Hi there, Valerieh. I understand that you'd prefer to set up a finance charge instead of applying a late fee.

To do that, you can manually set up and apply Finance Charges or a Late Finance Charge by creating a Product/Service item for a finance charge and then adding it to a new invoice.

Here's how:

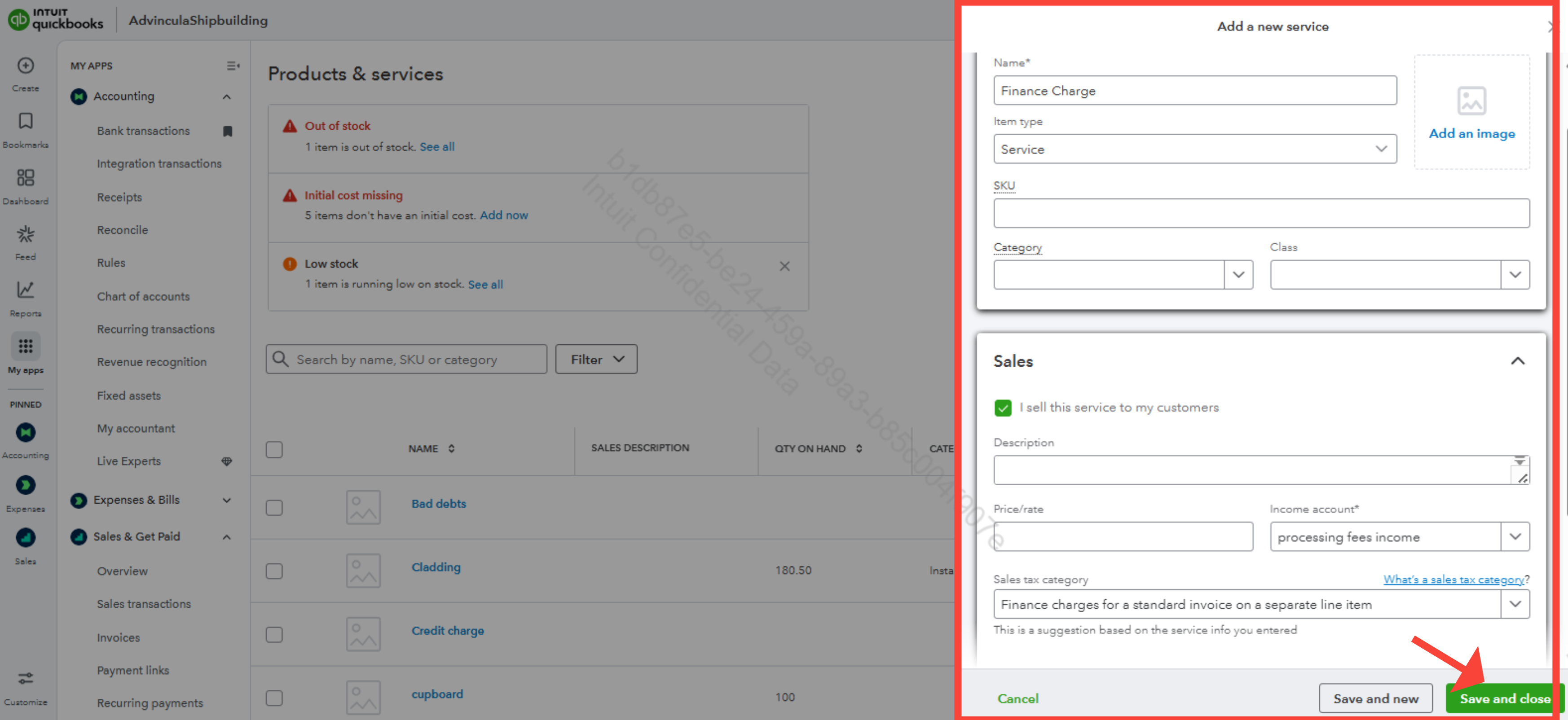

- Click the Gear icon at the top-right corner.

- Select Product and Services under the Lists section.

- In the upper right corner, click the New button.

- Choose Service.

- Name your service as Finance Charge or Late Finance Charge.

- Click on the drop-down menu under Income account.

- And select the Processing fees income.

- Hit Save and close.

