Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI was charged twice to my credit card from a vendor for a bill. I will be reimbursed via check for the second charge. I have correctly matched the first payment with the bill in my Quickbooks account, but I am now unsure how to categorize the additional payment (and the subsequent reimbursement check) so that everything is balanced. Any help would be appreciated!

Hello, Stevie31.

I know how to record the reimbursement check you receive from an overpayment made to a vendor.

Recording a refund from your vendor depends on how you record the purchase. I'll show you the step-by-step process.

Step 1: Enter a vendor credit.

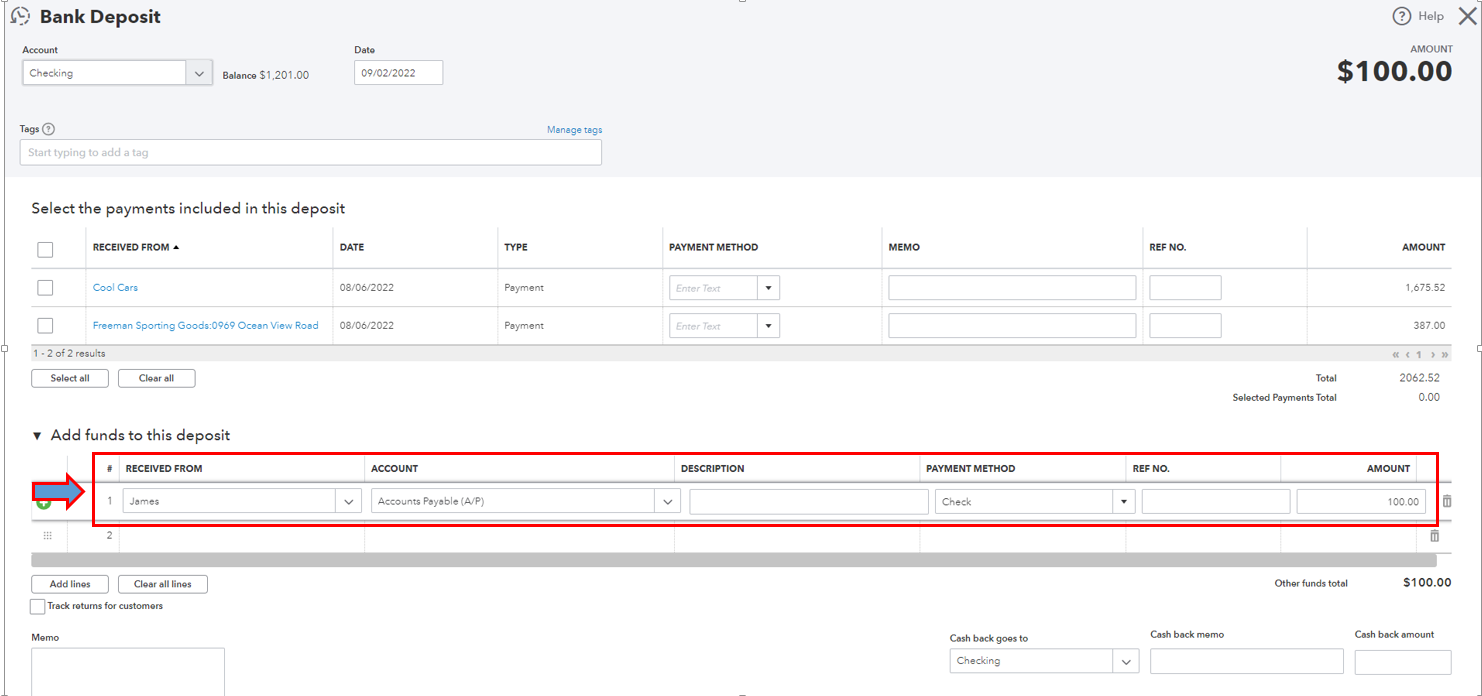

Step 2: Deposit the check you receive from the vendor.

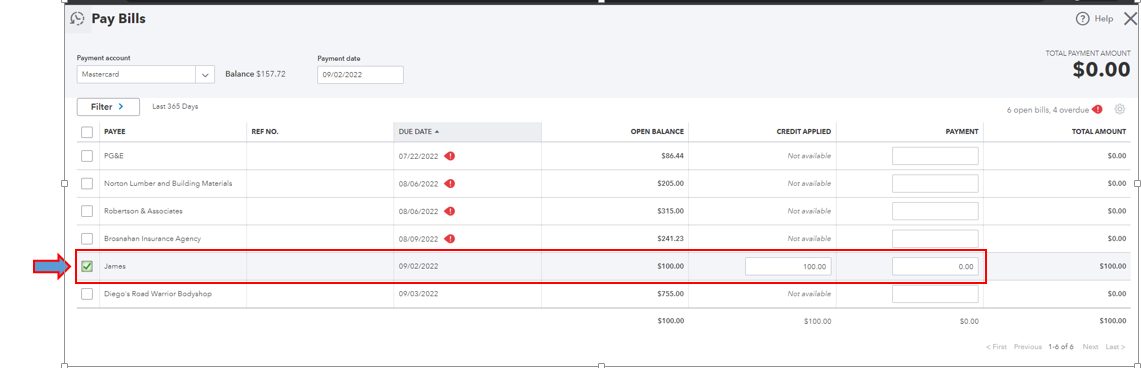

Finally, you can use the Pay Bills to link the bank deposit to the vendor credit.

Here's how:

For your reference, here is a complete breakdown of the refunding process for a vendor: Enter a refund from a vendor.

I've also included this link for future reference if you need to refund a customer purchase using a credit card: Refund a credit card payment.

If you need anything else, let me know. I'll be around to help you.

An easier approach is to create an asset (other current asset) account called "Due from Vendor ABC". Then, create a credit card charge for the charge made in error and assign it to the newly-created "Due from Vendor ABC" other current asset account. Then, when you receive the check, create a deposit and assign the deposit to the same "Due from Vendor ABC" account. The amounts will offset and you're good to go.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here