Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

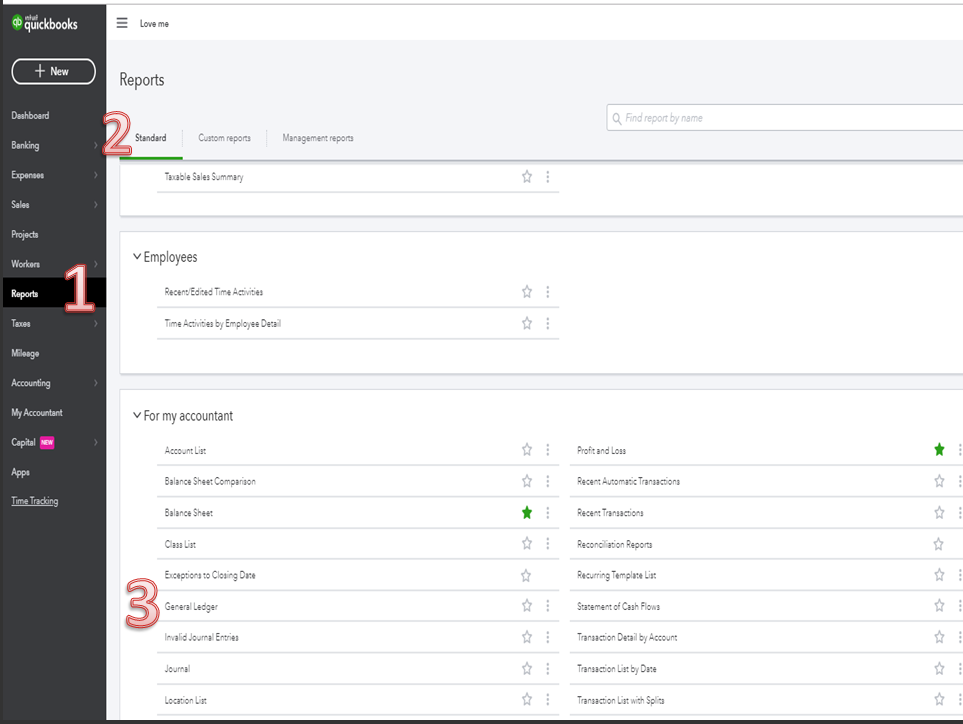

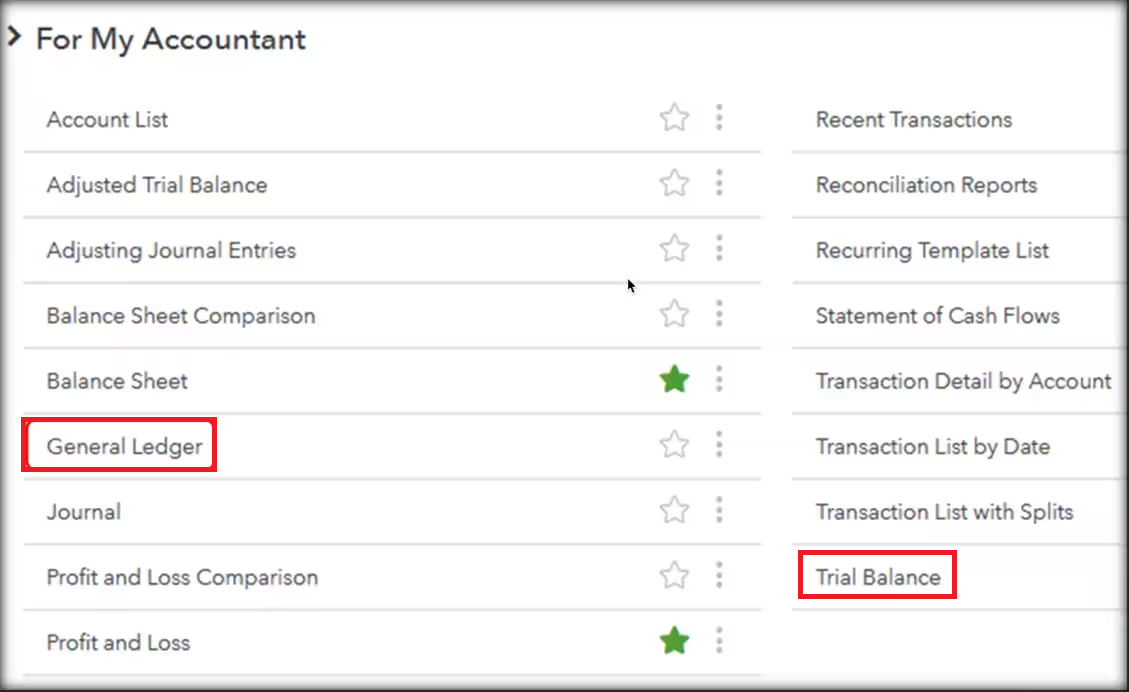

Buy nowGo to Reports.

In the Search field, enter Trial Balance and click it.

Change the Report period to the date range you want to view.

Tap Run report.

Thank you for reaching out to the Community, @accounting-emint. I am thrilled to help you obtain your reports and provide you with the information you need.

I understand the benefits of running a General Ledger Trial Balance report for your business. However, in QuickBooks Online, we can run the report separately.

The General Ledger report includes all the detailed transactions of all accounts, while the Trial Balance report only includes the ending balance in each of those accounts.

We can easily view either the General Ledger or the Trial Balance report with just a few clicks. These reports are accessible in both accountant and business view.

Here's how:

Allow me to share additional information about managing you reports:

Please let me know if you have additional questions about running your report or if you need help with any specific task. I can assist you at all times.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here