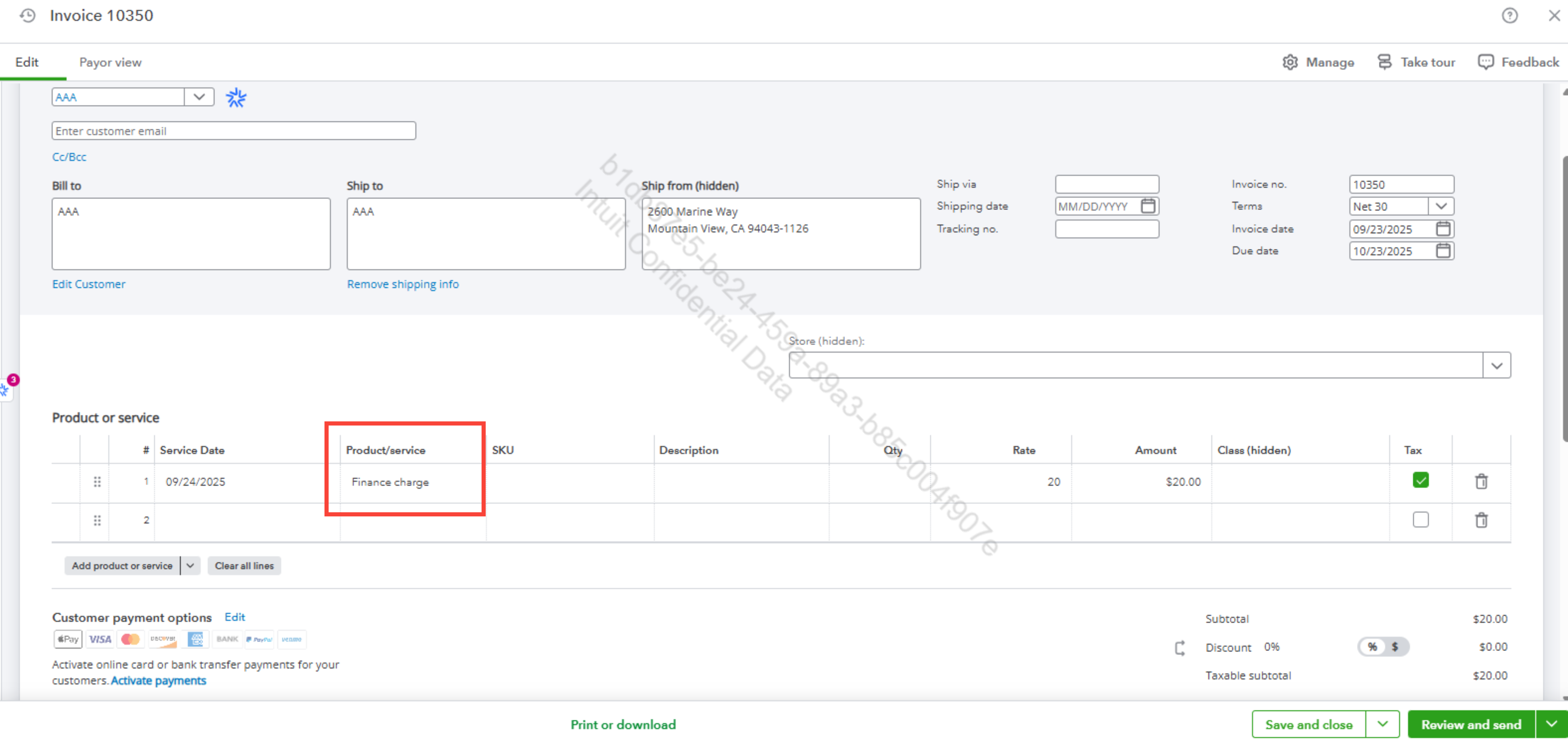

After setting this up, you can create a new invoice to apply the finance charge.

- Open the invoice page and select the customer who has the overdue invoice.

- In the Product/Service field, select the Finance Charge item you created earlier.

- Enter the amount of the finance charge based on your calculation.

- Set the due date to match your terms for the finance charge.

- Click Save and close.

Before we finish, I suggest you explore QuickBooks Live Expert Assisted to streamline your accounting, maintain precise financial records, and access professional support. This could free up valuable time, allowing you to concentrate on expanding your business.

Please don't hesitate to reach out if you have any additional questions or concerns. We're here to provide ongoing support and assistance.