When you embark into the entrepreneurial world of self-employment, you take on a lot more control over your income and finances. This also means you take on more responsibility for calculating your own tax liability. You may have to consider things that salaried employees don’t necessarily have to consider, such as deductible business expenses and how much sales tax to collect from customers. Whether you need to decide when to file your taxes when you’re short on cash, want help identifying deductible expenses you might overlook, or want help using online tools or a mobile app to streamline your bookkeeping, these self-employment tax tips can help you get started on the right foot.

How to Calculate Sales Tax in Quickbooks and Other Tax Tips for the Self-Employed

Always File Your Taxes on Time

It’s important to always file your taxes on time, regardless of your ability to pay. It may be tempting to hold off on filing until you save up the money to pay, but there's no benefit to this. Either way, the Canada Revenue Agency (CRA) charges you interest on past due amounts. But if you don’t file your return on time, you also have to cover a late filing penalty as well. As of 2018, the CRA charges a flat 5% just for being late and then 1% for each additional month you’re late, up to 12 months. This can add up quickly, and you may find your tax bill increases by as much as 17% just because you missed the filing deadline. Filing on time and then working out payment arrangements is the best way to catch up when you find yourself a little short on cash come tax time.

You can also request a tax filing extension from the CRA if you need more time. It’s sometimes even possible to waive penalties or interest if the reason for the delay is out of your control.

Properly Classify Your Sources of Income

According to the CRA, you may receive self-employment income from a business, profession, commissions, farming, or fishing. The tax rules for each area can vary, so it’s a good idea to take the time to make sure you properly classify your income and are up-to-date on the latest rules for each classification. The distinctions between categories can be subtle, so it’s helpful to check the CRA guidelines. If you raise dairy cattle, for example, the CRA considers this farming, but if you raise puppies for adoption, this is a regular business activity.

You may also be subject to special rules depending on your category. If you’re a designated business professional , which includes accountants, lawyers, and medical doctors, you must claim all income for the year, even if the work is still in progress and the client or patient hasn’t paid you yet. If you’re selling crafted products, on the other hand, you don’t have to recognize your work in progress as income.

Claim Often Overlooked Expenses to Maximize Your Tax Deductions

Knowing exactly which expenses you can claim helps you maximize your tax savings. For example, did you know that if you have a home office, you can deduct its cost? You may deduct the rent and any ancillary expenses if you rent an office from places like WeWork, the Centre for Social Innovation, or other shared office spaces.

If you have a vehicle you use exclusively for your business, you can deduct gas, insurance, repair costs, and parking fees. If you use your vehicle for both business and personal use, you can deduct a percentage of those costs based on how often you use your car for business.

Other little-known expenses include interest on vehicle payments, cleaning supplies for your home office, and deductions for bad debts and the cost of recovering balances that others owe you.

Use the CRA’s Technology When Calculating Taxes

The CRA has technology that makes filing taxes easier than ever before. If you’re a CRA “My Account” holder, you can import your tax information automatically from the CRA to your tax return software with just a few clicks. CRA’s “Autofill My Return” service populates everything from tax slips to retirement contributions directly into your return. These features ensure the highest level of accuracy.

There are also other online tools that make it quick and easy to file your return. For example, Turbo Tax Self-Employed provides with you helpful step-by-step guidance for reporting your income and helps you identify every possible business expense you can claim.

Use QuickBooks Self-Employed Sales Tax Tools

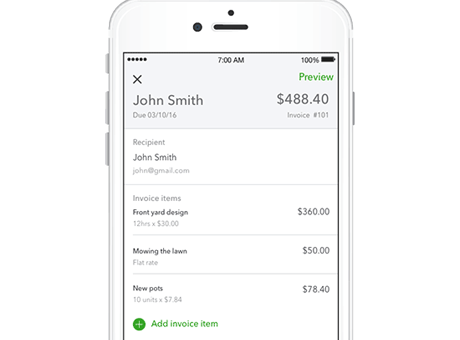

When it comes to keeping track of day-to-day business expenses, many entrepreneurs go digital. QuickBooks Self-Employed helps you stay in control of your business finances and prepare for tax time while on the go, with easy sales tax, expense, mileage, and invoice tracking. The app makes it easy to keep a close eye on the overall health of your business. With this app, you can see exactly how much money is going in and coming out, right from your smartphone or tablet.

Use QuickBooks Self-Employed’s expense tracking feature to automatically track and categorize your expenses with sales tax, so you’re ready come tax time. The category lists match the CRA’s T2125 form, so it'll be easy to fill out when you file your taxes.

With the Sales Tax feature in QuickBooks Self-Employed, you can now track and account for the collection and payment of Goods and Services Tax (GST), Provincial Sales Tax (PST), and Harmonized Sales Tax (HST). Watch the video below to learn how to categorize your expenses and add sales tax in seconds.

Here’s how to easily calculate sales tax in QuickBooks Self-Employed:

First, open the QuickBooks Self-Employed app on your phone. The app asks you if you need to file GST, PST, or HST on the home screen. Select “Yes.”

This takes you to the Sales Tax screen. Select the province where you operate your business. We’ve done the math for you on tax rates around the country, so you can know exactly what you owe based on your province.

Then you can select whether you want to calculate taxes based on an exclusive or inclusive basis. Put simply, do you want to include sales tax as a part of the final invoice amount or add it to the final invoice? These examples with a 5% GST on a $100 invoice can help you see the difference:

- Inclusive – If you select inclusive sales taxes, the app calculates your tax by assigning $95.24 to you as sales income and 5% of that amount, or $4.76, to GST. The total invoice amount is $100, or $95.24 plus $4.76.

- Exclusive – If you select exclusive sales taxes, the app adds the GST to the $100 amount. This gives you sales income of $100, $5 of GST, and a final invoice amount of $105.

The app offers suggestions based on what other businesses in your area use, but for more information on exclusive and inclusive sales taxes, you can click on the information icon. That way you can select what’s best for your business and location.

Once you fill out all the required information, hit “Set up sales tax,” and you’re ready to go.

The app doesn’t just help you with invoicing sales taxes. With QuickBooks Self-Employed, it’s never been easier to keep a close pulse on the health of your business and understand exactly how much money is going in and coming out – every kilometre you drive, every expense, and every tax dollar you owe.

Tax time doesn’t need to be overwhelming if you’re a small business owner. Just remember to file on time, classify income properly, claim every last one of your expenses, and use technology to save time and money. QuickBooks Self-Employed app helps freelancers, contractors, and sole proprietors track and manage business on the go.