Hope you're doing well today, FireMedic! I'm here to help you record your credit card cash rebate properly in QuickBooks.

Let's utilize the Credit card credit feature instead of creating a vendor credit. This records the amount as a payment in the register. I'll show you how:

- Go to the +New button.

- Click Credit card credit under the Vendors column.

- Click the Bank/Credit account drop-down arrow and choose the appropriate one.

- Under the Category details, select an account where you want to track your cash rebate. You can choose an expense account or an income account.

- Enter the amount and all necessary information.

- Click Save and close.

If you don't have an account yet to track your cashback, feel free to create a new one. Here's how:

- Go to the Accounting menu.

- Within the Chart of accounts, click the New button.

- Select details for this account.

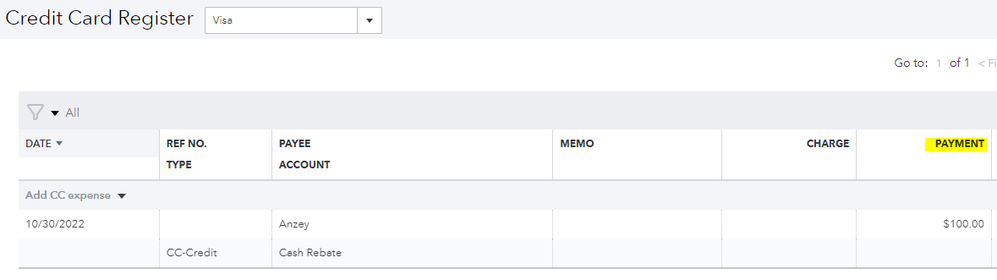

Once done, let's open the bank/credit account we used to track the amount. We'll see it under the Payment column. Here's a sample screenshot:

I've collected some resources that help you reconciling accounts:

If you have more concerns about recording transactions in QuickBooks, don't hesitate to post them here. I'm happy to help you more. Take care and stay safe always.