Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowLet me make it up to you by ensuring you'll be able to show sales receipts on a Profit and Loss report in QuickBooks Online (QBO), ahoy.

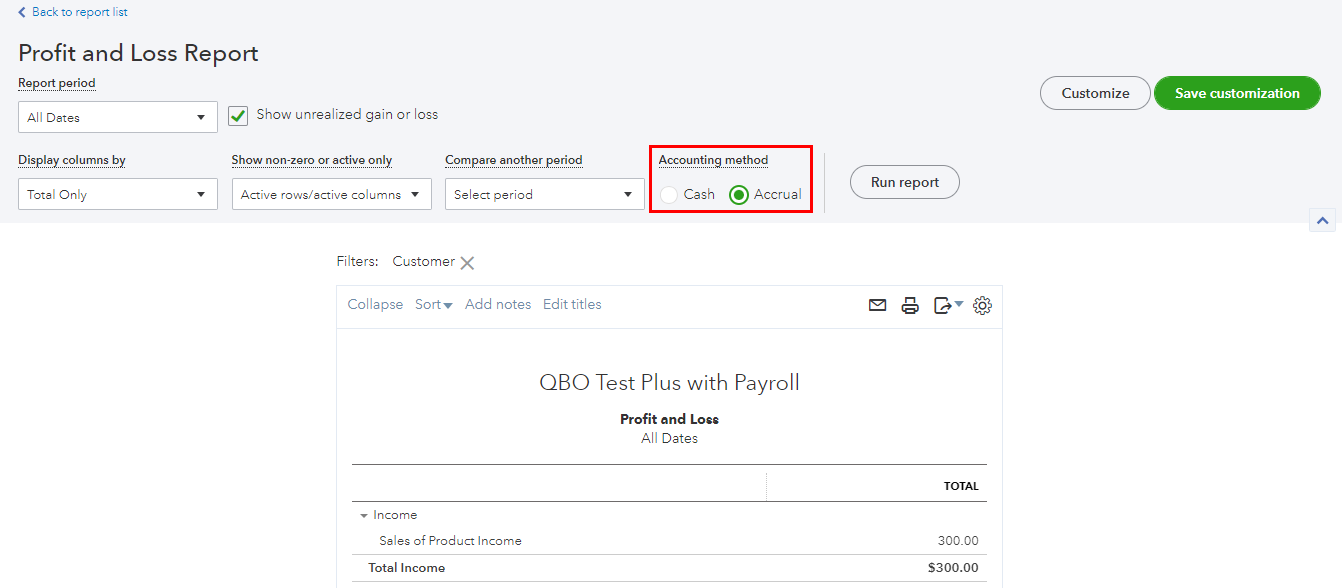

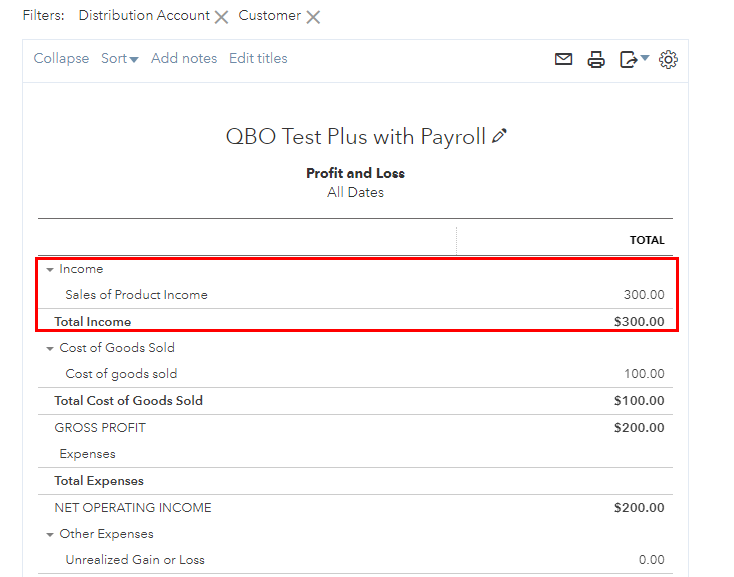

If a sales receipt you created is not showing up as income on your profit and loss report, It might be the accounting method used is incorrect. I've added screenshots for your reference.

Otherwise, you may need to ensure that this transaction is properly categorized and linked to the correct income account.

You can locate the sales receipt by going to the Sales menu from the left navigation bar. Here's how:

Once you have verified that the sales receipt is linked to the correct income account, you should be able to get it to show up as income on your profit and loss report in QBO.

In case you need to modify the details of your report in QBO, you can refer to this article: Customize reports in QuickBooks Online.

If you've got questions other than working with your sales receipt, please let me know in the comments. I'm always here to help. Stay safe.

Ignore the first part of advice given by @LeizylM. A sales receipt should show on your P&L regardless of accounting method because the sale and payment are one entry.

Go to the invoice, click 'More' on the bottom, then 'Transaction journal'. This will show you what accounts are being posted to on the invoice. There should be a credit entry to an income account. If there isn't, then the product(s) on the invoice are not mapped to an income account in the product setup screen. Change the account listed under 'Income account' in the product setup screen if appropriate.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here