Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI use a bank feed for my BBVA bank account to bring into QBO

I have online sales that are processed using Square (as sales receipts) and subsequently Square deposits net amount to BBVA after taking their fees.. I have not connected Square app.

My problem:

The auto feed enters the Square net deposit to the register, but I want to record the online sales to undeposited funds then manually make the deposit (adding the fee as a negative fund).

How do I avoid duplication of deposit income? Do I exclude the deposit transactions in the feed?

Thank you for any help. This is first year using QBO, instead of desktop

Solved! Go to Solution.

Thanks for posting here, @nova art,

Allow me to share some steps on how to categorize your transactions properly.

You can exclude the deposit if it is a duplicate of another bank transaction. Otherwise, if it needs to be included in the reconciliation, you can simply match the bank entry with the net deposit after fees in QuickBooks.

Here is the complete process of recording a bank deposit with the credit card fee so you can match it with the bank entry:

Enter a Bank Deposit for the credit care fee to relieve the balance from Undeposited Funds account.

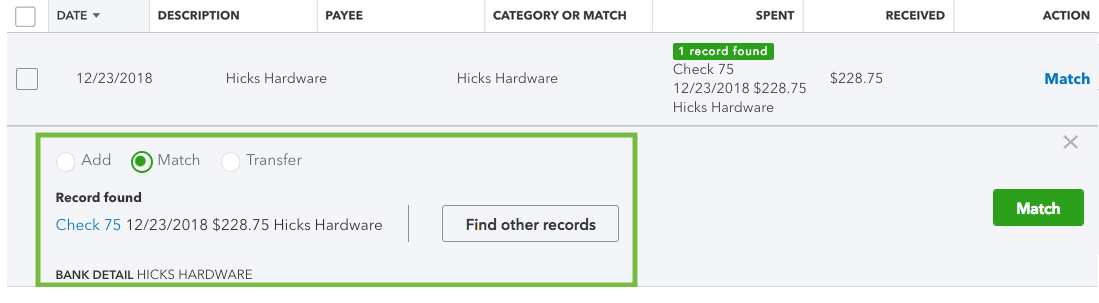

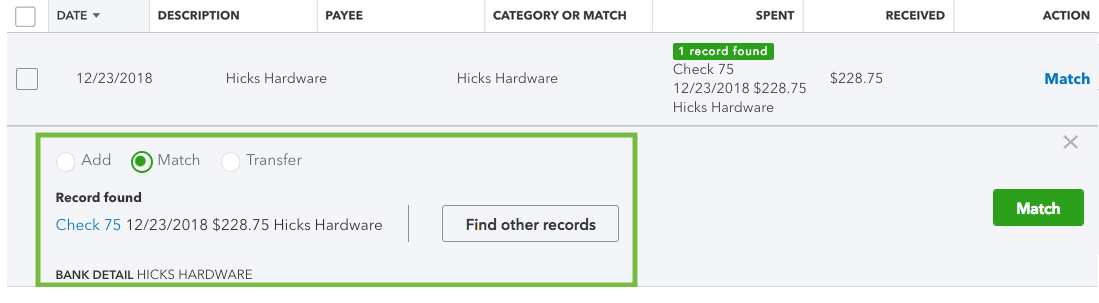

You can now match the transaction to the online banking transaction. Here are the steps with sample screenshot:

See this article to learn more about managing bank transactions in QBO: Categorize and match online bank transactions in QuickBooks Online.

If you need anything else, please let me know in the comment below. I'll be right here to help categorize your bank transactions. Have a good one!

Thanks for posting here, @nova art,

Allow me to share some steps on how to categorize your transactions properly.

You can exclude the deposit if it is a duplicate of another bank transaction. Otherwise, if it needs to be included in the reconciliation, you can simply match the bank entry with the net deposit after fees in QuickBooks.

Here is the complete process of recording a bank deposit with the credit card fee so you can match it with the bank entry:

Enter a Bank Deposit for the credit care fee to relieve the balance from Undeposited Funds account.

You can now match the transaction to the online banking transaction. Here are the steps with sample screenshot:

See this article to learn more about managing bank transactions in QBO: Categorize and match online bank transactions in QuickBooks Online.

If you need anything else, please let me know in the comment below. I'll be right here to help categorize your bank transactions. Have a good one!

Thanks for your help.

I have a similar issue. I just took over a client from another accounting firm. They have many duplicate deposits from last year. Looks like the duplicate deposits are the ones attached to the sales receipt and the deposits that are reconciled are the square payment with the square fee taken out. They were never matched up. What is the best way to fix this issue? Is there a way to fix this without having to re-open the bank recs? Please let me know if you need more information on this.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here