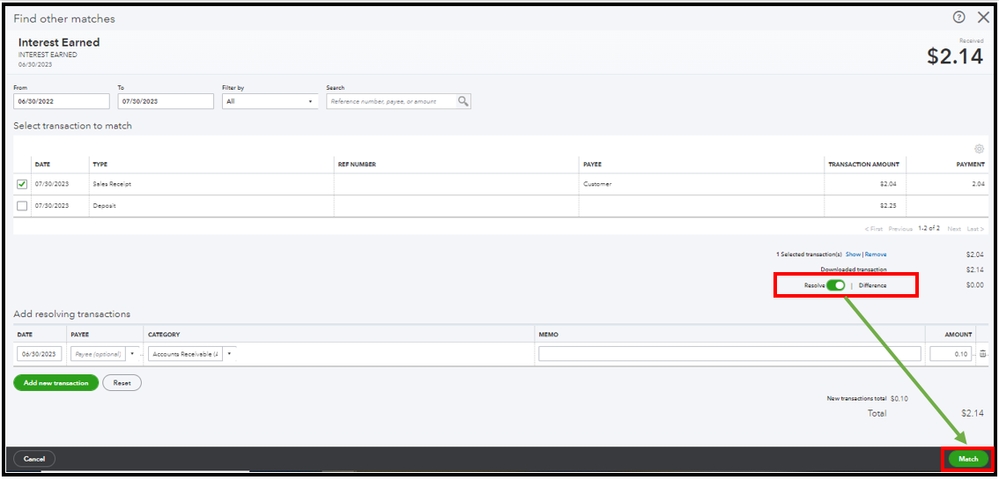

I can see that you've been there in the Find other matches window resolving the .10 income difference. You're correct that you can select an income account to book the amount. However, if you're unsure, I suggest consulting your accountant for assistance to account for this properly.

Here's how:

- From the Find other matches window.

- Scroll to the bottom of the table and then click the Resolve Difference button.

- Choose the right category for difference, then hit Match to confirm.

I've added some screenshots for your visualization.

Additionally, you can visit this article that'll help you learn how to run into some problems when reconciling your accounts in QBO: Fix reconciliation issues in QuickBooks Online.

Keep your posts coming if you've got additional questions about bank transactions in QBO. I'll be right here to assist you further. Stay safe.