Operating expenses are an essential part of running your business. Nearly every business or service has them, and without them, there would be no business to run! Since operating expenses and running a business go hand-in-hand, Canadians are able to deduct a percentage of these expenses on their personal income tax returns.

8 operating expenses you can deduct on your business taxes

What are operating expenses (OpEx)?

Operating expenses (aka OpEx) are all the costs and fees associated with running and managing your business. Thankfully, costs incurred for running your own company are tax-deductible. A deduction is a tax incentive where the government allows you to claim back a percentage of these necessary expenses on your federal income taxes.

Both the CRA and your income tax bracket dictate the percentage of allowable small business tax deductions for your business.

Operating cost ratios

Operating cost ratio (aka operating expense ratio), is a common metric businesses use to determine how efficient they are at keeping operating costs low while earning revenue.

Below are the two most important data points that you can get with your operating costs:

Operating income

One of the most important data points you’ll need to know is operating income, which is the total profit associated with your business’ operations. See the operating income formula below:

Operating income = Total revenues – operating expenses

For example, imagine a business earned $552,000 in revenue last year and has $100,000 in OpEx. The operating income for the year would be $454,000.

Operating expense ratio (OER)

The second important ratio to know is your operating expense ratio, which gives you a direct comparison of your expenses to your income. OER allows you to track the efficiency of your business.

From the previous example, we determined that the business’ operating income was $452,000. A good operating income is relative and isn’t always indicative of financial health. However, the operating expense ratio is a direct reflection of how well your business is operating. By measuring efficiency as a percentage, it’s easier to compare yourself to others in your industry.

The formula for OER is:

Operating expense ratio = Operating costs ÷ Revenues

Based on the above example, the OER is:

OER = $100,000 ÷$552,000 = .1812 x 100 = 18.12%

Operating expense ratios can vary by industry. For instance, banks have low operating expense ratios, sometimes as little as 0%. Others, like the building materials industries, have OERs as high as 73%. If you find ways to meet or beat the industry average, then odds are your business will be profitable.

Types of operating expenses

There are two main categories of operating expenses that businesses have to pay: fixed and variable costs. Both expenses have important roles for business operations, but there are key differences between them.

Fixed expenses:

Fixed expenses are costs that remain constant regardless of company output. In general, a lot of these expenses have nothing to do with production and rarely vary. Examples include insurance, payroll, property taxes, and rent.

Variable expenses:

Variable expenses change based on company production. When a company produces more goods and services, costs go up. The opposite happens when production goes down. An example of variable expenses is utility costs.

8 examples of business operating expenses businesses can deduct

Here are the top business operating expenses that are eligible for deductions and may apply to your business:

1. Office supplies, rent and utilities

When it comes to office supplies, there are a few things to consider. Office expenses attached to your workplace can be claimed back on your business taxes, but must be things you use for work. This includes pens, paper, ink, and toner. Supplies like calculators, desks, chairs, and cabinets don’t qualify as they’re considered capital items.

If you work from home more than 50% of the time, you can potentially write-off home office expenses, mobile phone bills, utilities, and laptop bills. In order to claim these costs, they must be used directly with work.

2. Insurance

All standard commercial insurance policies related to your business are all deductible. This includes premiums you pay for buildings, machinery, equipment, and even life insurance policies (depending on the amount).

3. Advertising

Advertising and marketing costs can take up a large percentage of a business’s budget. Thankfully, the costs associated with advertising can be written-off. This includes business cards, promotional gifts, broadcasting, online advertising, and in-person marketing.

4. Business tax, licensing and membership fees

If your business requires you to have specific licenses or memberships, you can deduct those costs from your taxes. A few examples of license fees include:

- Trade licenses

- Beverage licenses

- Personal certifications

- Motor vehicle registration permits

5. Professional services, accounting and legal fees

Professional fees are a type of business expense that can be written-off. As a business, if you need expertise from professionals in another industry, then you can claim the consultation fees each tax year.

6. Salaries

If your business employs workers, then you can take advantage of the deductions associated with employees. The wage and salary you pay your employees is considered a deductible. With the help of accurate timesheets, you can file these tax deductions come tax season.

7. Motor vehicle costs

If you use your personal vehicle for business purposes, it can be written-off each tax year. When driving for work-related purposes and business use (excluding commuting), you can track and deduct specific costs for your mileage rate.

If your company has specific vehicles only used for work purposes, then, depending on the scenario, you can deduct all charges associated with the cars. This includes maintenance fees, insurance, gas, and mileage. Learn more on how to expense motor vehicle costs for both personal and work use.

8. Meals and entertainment

The cost of food and entertainment related to business (whether for work travel, client meetings or employee purposes) are deductible. However, you can only claim up to 50% of the total cost of your meals and entertainment expenses.

