Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowFor Loans you want to set up a Liability Acct. If you think you may have multiple loans over the years, some people like to have a Loan Acct (which may already be in your Chart of Accts) and then create Sub Accts for each individual loan to keep them grouped together.

So Create a Liability Acct called something like "Square Loan 2023" and make it a Sub Acct of Loans *IF* you want. Also create another Expense Acct called "Loan Interest Paid."

When the money comes into your Bank Acct, link it to the Square Loan 2023 Acct.

When you make a payment, you'll want to make a Split Payment. Let's say your monthly payment is $100 where $90 is Principal and $10 is Interest. So in your Checking Acct you'll Split that $100 check to the Square Loan 2023 to bring down the Principal Owed (you would see the amount reduce by $90). And the $10 Interest would go to the Loan Interest Paid to show that expense.

For a retail client that got a square loan. Square takes a cut at the point of sale and part of the card processing so the Square payment does not hit the bank. I have a spreadsheet downloaded from Square that shows all the Automatic Payments. Where would be the best place to record those payments from?

I need help with this too. Did you figure it out?

In a few steps, @mbarry77, I'll show you how to set up a loan account in QuickBooks Online.

Setting up a liability account to record what you owe involves several steps. Here's a simple guide:

Once done, you can also refer to this account to track the money you got from the loan. Refer to step #2: Set up a loan in QuickBooks Online.

Remember, it is also essential to regularly update and review your liability accounts to ensure they accurately reflect what you owe and the interest amount of your loan.

It is good to learn more about the basic accounting terms and processes. Are you interested? See this page: Learn common accounting terms.

Ping me again if you need additional information on the Chart of Accounts. I'll be here to guide you.

Thank you. I have the same problem as above. I followed these instructions but since Square doesn’t show a loan payment that leaves their system, one must import the repayments. Square deducts a portion of daily sales to repay the loan, and the remainder gets deposited into the bank account. However as I have tried to download the payments from square into a spreadsheet and uploaded them, qb doesn’t allow me to call it a payment on this account because the account in qb is a liability. Must I set up two accounts in qb- one to list payments from and one as received because my bank is never involved directly in repayment. Also no category I can find for loan payments.

Tried this. Square takes a portion of daily sales as repayment. There is no actual “account” holding the balance and bank is not involved in repayment. I tried importing the repayments because I can pull those from square, but it’s not allowing me to categorize them as payments to the loan account because I have no “account” to list the repayment from. Do I need to create two accounts in qb- one that is the payable and one that is receiveable? I am lost and this is both a technical question for qb and an accounting question.

Thanks for reaching out to us, @Trog14. Let's work together to categorize your Square loan transactions in QuickBooks Online (QBO).

If you haven't yet, set up a liability account to record the loan and a clearing account to hold the loan repayment. When the payment is deposited to the bank account, we can split the transaction into multiple accounts by following the steps below.

Furthermore, QBO offers dozens of reports to help you obtain an overview of your business. This way, you can see how your sales and expenses are performing.

Please know that the Community is open around the clock whenever you have any follow-up concerns about Square loan transactions. Just mention me in your reply, and I'll sprint back into action. Stay safe, and have a wonderful day ahead!

Just re-reading this thread.... Sounds like two different things are being discussed. The first question had to do with a LOAN, which is not the same as your CC/Sales transactions.

CC vendors will take a percentage or some fee for every transaction. It may be taken out of each transaction or it may be taken out at the end of a set period (day, week, month) that was set up in your contract with them. But these transactions are not a LOAN where you are making a Loan Payment and an Interest Payment.

Check with your Accountant, but if we're taking CC transactions you want to set up two Accounts, possibly a Sub Acct of Sales as you may have Cash or other Sales as well. And the same for Fees.

Sales:Credit Card Sales - Income Acct to show the money from the CC vendor

Fees:Credit Card Fees - Expense Acct to show the fees that the CC vendor takes out.

Use the Credit Card Sales Acct as the other side with the CC Vendor makes a Deposit in your Checking account. And again, always check with your Accountant so there's no confusion on where these Accts come into your books.

Thank you. I found this helpful.

As of now, I have the clearing account showing the original deposit as a debit and the liability account showing a credit of the same amount. Is this correct or does it need to be opposite? Also, am I importing transactions to both accounts from Square through an excel spreadsheet, or if I import them to one either clearing or liability, will they show in the other?

I need help with this as well

My top priority is to assist you in setting up a Square loan in QuickBooks Online, @KerriY.

Let's get started by creating and setting up a liability account so you can record the loan.

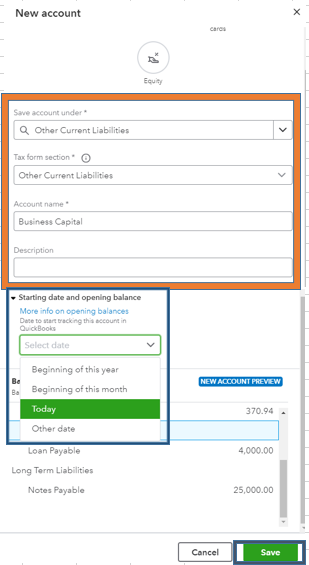

To create a liability account, please follow these steps:

When you create a liability account, it's important to determine the loan balance before you start tracking the loan payments.

If it's a new loan, the full balance that needs to be paid back will be shown. However, if the loan amount was already deposited to your bank and you have a prior loan that was added to QuickBooks Online and partially paid back, you should set the balance of the prior loan as the current payoff balance.

Here's how to set up a new loan:

Here's how to set up a prior loan:

If you deposit a loan amount and add a balance to the liability account during the process, you will need to make a Journal entry to record the deposit.

I recommend referring your accountant for further guidance on this matter. They can provide you with the necessary expertise and knowledge to help you make informed decisions.

You can also read this article for the complete details: Set up a loan in QuickBooks Online.

I recommend bookmarking these resources that provide a thorough discussion of managing income and payments. They include detailed instructions to maintain a balanced book.

Please don't hesitate to reply if you have any concerns related to recording loans or other QBDO-related tasks. I'm here to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here