Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowMy beginning balance in December is $1M off from what it should be.

When i click unreconcile to look at November beginning balance, this is off but by a different amount-$1.1M.

I called QB. First, the people that answer the phones know nothing; they are messaging techs who then play telephone game to relay info - I cannot actually talk to a tech. Then i ask for supervisor, thinking as a supervisor they would have more knowledge but nope - they just takes feedback.

Their solution - do a Journal entry to force balance to be correct!!! WHAT?!?!?! Any accountant knows that is against GAAP and that it will not help to do a JE if the bank recons are wrong for months at a time; i need to know WHY they are wrong and fix it and watch for it in the future. At least the near futuree becuase we are DUMPING QB ASAP!

So i pulled audit report and those shows 2 items totally $2K so no help there.

Is there an acutal accoutant or somepne with knowledge of GAAP who can help me fix this correctly? I dont mind undoing recons and fixing them but i need to know how far back. If it is more than a year, i cannot.

HELP!!!

Hi @KfrankLESCO, Discrepancies can occur for various reasons, such as incorrect opening balances or duplicate transactions, leading to data inconsistencies. Let's discuss this further below.

You're correct in recognizing that using Journal Entries (JE) to force a balance can compromise the integrity and accuracy of financial reporting. To effectively resolve this issue, it's important to undertake a thorough review of your previous period transactions. By comparing these transactions with your past bank statements, you can gain a comprehensive understanding of discrepancies. You can check the options below to accurately address your beginning balance issues in QBDT:

Fix beginning balance issues in QuickBooks Desktop.

Following these steps, you can identify and correct the underlying issues causing the discrepancies.

You can consider reaching our QuickBooks ProAdvisor. They have the expertise in GAAP and QuickBooks to provide tailored assistance for resolving these errors correctly.

For future reference, you can visit this article to help you resolve any reconciliation discrepancies you may encounter: Fix issues when you're reconciling in QuickBooks Desktop.

If you need further assistance don't hesitate to reply in the comment section, the Community space is here 24/7.

Doing a JE is not just compromising integrity, it is a violation of GAAP.

None of your solutions work as this error is on the recon screen beginning balance ONLY. My audit report is clean except for one $2K issue that we are aware of. Rebuilding data only showed that 2 reports had to be deleted.

My Balance Sheet, GL, and Check register are all correct. So, I can't do a journal entry to change balance. I need to know where the beginning balance on the bank recon report comes from as it is not the Bank general ledger account.

And the fact that no one at QB can help and your solution is to pay outside rep makes me wonder why we even have this system at all.

Thank you for taking the time to clarify further the concern you're encountering with the beginning balance on your bank reconciliation screen, KfrankLESCO. I acknowledge the importance of maintaining precise financial records and I am here to help you resolve this matter.

The beginning balance on the bank reconciliation screen is derived from the sum of all cleared transactions up to the last reconciliation date. If everything else in your QuickBooks like your Balance Sheet, General Ledger, and Check Register is correct, yet there's still a discrepancy in the starting balance of the reconciliation screen, this could indicate that there may have been errors in how previous reconciliations were recorded, or there could be existing issues within your company's data.

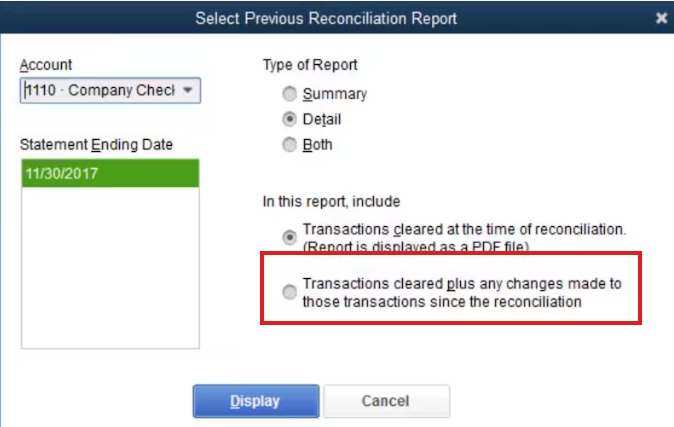

In case you haven't yet, run a reconciliation report if there's a change and can't trace them. This can help you identify if there have been changes to the previous period's transaction amounts that can be causing the beginning balance discrepancy. To run a reconciled report, here are the steps below:

For your future reference, you can refer to this article: Run a Previous Reconciliation Report.

On the other hand, if you don't find any issues in the report, this can be a company file issue. I understand you were able to run the Verify and Rebuild steps and if still doesn't fix the problem, I suggest reaching out to the QuickBooks Data Service Team for assistance in repairing your files.

Please don't hesitate to reach out if you have further questions or require additional assistance about beginning balance. We are here to support you and ensure that your experience with QuickBooks allows for seamless and accurate financial management.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here