Hi there, melainag,

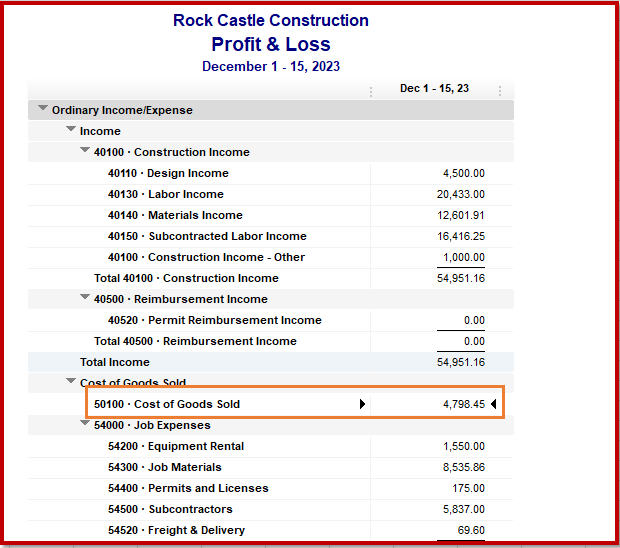

The Profit and Loss (P&L) report summarizes your income and expenses for the year. This is to tell whether you're operating at a profit or loss. It also indicates how the revenues are transformed into the net income.

Costs you have tracked that are directly involved in your products for sale are called Cost of Goods Sold (COGS). When the item is sold to your customer, the system removed it from the inventory and is reported as COGS in the P&L report.

COGS includes:

- the direct cost of producing the product or the wholesale price of goods resold

- the direct labor costs to produce the product.

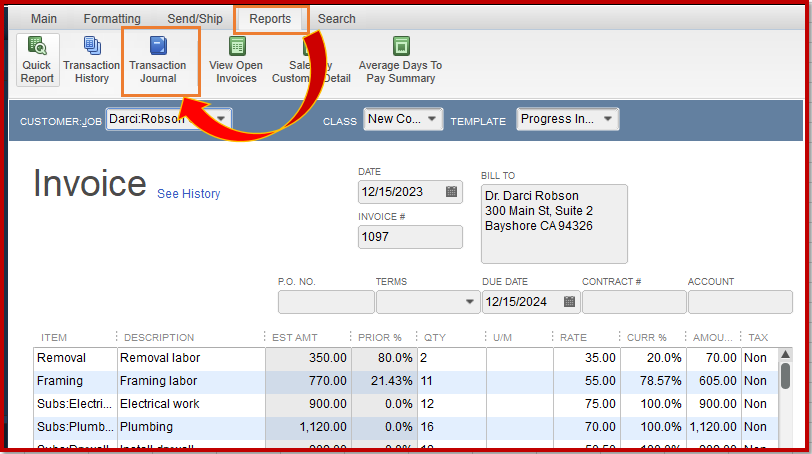

You'll want to click the amount under COGS and click each receipt. Then, open the transaction journal to verify the account used for the items.

I'm glad to walk you through this process:

- On the Profit and Loss report, click the amount next to the Cost of Goods Sold account.

- Click the entry to open it.

- Go to the Reports tab, then click Transaction Journal.

I've added the Customize company and financial reports link to help you easily get a view of how well your business is doing.

Feel free to leave a comment below if there's anything else I can help you. You know where to contact me again.