Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi,

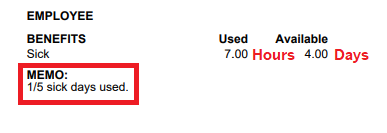

The issue is that QBO Payroll sick pay leave balance is currently shown in hours on online employee paystubs. My understanding of newly established paid sick days in BC is that it is primarily based on max 5 "Days" a year for eligible employees. Then for each sick day you pay the employee their average pay day of the last 30 calendar days before sick days. The way we currently pay employees is changing this average pay in hours and pay it as sick leave. It is good up to this point. However, to keep the sick balance for employee pay stubs you have to record the entitled sick leave in hours (Current options are 40 "HOURS" max a year. QBO payroll then deduct the sick hours from the entitlement and show the balance as available "HOURS" on pay stub. This is where it goes wrong. The available sick hours shown on employee paystub is only correct for the day after the sick leave. Because the average previous 30 calendar pay day changes day to day. When employee get sick the available sick hours shown on their paystub is not necessarily available. Moreover, the hours may be available on paper, but the employee might have already used all 5 "DAY". My recommendation: Change (or make available for BC) in QBO Payroll software the record keeping from "HOURS" to "Days". How you are going to design it on pay stub for calculation and presentation is up to QBO Payroll software engineers. It is the right thing to do. BC sick leave max is legally 5 DAYS a year not necessarily 40 hours a year (There are many employees who work less than 8 hours a day).

Please let me know if there are other work arounds to address this issue.

Thanks for sharing your insights with the sick pay feature in QuickBooks Payroll, accu1.

Product feedbacks are mainly handled by the Developers Team. Please know that you can share your suggestion within the program through sending a product request. Follow the steps below in a web browser:

If you have any more concerns about this topic or need help with the other features QuickBooks, feel free to post here again. I'll be right here to help you. Have a nice day!

Hey Accu1,

We couldn't agree more. You cannot put 40 hours in there as you'd be admitting liability for that whole amount even if someone reduces hours to an average of 6 per day. After some testing we decided to do our own thing but still utilize the QBO Sick Pay feature. You're welcome to copy what we did, here's an excerpt of what I sent to my clients explaining the work-around we had to use. (Better than using the Gear Icon for Feedback)

I hope this helps get you on the right track

Please mark this answer as a helpful solution if it answers your question

Thanks

McBride Bookkeeping

Thanks for the suggestion! Yes, this is the work around coming to mind for now! However, the manual process results in increased risk of errors, misuse and in weakened internal controls. QBO Payroll should address the issue quicker.

P.S. Not sure if QBO resets sick leave automatically on work anniversary (or, as some say, on calendar year for current employees). Hopefully it gets resolved before we get to that point.

Yes I agree,

Better than tracking it on a spreadsheet for now, which is what some of clients have opted to do in this case.

The Work anniversary reset seems to so far in our limited testing. and we're using a 5 "day" balance plus 5 "Day" max in the settings btw.

Hi @AJ2013

Unfortunately not to both questions.

You would need to track average pay somehow yourself, like a spreadsheet.

It can run different sick pay policies but my understanding is the new legislated BC policy is a minimum so if your internal policy exceeds that then it trumps it and you should use your own policy.

FYI QBO Payroll is VERY Limited. For more complex Payroll clients we use a 3rd party

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here