Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWorking for a nonprofit with a website that accepts donations from anyone. When receipts come into my quickbooks and are deposited automatically, if the donor isn't on my donor list, QB records as "unspecified donor". I am unable to add the name of the donor for my records. Error message says that you must delete the deposit before you may change the donor. I did that on one deposit and it made my balances incorrect. Any help is appreciated.

freda

Solved! Go to Solution.

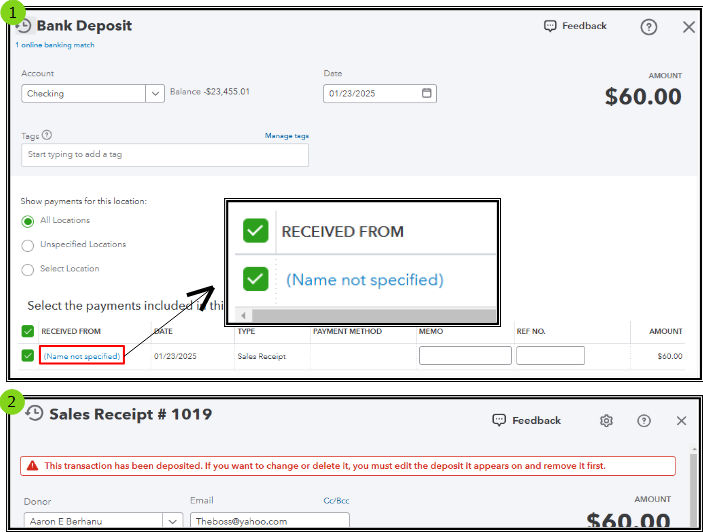

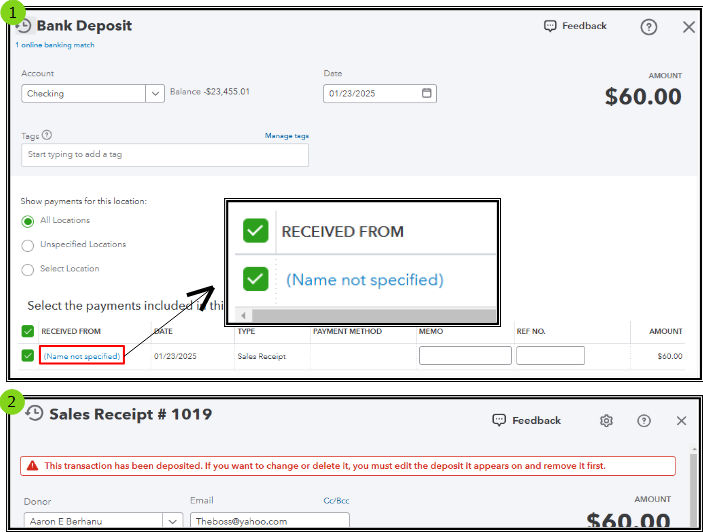

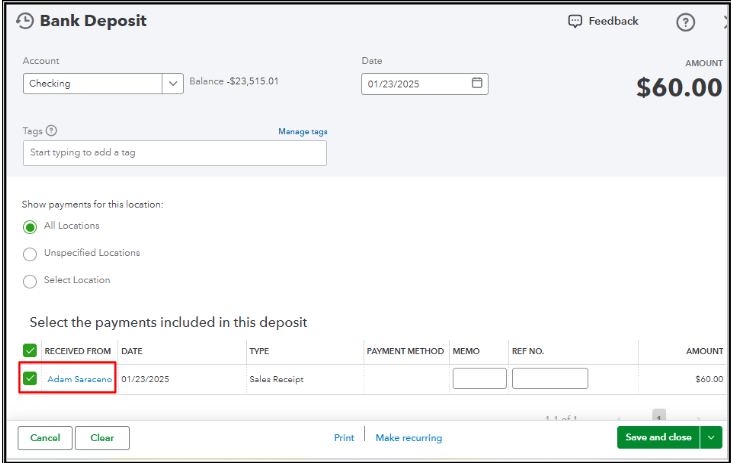

Effectively managing donations from donors who aren't listed yet in your QuickBooks Online (QBO) records can present some challenges, @Freda23. Based on your description, it seems like the issue arises when donations show up as Name not the specified and you get an error when trying to add a donor name to the sales receipt. I've added a screenshot as a visual reference:

If you have encountered the same experience as in the image, there's a way for us to correct this and I want to ensure I can provide the correct details and steps.

