Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGood to see you in the Community, user440healthy.

I can help you undo previous reconciliations in QuickBooks Online.

Removing the transactions from the reconciled period might affect your beginning and ending balance on the previous and future reconciliations. I'd suggest reaching out to an accountant to help you identify the best way on how to delete previous bank reconciliations.

The Undo option for a reconciled period is only available in QuickBooks Online Accountant. I'd recommend inviting your accountant to your company so they can delete or undo the previous bank reconciliations at once.

However, if you don't have an accountant using QBOA, you'll need to undo the reconciled transactions one at a time. Let me show you how:

For more details, you can click this link on how to undo or remove transactions from reconciliations in QuickBooks Online.

Once everything is set, you can start reconciling your account again. You can read through this article to help you with the process: Reconcile hub.

Keep me posted if there's anything else that you need help with. I'll be more happy to assist you. Take care and have a great day!

Thank you. I have already unreconciled the transaction that need it but there is a sizable discrepancy in the starting balance and I want to re-reconcile my month if possible. Can I just start reconciliation with my January bank statement and adjust at the end - until I get to my current period? I am a small company that was applying for non-profit/charity status but have changed my mind so the previous transactions needed to be changed and/or deleted since I am now a sole proprietor only.

I don't follow what changing your mind on structure would have to do with bank reconciliations. You get a monthly statement and in reconciling you clear ONLY and ALL transactions that the bank says went through their hands. Changing the details of a check or deposit , as long as total remains unchanged, has no effect on previous reconciliations. If you are merely changing transaction details but not total then there is no reason to undo reconciliations.

And if you have UNCLEARED outstanding transactions, these have never been reconciled and would never be part of a reconciliation if they are never processed by the bank (unless you void an old entry with a current period reversal)

We changed from a nonprofit to an LLC so I needed to move a bunch of accounts around and every time it says the things were already reconciled and I have to backtrack. I thought it would be cleaner just to start from scratch but I hate to lose the transactions - just wanted to re-reconcile after I made the changes. I think I deleted things in a closed period and ignored the warnings and now have a mess. You're right, I should have just reassign the accounts and split as needed but it is too late for that unfortunately.

I'm having the same issue.. that is... I went in my bank transactions and re-categorized some that I had categorized wrong ( supplies -> cost of goods: supplies) and now it says my account is not ready to reconcile after I did it and it was fine.... I can't seem to navigate to find the solution... any ideas???

Thanks for chiming in on this thread, @Mckibben2890. Let me share some details to help you reconcile your accounts in QuickBooks Online (QBO) seamlessly.

Since you're done with recategorizing some of your transactions, you'll want to make sure all of your transactions are unreconciled as well. Here's how:

For more details, you can visit this resource: Undo or remove transactions from reconciliations in QuickBooks Online.

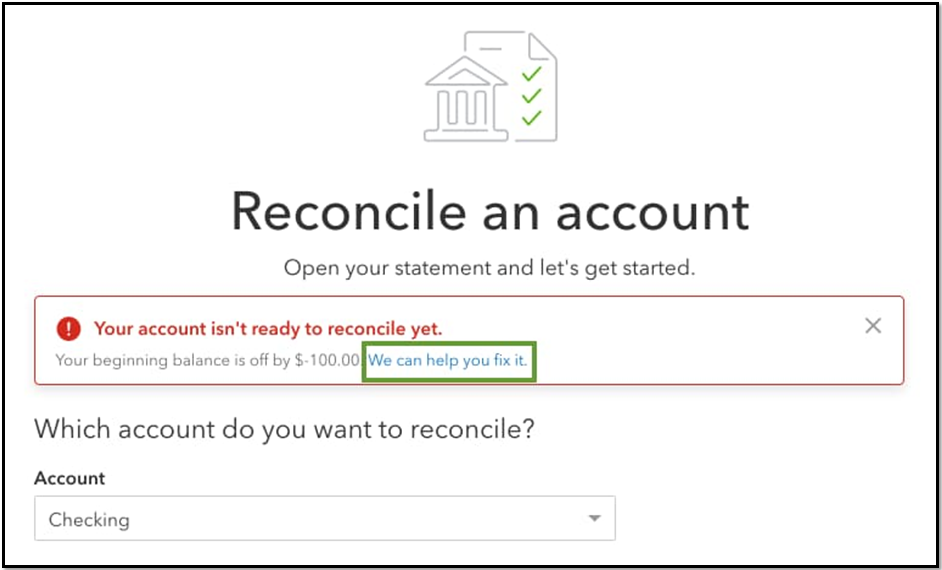

Moreover, you'll get a message before you start reconciling if anyone changes your beginning balance.

For the steps you need to take regarding the specific message, simply go to Step 4 in this article: Fix issues for accounts you've reconciled in the past in QuickBooks Online. Following an in-depth review of the discrepancy report, the total discrepancy difference must read US $0.00.

Also, I'd still recommend seeking assistance from your accountant to ensure that your books are accurate and to avoid messing up the data. They'll also be able to provide more expert ways of dealing with this situation.

Please comment on this thread if you have more questions or concerns about reconciling your accounts in QBO. I'll get back to you as soon as possible.

QB online is ridiculous. Desktop used to have a button to "undo previous reconcile". With as much as they charge for Online - you'd think they could include that feature. I waste so much time using QBO.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here