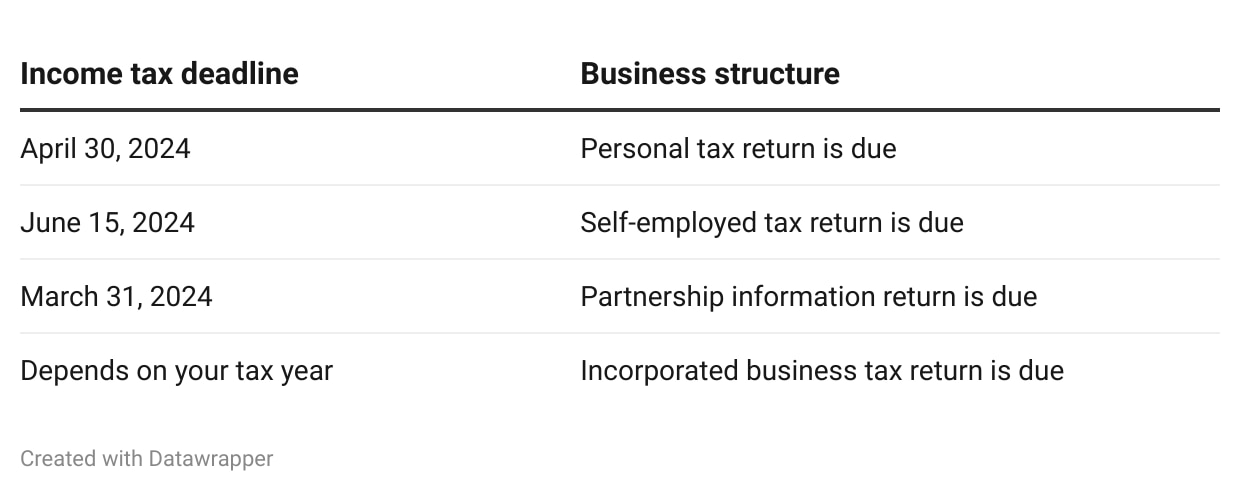

With 2023 coming to a close, business owners are starting to organize all their documents in preparation for the upcoming tax season. The business tax filing deadline in Canada varies based on your business structure. Small businesses that operate as sole proprietorships or partnerships have different filing deadlines than those run as corporations.

In this article, we’ll highlight the tax deadlines for 2024, explain what happens if you file your taxes late, and review the GST/HST and QST (if in Québec) return filing and payment deadlines.