Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowSolved! Go to Solution.

You're in the right place, @adaptivallc.

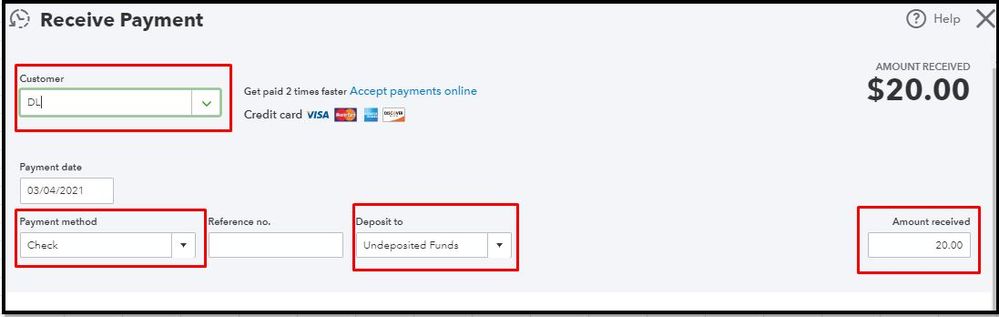

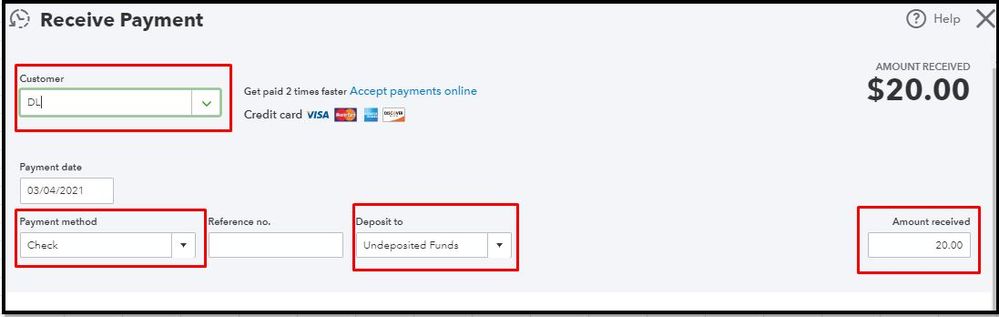

I can share steps so you can record the payment for your customer. To start, let's record the payment for the 50 customers and deposit the amount to undeposited funds. Here's how:

Once done, let's create a Bank Deposit. Follow these easy steps below:

Also, to get a list of all payments and invoices for each of your customers, you may pull up the Invoices and Received Payments Report. Then, customize it so it will only show the info you need.

Feel free to get back here if you need further assistance recording customer payments in QBO. I'm always around to help. Have a good one.

You're in the right place, @adaptivallc.

I can share steps so you can record the payment for your customer. To start, let's record the payment for the 50 customers and deposit the amount to undeposited funds. Here's how:

Once done, let's create a Bank Deposit. Follow these easy steps below:

Also, to get a list of all payments and invoices for each of your customers, you may pull up the Invoices and Received Payments Report. Then, customize it so it will only show the info you need.

Feel free to get back here if you need further assistance recording customer payments in QBO. I'm always around to help. Have a good one.

Thank you so much! I thought it would/should be relatively simple. :)

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here