Thank you for reaching out regarding the Journal Entry numbering system, WB19. I recognize you're encountering multiple entry sources, including manual entries from your employees, automated entries from Fishbowl, and payroll imports. This situation requires a thoughtful approach to maintain clarity on the audit trail. I've got some insight and suggestions to address your concerns.

If you opt to change the automatic numbering feature in QBDT, you'll need to manually assign numbers to each Journal Entry. This approach can enhance the clarity of your audit trail, allowing each entry to be uniquely identified based on who created it and when. To turn off this feature, here's how:

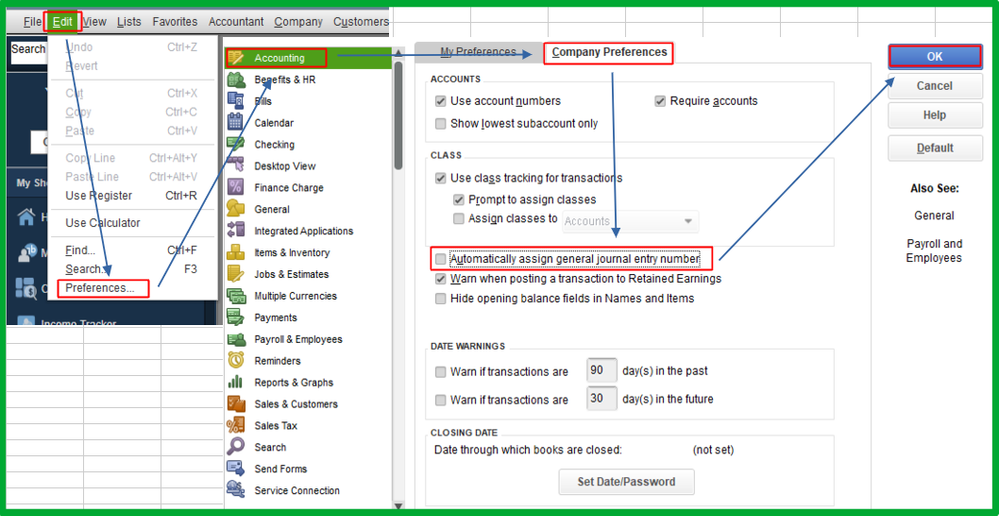

- Go to the Edit and choose Preferences.

- Select Accounting on the left.

- Click on the Company Preferences tab.

- Uncheck the Automatically assign general journal entry number box.

- Once done, tap OK.

QBDT relays the information imported from Fishbowl. To ensure consistency with your new manual numbering system in QuickBooks, it's crucial to align Fishbowl's settings accordingly. Also, you'll need to adjust or edit the numbers in the Journal Entries before importing data from Fishbowl. I recommend consulting Fishbowl's support to understand how their system handles journal entry numbering and if there are settings that allow customization.

Similar to Fishbowl, payroll journal entries depend on the imported data. Ensure these align with your new numbering system in QBDT. Prior to importing payroll data, you'll need to adjust or edit the numbers in the Journal Entries to maintain consistency across your financial records.

For more information about journal entries or how to edit, refer to this article: Create a journal entry in QuickBooks Desktop for Windows or Mac.

Additionally, regularly reconcile your accounts to ensure they accurately match your bank and credit card statements. This practice helps maintain the integrity of your financial records and allows you to catch any discrepancies or errors early.

I hope this information helps you address the challenges with your journal entry numbering system. If you decide to move forward with these changes or have further questions during this process, please don't hesitate to reach out. We're here to help you ensure your financial records are accurate, transparent, and audit-ready.