You don't need to unreconcile your Credit Card (CC) account from the past few months, Ktomari. Let me guide you on how to correct the credit card payment recorded in QuickBooks Desktop (QBDT) as a credit instead of a payment, and then perform a mini reconciliation.

To correct the incorrect credit card entry, locate the CC credit and choose whether to void or delete the transaction. Here's how:

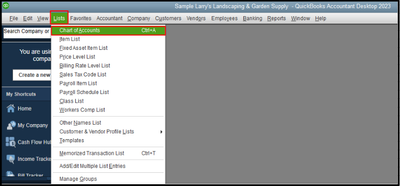

- Go to the Lists menu and click Chart of Accounts.

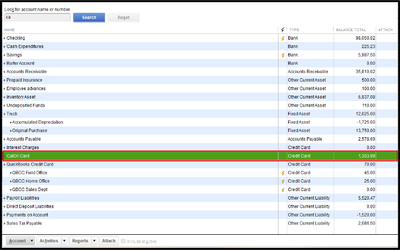

- Find your CC account and double-click to open it.

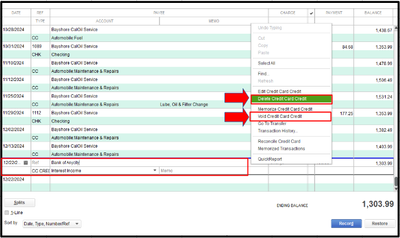

- Locate the CC credit, then right-click and select Void Credit Card Credit or Delete Credit Card Credit.

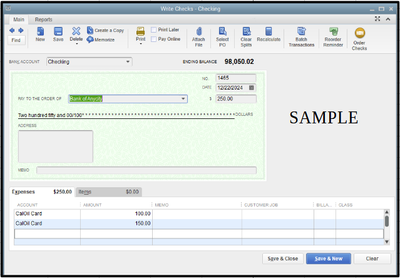

Then, you can record the payment properly using the Write Check feature. Here's how:

- Go to Banking and select Write Checks.

- In the Expenses tab, click the CC account from the Account dropdown.

- Enter the amount and complete the other necessary fields.

- Hit Save & Close.

Once done, you can now perform a mini-reconciliation. Please refer to the steps below:

- Go to the Banking menu and click Reconcile.

- Select the CC account you need to reconcile.

- In the Date of Statement field, enter the date for an off-cycle reconciliation. This date can be any date between your last reconciliation and the next scheduled one.

- In the Ending Balance field, enter the balance of your last successful reconciliation and hit Continue.

- In the Reconcile window, tick off or place a checkmark before the transactions you are fixing and re-reconciling.

- Make sure the Difference field shows $0.00.

- If everything looks good, hit Reconcile Now.

Furthermore, check out this article to guide you in addressing discrepancies between your QBDT accounts and your bank statements during reconciliation: Fix issues when you're reconciling in QuickBooks Desktop.

If you have further questions about handling reconciliation in QBDT, feel free to comment below. The Community is always ready to assist you.