Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm late to the game for learning to do accounting & filing my taxes late. When I joined Quickbooks a few months ago, it only imported the previous few months of 2025. I need to complete taxes for 2024 but don't want to have to enter everything manually if I can avoid that. Any help/advice would be greatly appreciated. Thanks so much!

I completely understand how overwhelming it can feel to catch up on your 2024 accounting and taxes after starting QuickBooks recently, @k-formisano712. The good news is you can avoid manually entering all your 2024 transactions by using your bank’s transaction history.

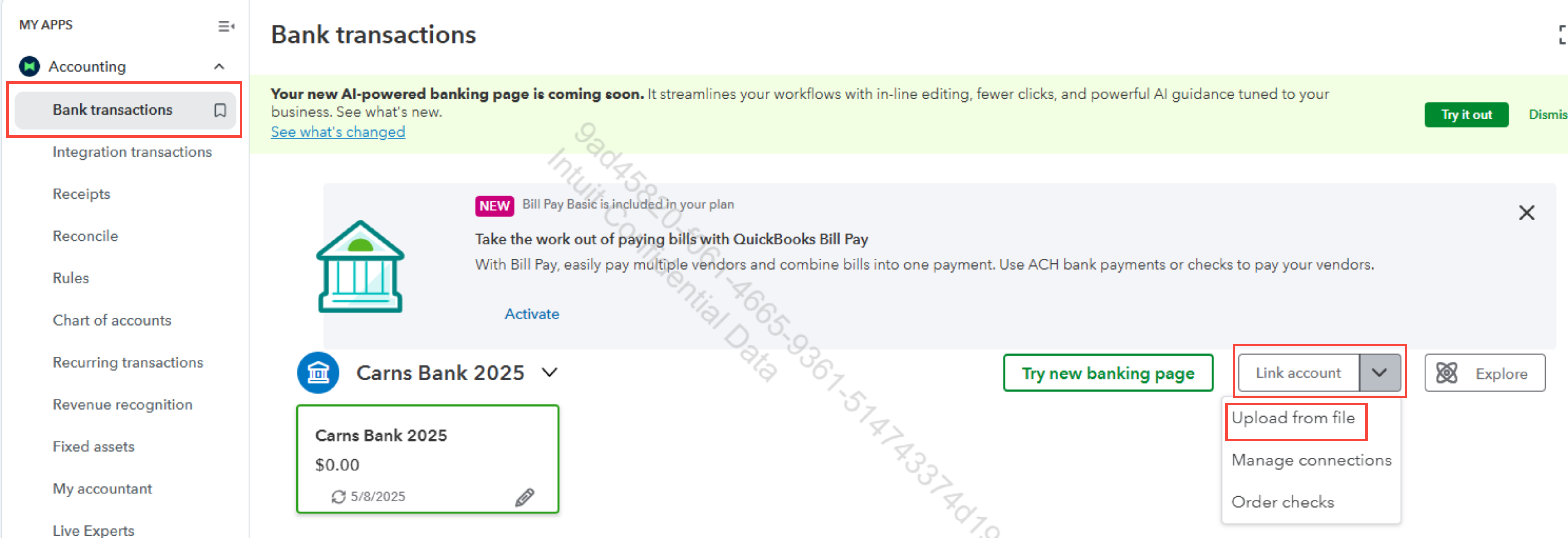

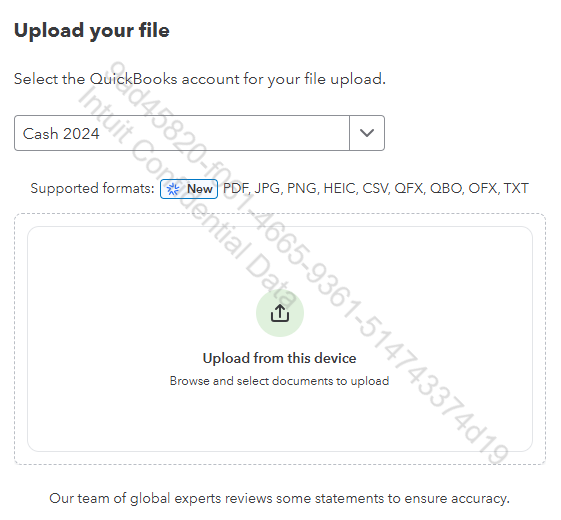

To do this, download your full 2024 bank statement or transaction history from your bank’s website in a CSV file. Ensure that you follow QuickBooks’ CSV formatting guidelines to ensure the file imports smoothly. Once you have the CSV file ready, you can upload it directly into QBO. Here's how:

By uploading your full 2024 bank transactions, you’ll save a lot of time and avoid manual entry, making your tax preparation much smoother. If you run into any challenges with downloading or importing your file, feel free to reach out. I’m here to help you every step of the way. Thanks again for reaching out, and best of luck as you wrap up your 2024 accounting!

You can use csv2qbo converter tool as a workaround. It's a $60 one time license.

https://www.moneythumb.com/?ref=110

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here