Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI had to import bank transactions that didn't auto-import. Now rules don't apply to those. How can I apply a Split rule to an imported transaction? Where do I even find the rules I've created?

Solved! Go to Solution.

Hey there, Marina. You can locate the Created rules in the Tools column from the Gear icon indicating your first name.

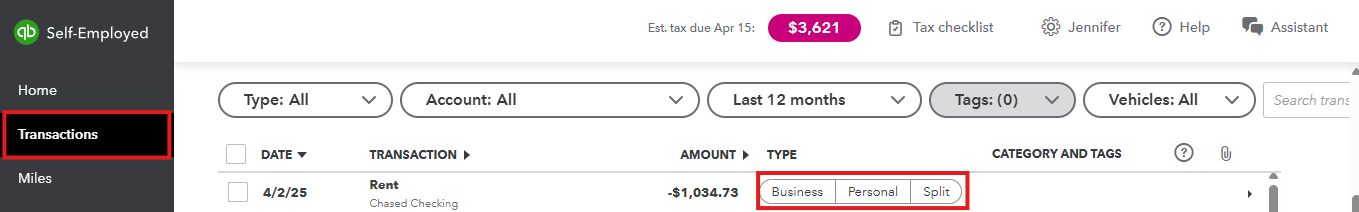

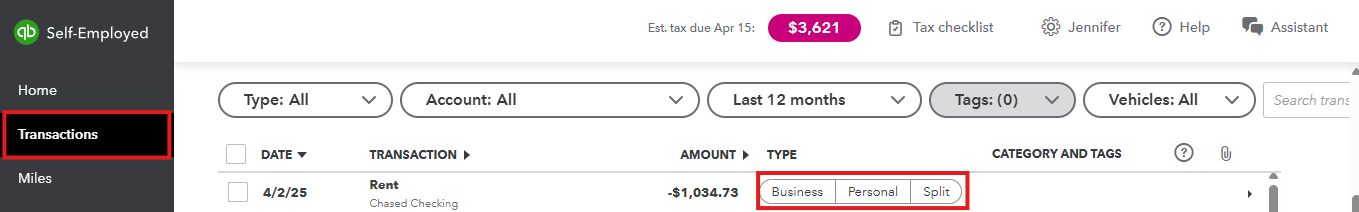

However, you'll need to manually Split and review the categorization of these transactions since applying the existing rule to a manually uploaded bank transaction in QuickBooks Self-Employed (QBSE) isn't possible. Here's how:

Check out this article for more information: Categorize transactions in QuickBooks Self-Employed.

I'll also add this article to learn what federal self-employment taxes are and how they relate to your tax payments: Automatically estimate your income tax in QuickBooks Self-Employed.

Drop a comment below for additional questions about categorizing the manually imported transactions.

Hey there, Marina. You can locate the Created rules in the Tools column from the Gear icon indicating your first name.

However, you'll need to manually Split and review the categorization of these transactions since applying the existing rule to a manually uploaded bank transaction in QuickBooks Self-Employed (QBSE) isn't possible. Here's how:

Check out this article for more information: Categorize transactions in QuickBooks Self-Employed.

I'll also add this article to learn what federal self-employment taxes are and how they relate to your tax payments: Automatically estimate your income tax in QuickBooks Self-Employed.

Drop a comment below for additional questions about categorizing the manually imported transactions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here