Hi there, @bobby13sims.

Thank you for posting here in the Community. Let me share with you some insights on how to resolve duplicate transactions in QuickBooks Self-Employed.

The best way to handle duplicate transactions is to exclude them. This way, QBSE will stop adding those transactions to your tax year calculations.

Here's how:

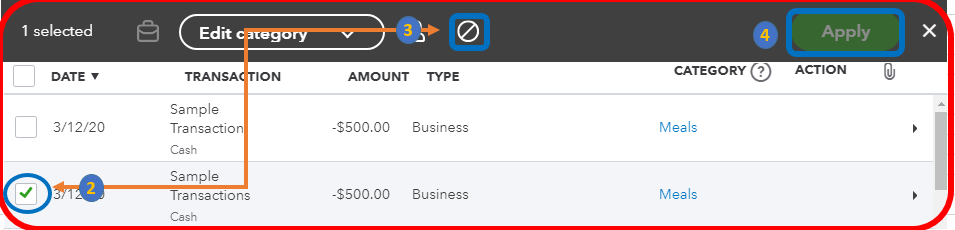

- Go to the Transaction tab on the upper left side.

- Put a check marked on that transactions.

- Choose the Exclude button.

- Hit Apply.

For more information about excluding data in QBSE, check out this article: Exclude or delete transactions.

You can run, print, and email any reports from the Reports menu. This way, you can track the data outside QuickBooks. For the detailed steps, please see this link: Manage reports and forms.

Please browse through this article: Handle duplicate transactions in QuickBooks Self-Employed. This link guides you on how to hide a bank account that are duplicates in your account.

Let me know if you have another concern. I'm always here to help. Take good care.