To clarify, the Name not specified in the Bank Deposit screen isn't a separate donor profile, but rather an indication that there's no associated donor name for the Sales Receipt yet. Deleting the deposit can be the way to go to modify the sales receipt, but please know that the sales receipt remains in your QBO records since they are separate transactions.

I recommend modifying the existing sales receipt instead of creating a new one to correct this. When manually creating the deposit entry, you can link this receipt. The reason for this approach is that the existing receipt contains more detailed information about the donations made through the website. I'll outline the steps below.

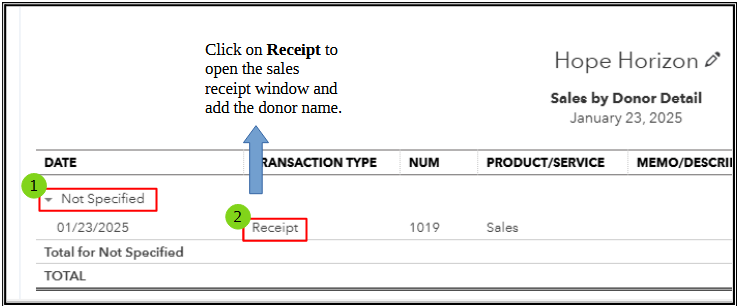

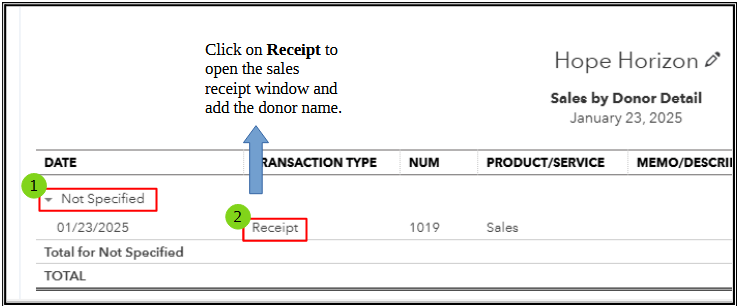

First, pull up a Sales by Donor Detail report to track the sales receipts with no donor name so you can edit it. Here's how:

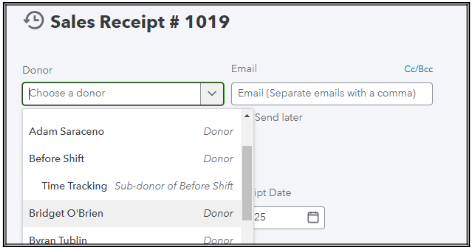

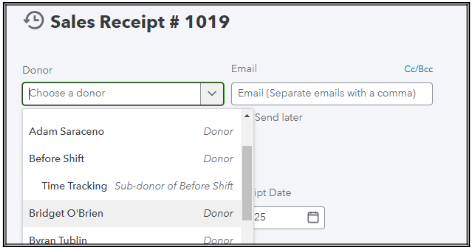

Next, edit the sales receipt to add the donor's name. Follow these steps:

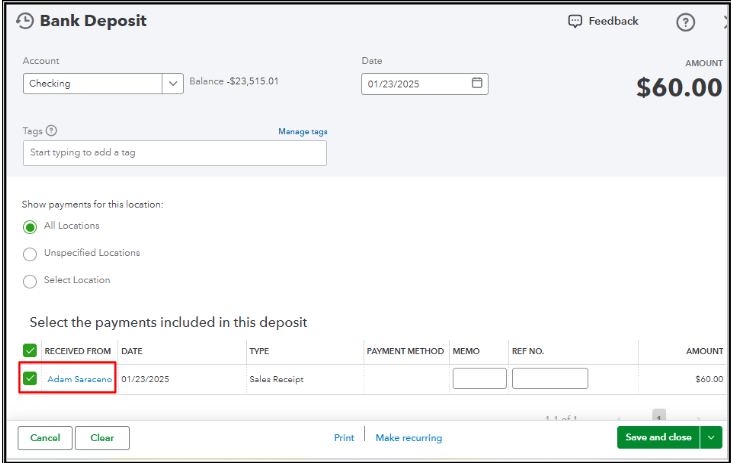

After this, recreate the bank deposit entry. Here's how:

Once done, run a Statement of Activity by Donor report to ensure transactions are associated with the correct donor: Run a report in QuickBooks Online.

