Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIn September, I recorded and deposited $550 into my checking account. The bank recorded the deposit as only $500.00. Now that I am in October, I want to make adjustments. I can't make a receivable from my customer because he sent the correct amount. How do I do this?

Yes, you’re correct that you don’t need to create a receivable since it’s a deposit, @crescere.

To begin with, I recommend checking your September Statement and comparing it with your bank register in QuickBooks Desktop (QBDT) to verify whether the deposit has been recorded accurately. If everything matches, consider reviewing your other transactions, as you may have already credited the missing $50 deposit elsewhere.

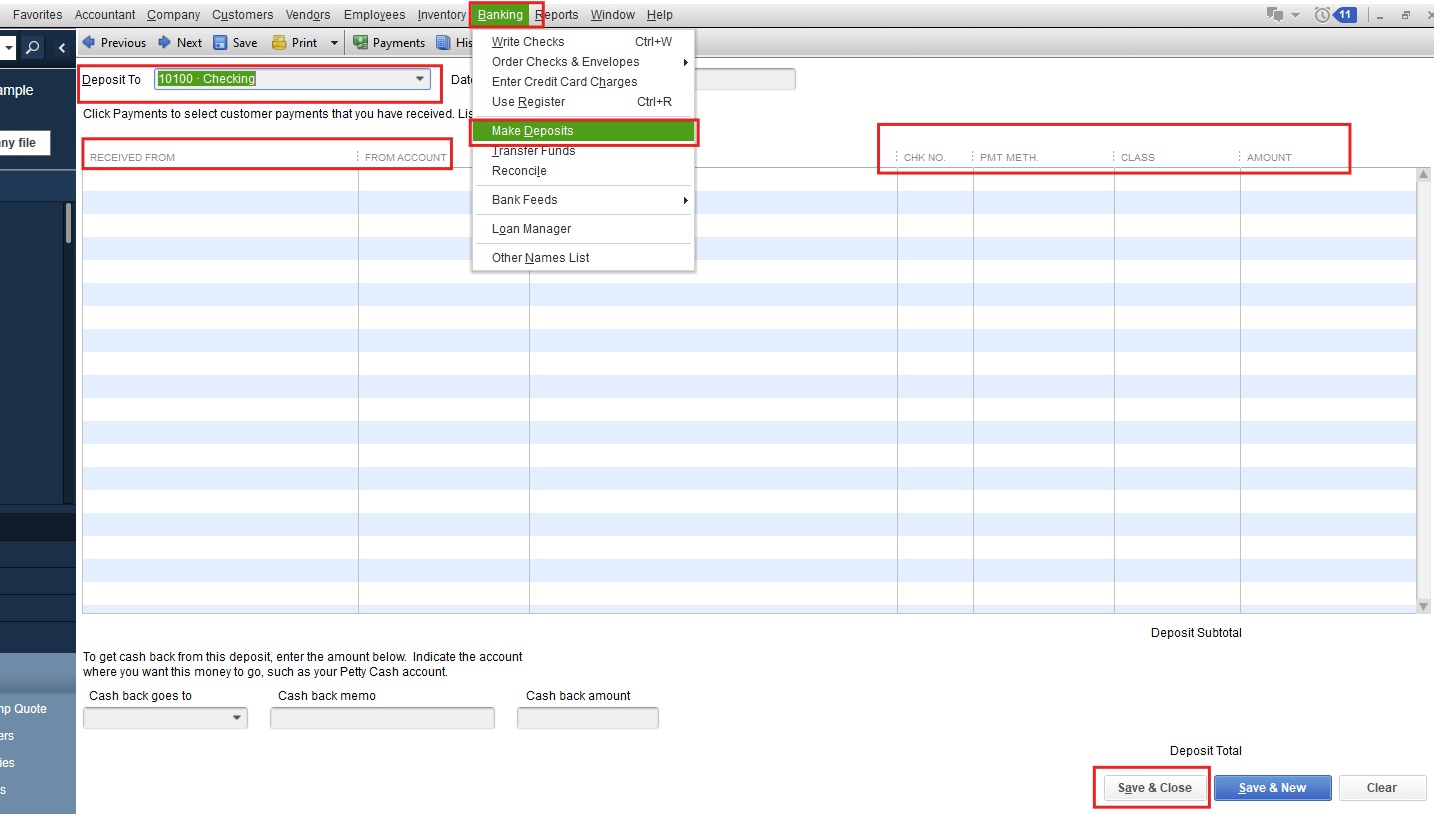

However, if the amounts don’t match, you can manually create a bank deposit to address the $50 discrepancy. Here’s how:

We’re always here to help you if you have any other concerns.

It sounds like the bank made an error when processing your deposit. Since your customer paid the correct amount ($550), you don’t want to adjust your receivable or sales records. Instead, you’ll need to record the $50 discrepancy as a temporary item until the bank corrects it.

Here’s how you can handle it in QuickBooks:

Go to your Chart of Accounts and create an account called something like “Bank Errors” (type: Other Current Asset).

Record a Journal Entry for the difference:

Debit: Bank Account $50

Credit: Bank Errors $50

This keeps your books accurate and matches your records to the actual amount your customer paid.

Once the bank corrects the $50 and deposits it, you can simply reverse the entry by debiting Bank Errors and crediting your Bank Account.

If the bank refuses to correct it, you can write it off later as a small bank charge or loss, but ideally, the bank should fix the error.

If you’d like, feel free to message me, I’m a professional bookkeeper and QuickBooks freelancer based in the UK, and I can help you review your file or make the adjustment properly.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here