I can help you review and record your bank transaction for a sale of cattle in QuickBooks Online (QBO), @SS404.

First, we don't need to Exclude the transactions or create a Journal entry. It's how you made the sales transaction.

There are two options for entering sales transactions: by invoice and sales receipt. If you entered it as an Invoice, let's ensure you've chosen the right GST for the goods sold.

Then, we can receive the payment under the Undeposited Funds.

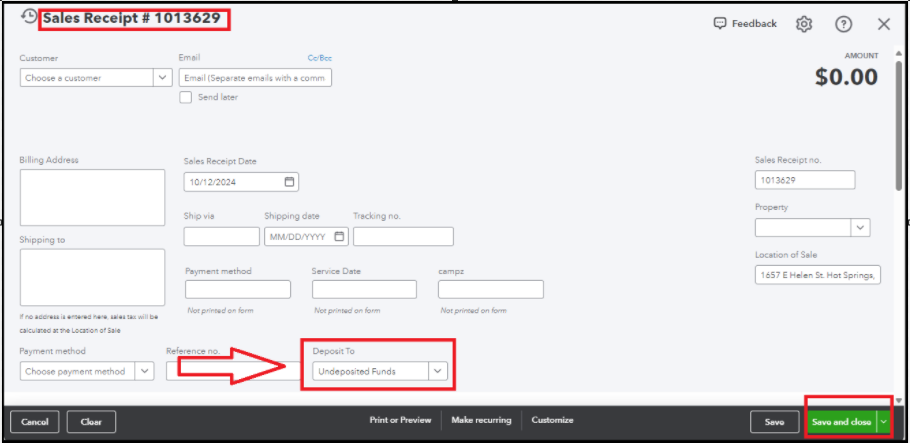

On the other hand, if you've entered it as a Sales receipt, let's ensure that under the Deposit to tab, we select the Undeposited Funds account.

After that, we'll have to record the vendor's charges, such as commission and some fees, which are subject to GST as a Bank Deposit.

Here's how:

- Go to the +New icon, and select Bank deposit.

- On the page, fill out the necessary information.

- In the Account dropdown, choose an Expense account.

- Enter the correct GST and the amount of the expenses to match them in your net figure.

Additionally, you'll want to visit this article and make sure the amounts match your real-life bank and credit card statement: Learn the reconcile workflow in QuickBooks.

It's my pleasure to answer if you need further assistance with your sales transactions. Have a great day ahead.