I hope the details above help you accurately document your donors' contributions. If you need more assistance or have further updates, feel free to click on the Reply button. We're committed to offering ongoing support.

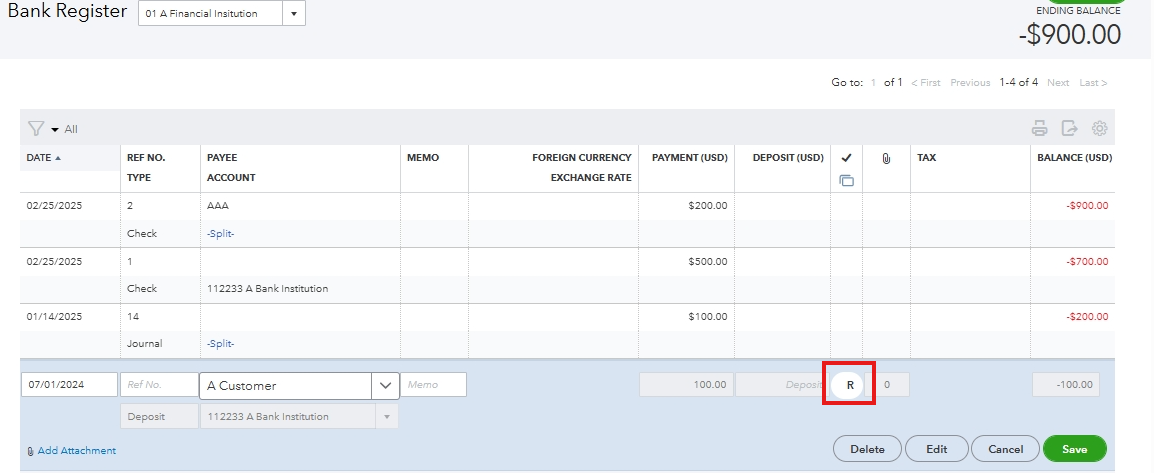

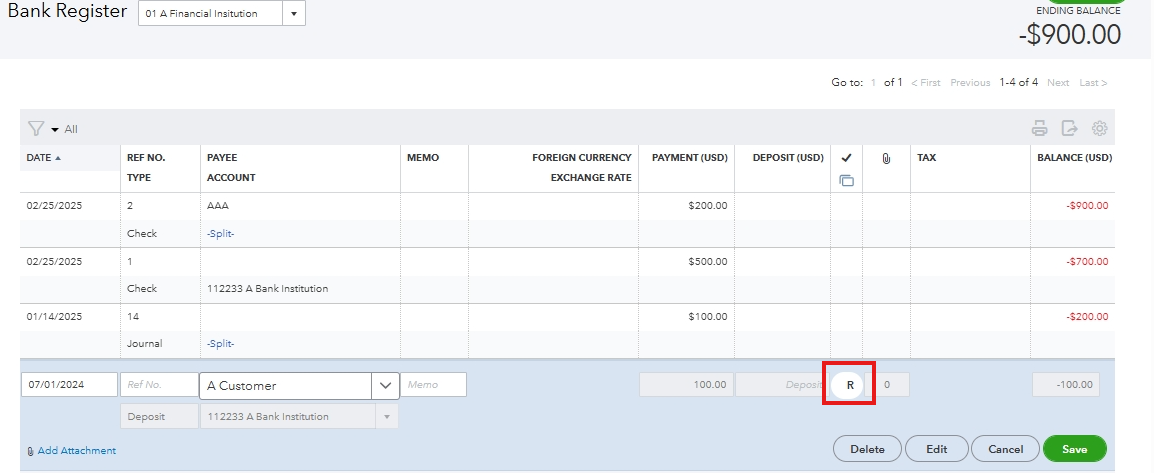

You can manually undo the reconciliation, then delete and recreate the deposit with the correct donor's name and date, Freda. Below, I'll provide a detailed step-by-step guide to help you successfully execute this task.

This process ensures the financial records accurately reflect the correct details of the entry. Please know this action will not affect your overall reconciled balance, given that the reconciliation has been undone and if the transaction amount has not changed.