How to deduct operating expenses on your taxes

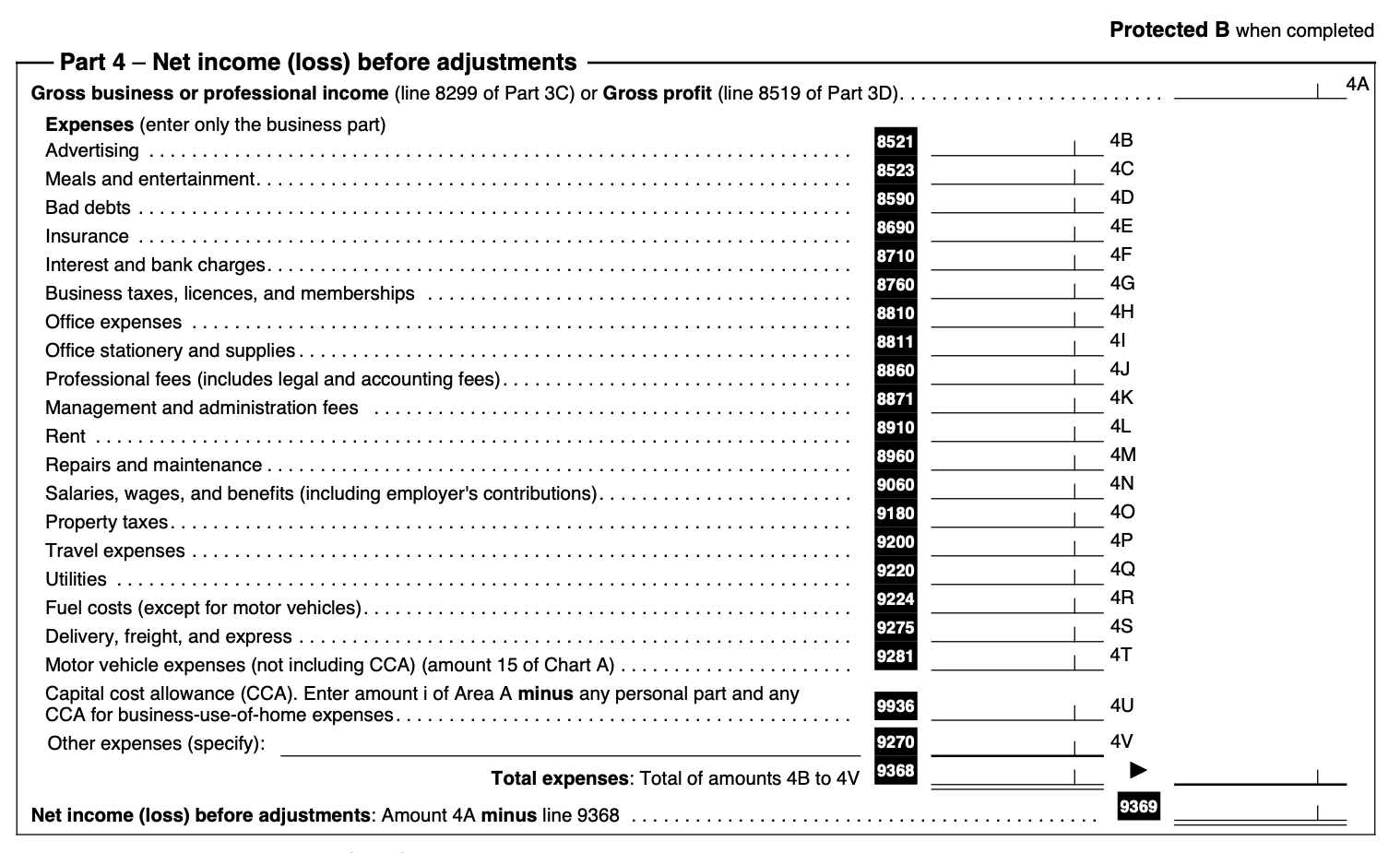

To claim the deductions on your tax returns, you need to fill out form T2125, Statement of Business or Professional Activities. On page 3, Part 4 of the T2125 tax form, you will see the list of business expenses where you fill in the total amount of deductions on the right-hand side.

Business structure dictating claims

Many small businesses are structured as sole-proprietorships or partnerships. If that’s the case, small business owners can write-off business operating costs on their personal tax returns. Self-employed individuals, small business owners that run as sole proprietors, unincorporated partnerships, general partnerships and limited liability partnerships, must fill out and file both T2125 and T1 tax forms.

Incorporated businesses or businesses that run as corporations have separate corporate tax returns from their personal returns. It’s on a corporate’s returns that these expenses must be claimed. For those who own incorporated businesses, learn more about corporate deductions.

Operating expenses formula

In accounting, the operating expense formula is straightforward. All you need to do is add all costs together to find your total operating expenses for the tax year. For example:

Total operating expenses = Office supplies + rent + utilities + insurance + advertising + marketing + business taxes + licensing fees + accounting services + legal fees + employee salaries + mileage + travel expenses + meal and entertainment expenses

Using QuickBooks for tax deductions

To take full advantage of the ability to deduct business costs come tax season, you first need to track and record all expenditures made by your business throughout the year. QuickBooks Online is accounting software that can help you with this task. With automatic tracking and categorization of expenses, filing for deductions can be a straightforward endeavour.

Get proactive and start tracking your small business expenses today.