Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello,

I've literally recorded & matched about 90-95% of the transaction within my 1 of the many banks. I just notice the balance is sky different, at least 8000 to 10000 while I only have about 1-2k left non recorded at max. I mean for the other accts that has no matching done, I can delete & readd the account and put 2020 dates & balance but it still would be off for partial recording of the 2019 expense/sale receipt within QBO. I believe the issue was me leaving a blank date of starting balance recording when linking the bank account to QBO & also only making records of some transaction sales receipt & expense from 2019 to carry over the remaining inventory to 2020. Now because of that, everything is so messy in balance wise, not sure if I should leave it at a big gap which will carry on year by year, basically 2019 balance is way off, but 2020 moving forward is perfect. I have no reason to record all of 2019 transaction due to taxes being done & started using QBO couple months ago. Not sure how i should handle this, thanks.

It's essential to upkeep your accounts regularly, @mikelu9661. I'm here to guide you on how to fix the discrepancy.

Here are the possible causes of ending balance issues:

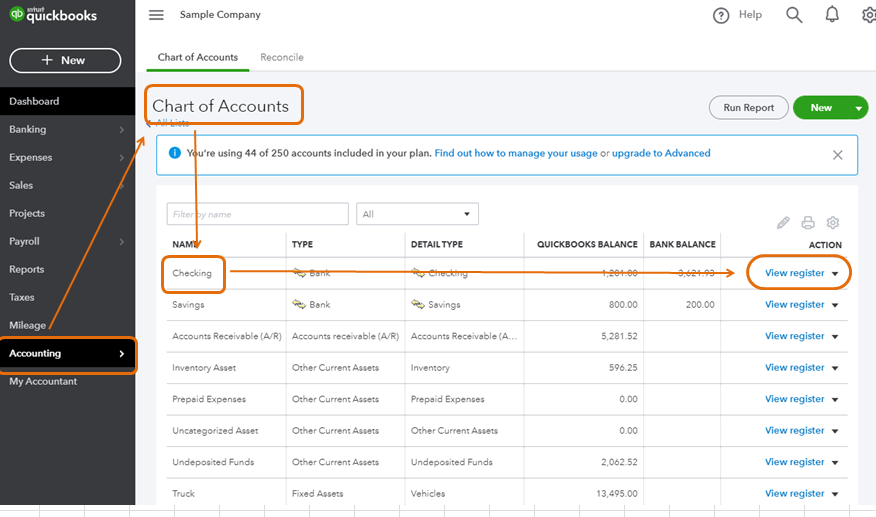

You'll need to review your opening and beginning balance. Follow the steps below on how to correct opening account balance.

You can refer to this article for more details: Fix beginning balance issues.

Also, let me add an article to fix other issues when reconciling accounts in QuickBooks Online: Fix reconciliation discrepancies.

Don't hesitate to comment below if you need further assistance. Have a great day.

Hello,

Thanks for your prompt reply, unfortunately after deep searching it looks like I didn't have open balance equity under the register so i manually made one through the journal entry using the guides. Although I notice a problem and am not sure the best way to handle this. As previous mentioned since i only have a small portion of the necessary expense/sale receipt/etc transaction from 2019, I only create manual entry of those. But if I put open balance equity for 2019 it would still not balance out properly because of the whole gap of a transaction within 2019 after the date i put in since I'm only inserting the ones I need. I thought about just starting balance from jan 1st 2020 since everything 2020 is fully recorded, although it still seem to balance out with 2019 transaction even though i journal entry from 2020.

Please let me know if there's another option to balance our properly, I'm only recording the 2019 expense due to the inventory carryover to 2020 and the purpose of it is to have a COGS when it does sell moving forward. Due to taxes being done in 2019, I have no reason to go through a whole year of work

The only thing I've come to mind & was able to fix this was editing that journal entry balance to the amount it is negative by on dates before 01/01/2020, so if my 2019 transaction brought the balance down to -$8000, I would put positive $8000 starting balance for "open balance equity" on the journal entry so starting 01/01/2020 my balance would be $0 then any transaction comes after the open balance equity would just balance out perfectly since all transaction are recorded.

But I'm not sure if that would be the right way to do it, would need confirming or if there's a better way to handle this.

Hi mikelu9661,

I appreciate all the steps that you've tried in trying to resolve this issue.

Creating a journal entry is one of the most effective ways that allow you to adjust transactions post entries. While editing the journal entry balance somewhat fixes the balance, I would suggest reaching out to your account for other ways on how to deal with it.

For future reference, you'll want to run reports in QuickBooks. Please check this article for more information: Run Reports in QuickBooks Online.

If there's anything else you need, let me know so I can help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here