Here's how:

After the reconciliation status is removed, delete the deposit. Then, recreate it correctly, ensuring the correct donor's name and date are entered.

Once this is done, reconcile the newly created deposit by marking the checkmark column until the box shows an R, ensuring it aligns precisely with your bank statement.

Moreover, you can generate a detailed Statement of Activity by Donor report to review the accuracy of your financial records and accountability in donor contributions: Run a report in QuickBooks Online.

Furthermore, if you require additional assistance with your reconciliation, our QuickBooks Live Expert Assisted service is here to help. Our experts are ready to provide you with guidance and share valuable insights on how to harness the full capabilities of your accounts, ensuring optimal performance and maximum potential.

The instructions above will help maintain the integrity of your financial data and keep your accounts accurate and organized. If you have any further questions or need assistance, please don't hesitate to reach out. Remember, keeping on top of these details is essential for effective accounting management. Have a good one!

Hey Freda23,

Welcome to the QuickBooks Community! I will be happy to assist you. But first, could you let me know the steps you use when you tried the add the name of the donor. Also, could check the donors list to see if there is one called "Unspecified Donor". Knowing this will aid greatly!

I am looking forward to your response! See you in a few.

I have no donor name "Name not specified" (This is the way it comes up on the QB deposit.

I think I added the payment in the correct donor's name and tried to delete the QB deposit but it is still showing up on my Bank Deposits screen.

I have no donor named "Name not specified" This is how it shows up. I added the receipt separately and then tried to delete the original QB generated deposit, but it still shows up...

Effectively managing donations from donors who aren't listed yet in your QuickBooks Online (QBO) records can present some challenges, @Freda23. Based on your description, it seems like the issue arises when donations show up as Name not the specified and you get an error when trying to add a donor name to the sales receipt. I've added a screenshot as a visual reference:

If you have encountered the same experience as in the image, there's a way for us to correct this and I want to ensure I can provide the correct details and steps.

To clarify, the Name not specified in the Bank Deposit screen isn't a separate donor profile, but rather an indication that there's no associated donor name for the Sales Receipt yet. Deleting the deposit can be the way to go to modify the sales receipt, but please know that the sales receipt remains in your QBO records since they are separate transactions.

I recommend modifying the existing sales receipt instead of creating a new one to correct this. When manually creating the deposit entry, you can link this receipt. The reason for this approach is that the existing receipt contains more detailed information about the donations made through the website. I'll outline the steps below.

First, pull up a Sales by Donor Detail report to track the sales receipts with no donor name so you can edit it. Here's how:

Next, edit the sales receipt to add the donor's name. Follow these steps:

After this, recreate the bank deposit entry. Here's how:

Once done, run a Statement of Activity by Donor report to ensure transactions are associated with the correct donor: Run a report in QuickBooks Online.

I hope the details above help you accurately document your donors' contributions. If you need more assistance or have further updates, feel free to click on the Reply button. We're committed to offering ongoing support.

The deposit has already been reconciled with the new sales receipt that I created. If I delete the deposit, it will make my bank statement reconciliation off...

You can manually undo the reconciliation, then delete and recreate the deposit with the correct donor's name and date, Freda. Below, I'll provide a detailed step-by-step guide to help you successfully execute this task.

This process ensures the financial records accurately reflect the correct details of the entry. Please know this action will not affect your overall reconciled balance, given that the reconciliation has been undone and if the transaction amount has not changed.

Here's how:

After the reconciliation status is removed, delete the deposit. Then, recreate it correctly, ensuring the correct donor's name and date are entered.

Once this is done, reconcile the newly created deposit by marking the checkmark column until the box shows an R, ensuring it aligns precisely with your bank statement.

Moreover, you can generate a detailed Statement of Activity by Donor report to review the accuracy of your financial records and accountability in donor contributions: Run a report in QuickBooks Online.

Furthermore, if you require additional assistance with your reconciliation, our QuickBooks Live Expert Assisted service is here to help. Our experts are ready to provide you with guidance and share valuable insights on how to harness the full capabilities of your accounts, ensuring optimal performance and maximum potential.

The instructions above will help maintain the integrity of your financial data and keep your accounts accurate and organized. If you have any further questions or need assistance, please don't hesitate to reach out. Remember, keeping on top of these details is essential for effective accounting management. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here