I know how precious time is for you and the relevance of changing your bank accounts, @bjones1075. Below, I'll guide you through the process of changing your bank accounts.

First, gather your bank account information and principal officer address as this is important when changing to a new bank account. Make sure you have the following:

- Your bank details such as the bank name, routing number, and account number, which you can find on a check (please avoid using the routing number found on deposit slips).

- Your online banking user ID and password if you're using QBO Payroll.

- The physical address of your principal officer. This can't be a P.O. Box. As a licensed money transmitter, Intuit Payments must comply with legal requirements, applicable laws, and regulations.

Once you've gathered your bank information, set up your Chart of Accounts to ensure that your payroll transactions are accurately recorded. If needed, your accountant can assist with this setup.

Next, it's crucial to check for any pending tax or payroll transactions to guarantee that the transition of your accounts goes smoothly and that funds are withdrawn from the correct account.

For Pending tax payments:

- From the left navigation panel, select Taxes.

- Click the Payroll tax option.

- Then, select the Payments or Tax Payments tab.

Any payments scheduled for today's date or earlier will continue to be processed from your current bank account. For payments dated after today’s date, please contact our live support team for further assistance with handling these payments.

For Pending payroll transactions:

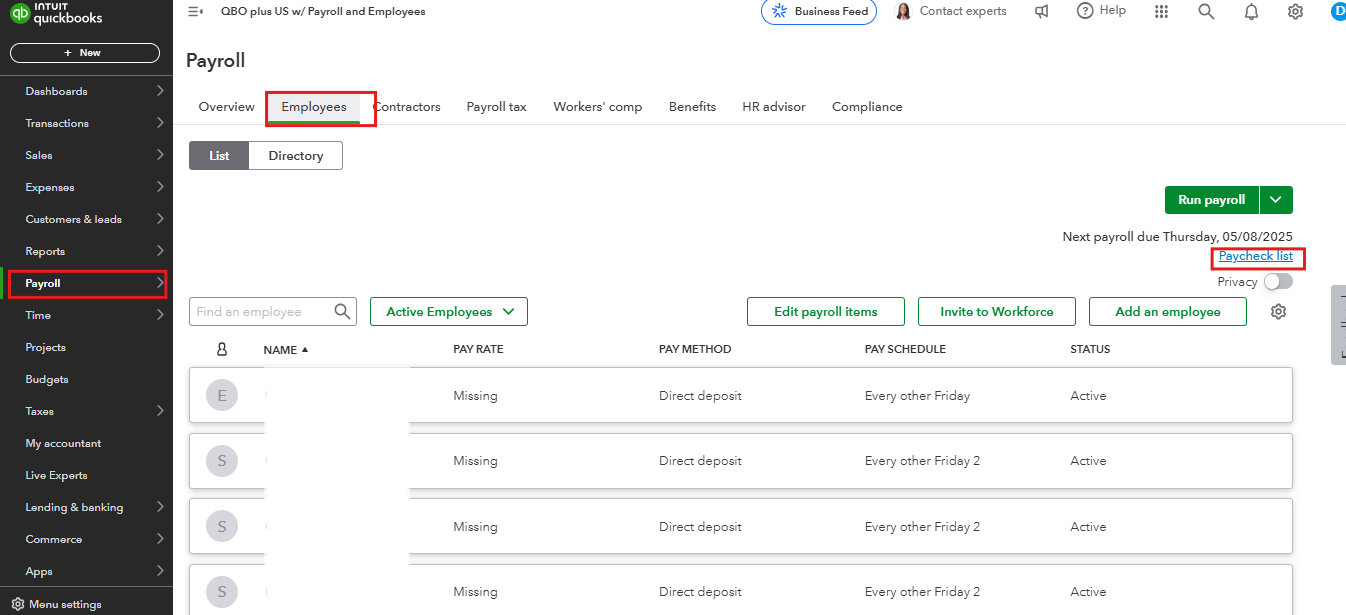

- Select Payroll in the left navigation panel.

- Go to the Employees option.

- Below the Run Payroll button, click the Paycheck list.

Paychecks dated one business day or sooner from today will use the current bank account for processing. However, paychecks dated two business days or later (and it’s before 6:00 PM PT) can be deleted by checking the box next to each relevant paycheck and clicking the Delete button located above the list of paychecks.

After that, you can update your bank account. Follow these steps:

- Select Settings and then choose Payroll Settings.

- Click on Edit under Bank Accounts.

- Select Update and click Add new bank account.

- Enter your bank name, and you may need to input your online banking user ID and password or opt to enter your bank info manually.

- Once done, save your details and select Accept and Submit.

For more detailed information on changing your bank account, refer to this article: Change your payroll bank account.

If everything looks good, you can generate a Payroll Summary report to see your payroll totals, including employee taxes and contributions.

Please let me know if there's anything that I can help you with changing your bank accounts in QBO. You can drop your reply below, and I'll get back to assist you.