Hi @6741 (if that is your real name ;)

The best setup for a two-sided marketplace is generally to do the following:

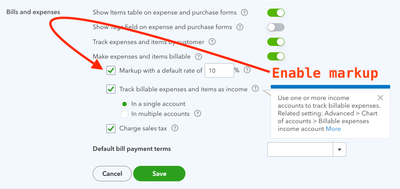

- Create a Bill on behalf of the seller and designate each line item as a re-billable expense with a 10% markup. Be sure to designate an income account for the markup; i.e. if the marketplace is Etsy, the markup fee would then be automatically booked as Etsy income.

- Create an invoice on behalf of the buyer and add the re-billable "expenses" from the bill you just created

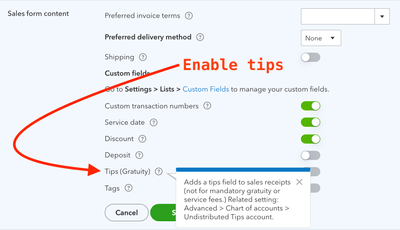

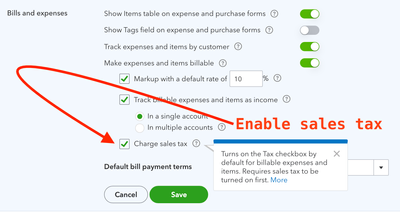

If the purchase breakdown from your example is real, that's great as well because QuickBooks Online has a setting that allows booking both tips and tax on an invoice (see screenshots).

This setup is nice because it more-or-less automatically separates tips, tax, and the two-sided marketplace's fee automatically.

Let me know if any of this is unclear, or if you have other questions about it.