Hello there, joysdowntownflow.

Accurate financial data is vital for any business, particularly for the amounts on the Reconciliation page. This ensures that you can reconcile the account on time. Let me guide you in the right direction on how to handle your concern.

If you have several years of unreconciled data in your company, reconcile them one year at a time. Thus, bypassing your 2021 and 2022 data may cause discrepancies.

Also, the figure displayed in the Payments and Deposits section is the total amount for each transaction type shown on the Reconciliation page. To adjust the information, manually reconcile the entries stated above. I recommend consulting an accountant first to keep your books in order. They can offer advice on how to handle the matter, especially your previous years' data.

To manually reconcile:

- In QuickBooks Online (QBO), head to the Accounting menu on the left panel and choose Chart of accounts.

- From the list, choose the bank or credit account you're working on.

- Tap the View register link to view all transactions.

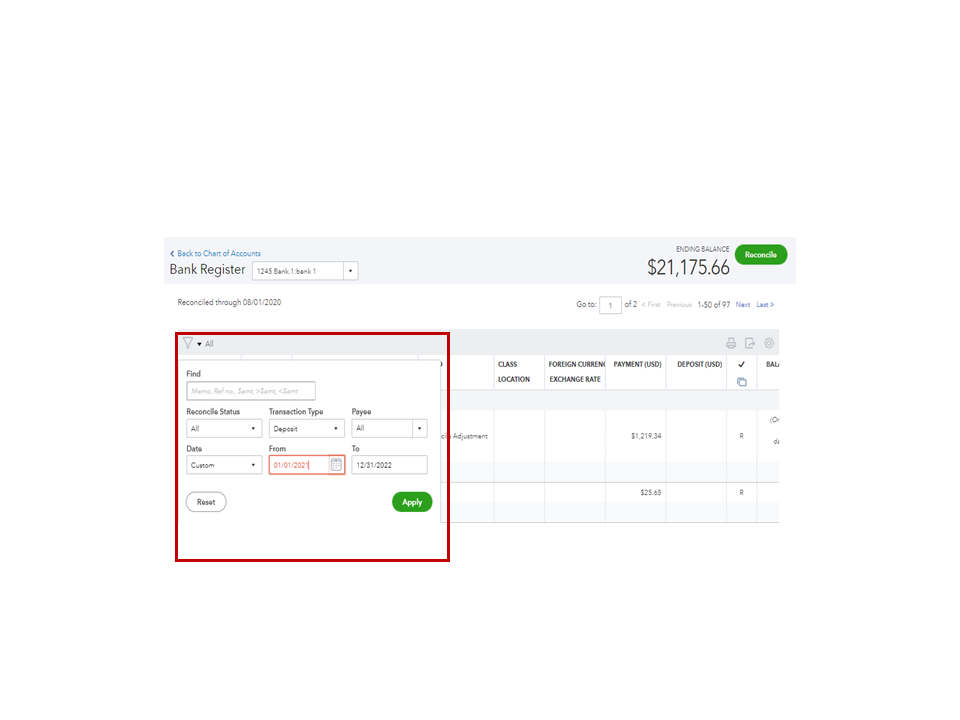

- Click the funnel icon to filter the data and fill in the fields with the correct information.

- Press the Apply button for the changes to take effect.

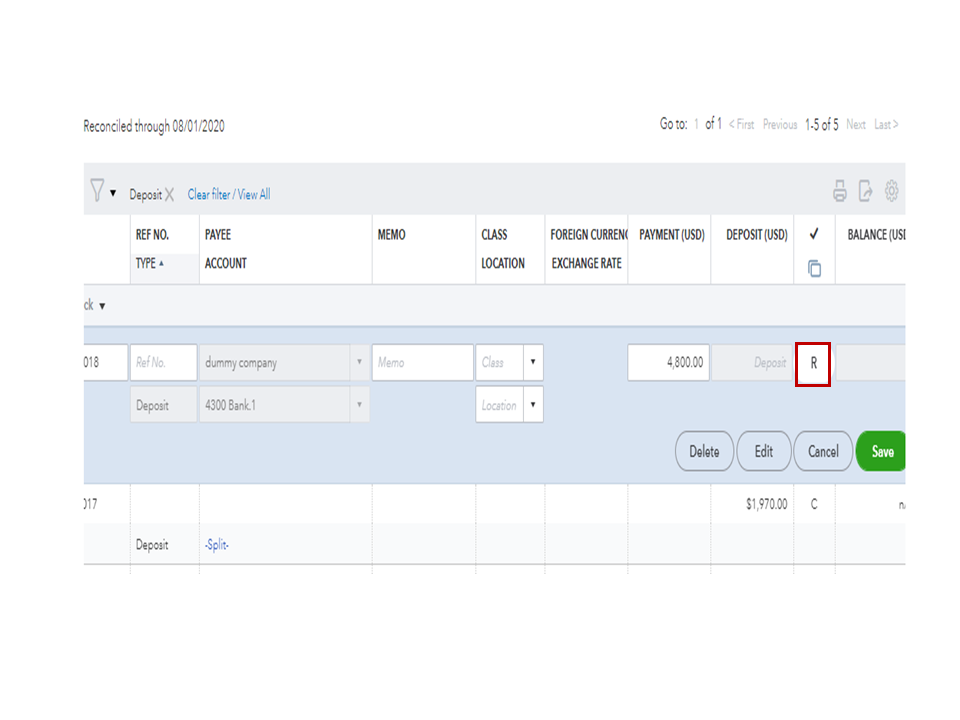

- Click on the deposit to expand the line item.

- Under the Check mark column, click the blank box until an "R" appears.

- Choose Save.

Perform the same steps for the remaining entries. I also suggest that you keep the following information for an easy reconciliation process:

- Get all of your bank and credit card statements together before you start. If you don't have them all, get them from your bank's website or contact them directly.

- Your bank and credit card statements are the source of truth. QuickBooks should always match them, not the other way around.

- Always start with your oldest bank statement. Then reconcile each month, one at a time. The order matters. If there's an issue with an earlier reconciliation, it affects all reconciliations going forward.

- If you reconciled an account at some point during the past year, start from where you left off. Then continue to reconcile each month, one at a time.

- If you have a lot of transactions to reconcile in QuickBooks, you may not see them in a single window. Use the search and filter features to narrow down the list.

When you're ready, you can start reconciling the account. Follow the instructions in this article if you wish to unreconcile the entries: Undo or remove transactions from reconciliations in QuickBooks Online.

To resolve any discrepancies, these resources contain solutions on how to resolve them:

Feel free to comment your replies below if you have more concerns about balancing your bank or credit card account. I'll get back to you as soon as possible.