When most people think of accounting, they think of services that help them file their tax returns. While tax compliance is a huge chunk of many accounting businesses, accountants who focus solely on these services could be missing out on extra revenue streams. During tax season, you can gauge what types of services your small business clients most desire and suss out the things they’d love to turn over to someone else. When you know which financial duties cause your clientele anxiety, you can then use that information to diversify your accounting offerings to better accommodate their needs past their filing dates. By expanding your offerings to include financial planning, payroll processing, and virtual CFO services, you can create a dynamic accounting business that’s busy year-round instead of just during tax season.

How to Diversify Your Income Stream: Ideas for Accountants

Financial Planning

Since small business owners work for themselves and don’t benefit from group insurance or retirement policies, most need help with the ins and outs of financial planning. This is a lucrative niche you can easily expand during tax season. Since you already have an idea of the company’s finances, you can better understand profit margins and project earnings on company investments. By offering a discounted financial planning consultation, you might shift these once-a-year customers to full-time clients. By helping clients plan ahead for the future and create small and manageable financial goals, you create loyal, financially literate clients who provide great word-of-mouth advertising for your accounting business. You can also help them research any investments they wish to make, get better deals on loans and mortgages, and set up automatic savings that keep their businesses operational during leaner seasons.

Payroll Processing

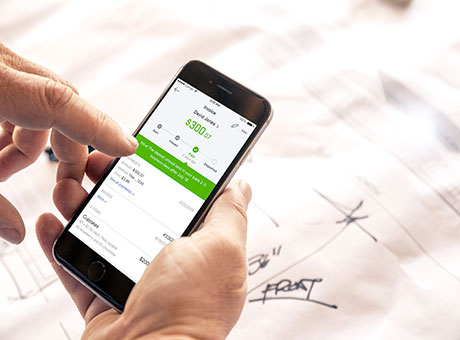

While payroll processing used to be far more labour-intensive, accounting programs like QuickBooks have automated many of the more tedious processes. This makes offering payroll processing services a quick and easy way to diversify your income stream without consuming too much of your time. By using the cloud to stay connected to each client’s payroll information, you can import all the data you need to ensure each employee receives accurate pay with all the correct deductions. Automation also makes it simple for you to provide each client with detailed expenditure reports, and you can use this information to better tailor your services to their particular needs and concerns.

Virtual CFO Services

Technology has made it easier than ever for accountants to offer virtual chief financial officer services to small- to medium-size businesses. Once the domain of larger companies, these financial professionals keep tabs on a business’ total financial picture and use their expertise to point out key information that can improve a business’ outlook. By offering growing businesses your accounting expertise as a virtual CFO, you open up a broad revenue stream while helping clients succeed. By looking at labour and materials costs, you can point out cost-cutting measures that give clients more funds to invest in more profitable sectors. Duties for this accounting specialty also include helping clients manage financial risks while researching and vetting worthwhile investment opportunities. You can also focus on broad financial planning, recordkeeping, and regulatory compliance. While most accountants stay super busy during tax season, many struggle to make ends meet the rest of the year. By diversifying your offerings to include specialized services for existing and new clientele, you can grow your business and stay busy year-round.