

General journal entries are used for the vast majority of day-to-day business transactions that don't fit neatly into specialized journals.

General entries are used for day-to-day business transactions. If you can’t fit a transaction too neatly into one of the specialized journals below, this is the one to use. Here are some examples of general journal entries:

- Sales of goods or services.

- Purchases of inventory or supplies.

- Cash receipts and payments.

- Expenses like rent, utilities, and salaries.

For most small businesses, the general journal is the primary place where financial transactions are initially recorded using the double entry accounting method.

Adjusting entries

Adjusting entries are crucial for ensuring that your financial statements accurately reflect your business's financial position at the end of an accounting period (e.g., month, quarter, or year). These entries typically involve non-cash transactions and are necessary to comply with the accrual basis of accounting. Common types of adjusting entries include:

- Accrued Revenues: Recognizing revenue that has been earned but for which cash has not yet been received. For example, if you completed a service for a client in the current period but haven't invoiced them yet, an adjusting entry would record this revenue.

- Accrued Expenses: Recognizing expenses that have been incurred but for which cash has not yet been paid. An example would be salaries earned by employees at the end of the period that will be paid in the next period.

- Depreciation: Allocating the cost of a long-term asset (like equipment) over its useful life.

- Unearned Revenues: Adjusting for cash received in advance for services or goods that have not yet been provided.

- Prepaid Expenses: Adjusting for expenses paid in advance that have now been used up. For instance, if you paid for an annual insurance policy upfront, an adjusting entry would recognize the portion of the insurance that has expired during the period.

Closing entries

Closing entries are made at the end of an accounting period to reset the balances of temporary accounts (revenue, expense, and dividend accounts) to zero. This process transfers the net income or loss for the period to a permanent owner's equity account (like retained earnings).

Closing entries are a key step in the accounting cycle, ensuring that each new accounting period starts with a clean slate for temporary accounts. If you would like to know more, we also have an article specifically on opening and closing entries.

Reversing entries

These are optional entries made at the start of an accounting period used to reverse certain adjusting entries made in the previous period. Their purpose is to simplify the recording of routine transactions in the new period and are most commonly used for accrued revenues and expenses.

Say, if you accrued salary expense at the end of the previous period, a reversing entry at the beginning of the new period would debit the accrued salaries payable and credit salary expense. This allows you to record the subsequent cash payment of salaries in the usual way, without needing to remember the prior accrual.

Compound entries

Finally, a compound journal entry is used when a single transaction affects three or more accounts. Instead of creating multiple separate journal entries, a compound entry combines all the related debits and credits into one entry.

For example, if your business receives a lump sum payment from a customer that includes both sales revenue and sales tax, a compound entry would debit the cash account for the total amount and credit both the sales revenue account and the sales tax payable account. Using compound entries can help allows you to reduce the number of total entries, speeding up the workstream.