Accrual accounting principles in Canada

In Canada, the types of businesses that can use the cash accounting method are limited to farmers, fishers, and self-employed commission agents. For other businesses, especially those of a larger scale or those requiring financial statements audited in accordance with generally accepted accounting principles (GAAP), the accrual method is not just preferable, but often necessary.

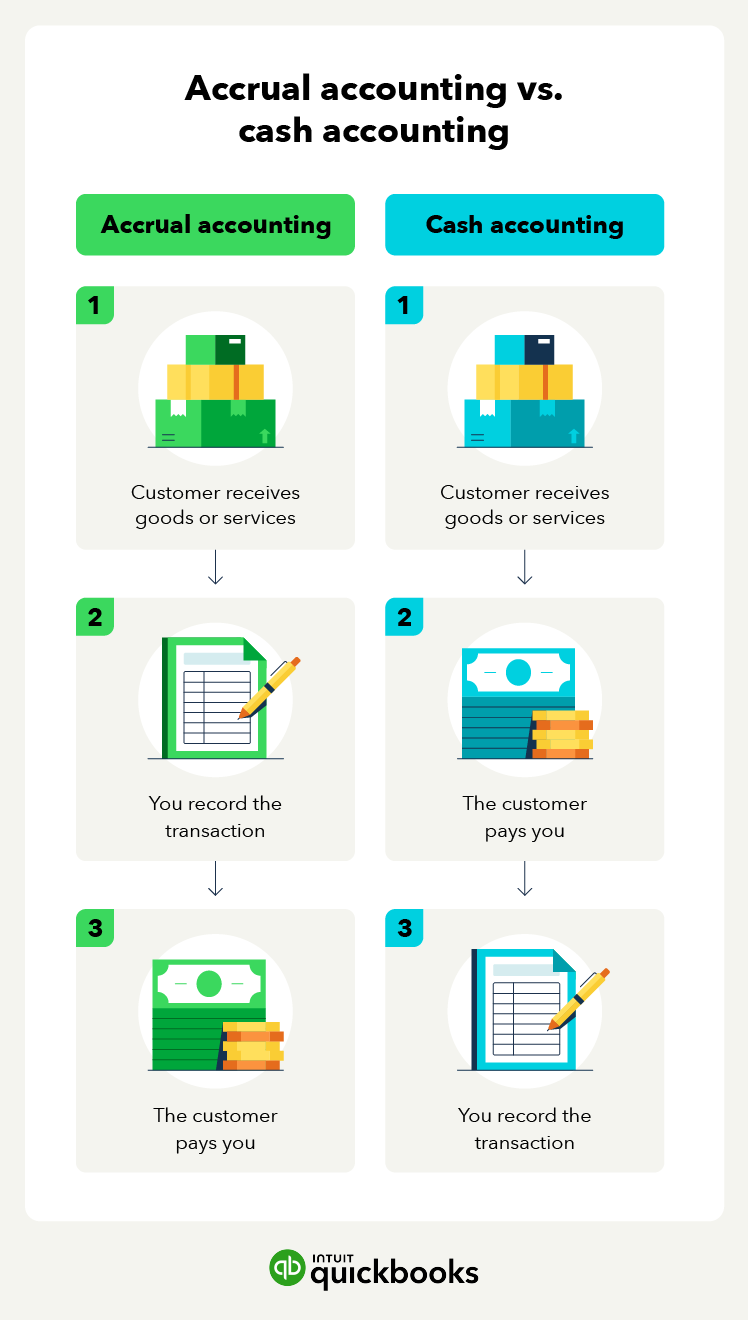

Key accrual accounting principles are revenue recognition and the matching principle. The revenue recognition principle states that revenue should be recognized in the accounting period in which it's earned, regardless of when the cash is received.

The matching principle states that expenses are recorded when they are incurred, not when they are paid. This principle ensures that expenses are matched with the revenues they help generate.

For example, if a Toronto-based marketing agency incurs expenses for an advertising campaign that takes place in December, these expenses are recorded in December's financial statements, even if the payment is made in January.