Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowWhen reconciling in Quickbooks online why do checks show up twice? The first one show up with the check number in the ref no column then the same check shows up with the ref no. column empty but now the check number shows up in the memo column. Why is this happening? Is the check being deducted twice from our account? How do I correct this from happening?

Good day, @director-stluken.

Reconciling is a great way to review to catch simple errors, as it is important to record transactions correctly.

Can you please share a screenshot of how the duplicate Checks appeared on the reconciliation page? Did you match or add them to the Banking?

Any additional information will help me provide an accurate way to fix this. I'll be on the lookout for your response. Take care.

Thank you for your reply. Unfortunately, I reconciled my account so I can no longer show you how it looked. I did notice that when I printed out my report the duplicate entry showed up as uncleared checks. Now I am unsure what is going on. I matched or added entries before reconciling. That is why I am confused on what is going on. Do you have any suggestions?

Good evening, @director-stluken.

Thanks for chiming back in and letting us know some additional information.

Since we can't see how this happened directly, I recommend review the Audit Log. The Audit Log track all information that we entered, changed, or deleted in your QuickBooks Online account.

From there, you can see use a screenshot of that information so we can determine the next steps for you and your business.

I'll be waiting for your response!

I tried to take a screenshot but it is saying the image upload failed. I looked in the audit log and I only see the checks when they were created, edited and matched. I am not sure what do at this point or if anyone has any more suggestions.

Thanks for returning to this thread, @director-stluken. Allow me to share additional steps to remove the duplicate check that shows in your reconciliation window.

First, you may have incorrectly added the check from the bank feeds, causing it to appear as a duplicate during reconciliation. To verify, I suggest comparing the transactions in your bank statement with the ones you entered in QBO.

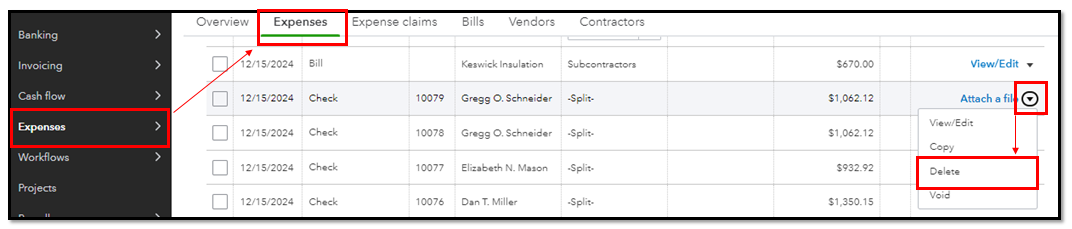

If confirmed duplicate, you can delete the duplicate entry. To do that:

Moreover, I'm sharing additional articles to help you resolve issues when reconciling in QBO:

Stay in touch whenever you need further assistance concerning duplicate entries during reconciliation. I'll be always available to respond right away. Take care and have a great weekend!

JaeAnnC, thank you for your response. Your suggestion is very helpful. I do see in the expenditures that I do have duplicates. The bank feed wants me to either match or add my checks written, deposits, etc each time I go to reconcile. I believe this is why it is showing up as a duplicate. Am I correct or am I doing something wrong?

Another question, when we started QBO I had to bring over our bank feed from the previous (last Dec) to bring in the checks that had cleared in January. Seeing most of the transactions were reconciled in a previous program they are still showing up as outstanding transactions. Can I go into the expenditures and simply delete them seeing they have already cleared/been reconciled? It is throwing off the reconciliation each time I do it. I have to figure out which ones they are and uncheck them. Any help is greatly appreciated.

I agree with you, @director. I'll shed some light, and let me begin that process with you.

Reviewing the details of each transaction is crucial to avoid any discrepancies during the reconciliation process. By carefully examining the transactions, we can ensure that there are no duplicates and that all the information is accurate. It helps maintain the integrity of the reconciliation and prevents any potential issues or errors.

Thus, if QuickBooks lets you match the transaction, this will not cause duplicates. However, we need to be mindful that if you miss the other transaction that isn't intended for matching, this can also cause disbalance. With that, it would be best to refer to your bank statement.

Moreover, if you have verified that a transaction or expenditure has been cleared, you can delete it from your records. Deleting cleared transactions helps keep your financial records organized and up to date. Make sure to double-check before deleting to ensure that you have accurately verified the clearance of the transaction.

I'm also adding this article for your future reference:

If you need guidance with the reconciliation process, let me know in this thread. Have a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here